Box: Fiscal 3Q20 Financial Results

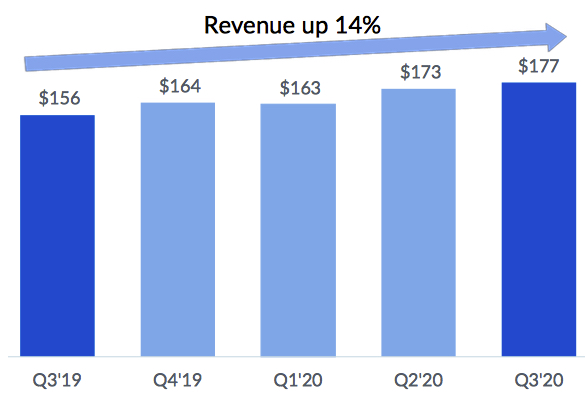

Sales up 14% Y/Y and 3% Q/Q with losses continuing at $41 million

This is a Press Release edited by StorageNewsletter.com on December 3, 2019 at 2:22 pm| (in $ million) | 3Q19 | 3Q20 | 9 mo. 19 | 9 mo. 20 |

| Revenue | 122.3 | 177.2 | 444.7 | 512.7 |

| Growth | 14% | 15% | ||

| Net income (loss) | (40.2) | (40.9) | (114.9) | (114.0) |

Box, Inc. announced financial results for the third quarter of fiscal year 2020, which ended October 31, 2019.

“With these solid results and our delivery of key product and go-to-market initiatives, we are in a strong position to continue to improve our balance between growth and profitability,” said Aaron Levie, co-founder and CEO. “In 3Q20, we launched Box Shield, major new Relay enhancements, and deeper integrations with IBM, Microsoft Teams, and Slack. These new products and capabilities will enable our customers to expand their use of Box for frictionless security and compliance, seamless internal and external collaboration and workflows, and a more productive workplace by leveraging a best-of-breed IT stack. And with Box Suites, we are making it easier than ever for customers to adopt the full power of Box.”

“We continue to build the foundation to drive more profitable growth,” said Dylan Smith, co-founder and CFO. “In 3Q20, we delivered operational efficiencies on our path to achieving our first full year of non-GAAP profitability in FY20, and we are committed to delivering significant improvements in operating margin in FY21 and beyond.“

3Q20 Highlights

• Revenue was $177.2 million, an increase of 14% from 3FQ19.

• Remaining performance obligations as of October 31, 2019 were $636.0 million, an increase of 5% from 3FQ19.

• Deferred revenue was $325.6 million, an increase of 8% from 3FQ19.

• Billings were $171.9 million, an increase of 10% from 3FQ19.

• GAAP operating loss was $39.2 million, or 22% of revenue. This compares to a GAAP operating loss of $39.5 million, or 25% of revenue, in 3FQ19.

• Non-GAAP operating loss was $0.5 million, or 0% of revenue. This compares to a non-GAAP operating loss of $7.7 million, or 5% of revenue, in 3FQ19.

• GAAP net loss per share, basic and diluted was $0.28 on 148.6 million weighted-average shares outstanding. This compares to a GAAP net loss per share of $0.28 in 3FQ19 on 142.4 million weighted-average shares outstanding.

• Non-GAAP net loss per share, basic and diluted, was $0.01. This compares to a non-GAAP net loss per share of $0.06 in 3FQ19.

• Net cash provided by operating activities totaled $8.9 million. This compares to net cash provided by operating activities of $6.8 million in 3FQ19.

• Free cash flow was negative $1.7 million. This compares to negative $4.1 million in 3FQ19.

Business Highlights

• Delivered wins and expansions with leading organizations such as Asahi Kasei Homes, Epic Games, Impossible Foods, Los Angeles World Airports, NHL, D.C. Office of the Attorney General, Police Service of Northern Ireland, and Vistra Energy.

• Announced the availability of Box Shield, helping customers reduce risk and prevent data breaches through classification-based security controls and intelligent threat detection.

• Launched new enhancements to Box Relay, enabling enterprises to streamline routine, collaborative business processes in Box.

• Hosted the company’s ninth annual BoxWorks, attracting thousands of attendees from the Fortune 1,000 and including speakers from enterprises such as Intuit, the NBA, and Uber as well as CEOs from partners at Okta, PagerDuty, Slack, and Zoom.

• Announced integrations with Adobe Acrobat, Microsoft Teams, and Slack, providing customers with an integrated experience to ensure seamless and secure collaboration.

• Announced the commitment to build a new integration between Splunk and Box Shield to power automated threat detection and response, giving customers deeper visibility into content access patterns.

• Announced two new integrations with IBM, including IBM X-Force and QRadar with Box Shield for advanced threat intelligence and IBM’s Watson Knowledge Catalog InstaScan tool to give joint customers the ability to identify sensitive data throughout their Box folders.

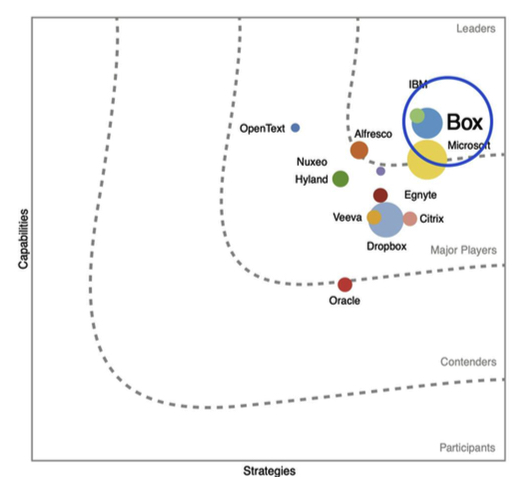

• Recognized as a Leader in the IDC MarketScape: Worldwide SaaS and Cloud-Enabled Content Applications 2019 Vendor Assessment.

• Recognized as a Leader in the Gartner Magic Quadrant for Content Services Platforms 2019.

4FQ20 Guidance

Revenue is expected to be in the range of $181.0 million to $182.0 million. GAAP basic and diluted net loss per share are expected to be in the range of $0.22 to $0.21. Non-GAAP basic and diluted net income per share are expected to be in the range of $0.04 to $0.05. Weighted-average basic and diluted shares outstanding are expected to be approximately 150 million and 155 million, respectively.

FY20 Guidance

Revenue is expected to be in the range of $693.7 million to $694.7 million. GAAP basic and diluted net loss per share are expected to be approximately $1.01. Non-GAAP basic and diluted net income per share are expected to be approximately $0.01. The weighted-average basic and diluted shares outstanding are expected to be approximately 148 million and 154 million, respectively

Comments

Revenue for the quarter at $177 million was above the high end of guidance ($174 million to $175 million), and up 14% Y/Y and 3% Q/Q.

In cloud content management, Box is an indisputable leader for analysts.

Gartner

Forrester

IDC

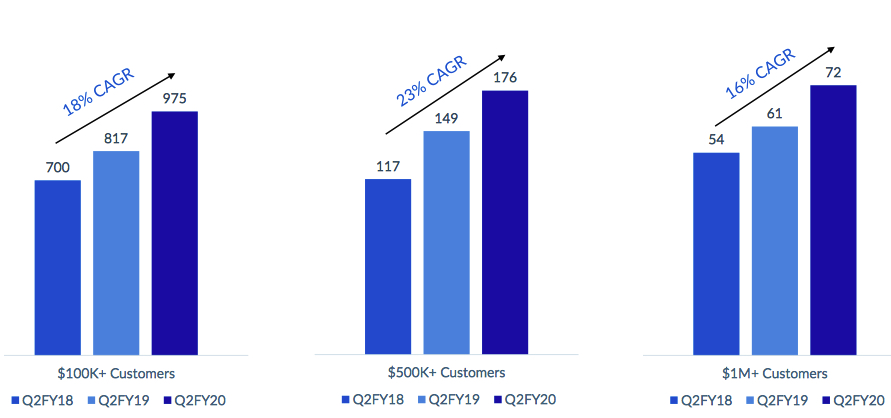

Expansion Fuels Consistent Growth in Large Customers

$1 million+ customers have grown in count and ACV by 35% over past 2 years

This most recent quarter, the company closed 3 deals worth more than $1 million in line with 3FQ19, 7 deals over $500,000 vs. 11 a year ago, and 64 deals greater than $100,000 vs. 57 a year ago.

In 3FQ20 more than 80% of $100,000+ deals included at least one add-on product.

25% of this quarter's revenue came from regions outside of USA, with Japan now exceeding 10% of revenue. Six figure metric was impacted by slower than expected growth in EMEA.

The company expects to deliver at least a 25% increase in global sales in FY21 and 35% in FY23, but without growing headcount in FY21.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter