FalconStor: Fiscal 3Q19 Financial Results

Revenue flat as usual at mere $4 million, not profitable, cash down sharply to $1 million

This is a Press Release edited by StorageNewsletter.com on November 21, 2019 at 2:29 pm| (in $ million) | 3Q18 | 3Q19 | 9 mo. 18 | 9 mo. 19 |

| Revenue | 4.1 | 4.0 | 13.1 | 12.4 |

| Growth | -2% | -5% | ||

| Net income (loss) | (0.3) | (0.6) | (0.8) | (1.9) |

FalconStor Software, Inc. announced financial results for its third quarter ended September 30, 2019.

Strategic Highlights:

Making progress expanding its technology to deliver an enterprise-scale, flexible backup and archive data optimization solution.

As part of these efforts, the company is:

- Continuing to enable backup and archive storage virtualization to independent targets, freeing our customers from vendor-specific hardware, and extending ability to leverage multiple cloud-based storage offerings

- Evolving go-to-market paths beyond legacy tape replacement

- Innovating to make improvements in ease-of-use and storage agility

- Investing to create flexible and extensible storage innovations for the next decade that provide both emerging technology and continuity with our current offerings, anticipating these innovations will provide the next level of security, flexibility, and choice for customers to exploit the market options for enterprise data protection

Financial results

- Grew backup and archive data optimization solution sales Y/Y by 65% during the quarter

- Achieved total Y/Y sales growth of 11%

Product Highlights

- Backup and archive data optimization – Completed cloud integration for IBM-COS data storage

- Backup and archive data optimization – Completed phase 3 integrations into its unified user console, in order to extend storage orchestration and ease-of-use capabilities to backup and archive use cases

- Next gen innovations – Increased development efforts for a new storage technology, to enable launch in 2020

“3FQ19 delivered the second consecutive quarter of double digit Y/Y billings growth, with an 11% increase, compared to 3FQ18,” said Todd Brooks, CEO. “Our billings growth continues to be driven by adoption of our expanded backup and archive optimization solution, the industry’s best performing and most cost effective solution, as validated by the Evaluator Group. According to IDC, up to 75% of data managed by an enterprise is directly related to routine backup and archive. Our solution allows an enterprise to leverage existing backup policies and procedures, while ensuring the most stringent backup window is met, storage capacity is reduced by up to 95%, and cloud storage alternative such as AWS, Hitachi Content Platform, and IBM-COS are available for improved storage efficiency.

“Our team also increased development efforts for a new and innovative storage technology during the quarter. I am especially excited by our team’s work to identify and pursue these product innovations, which will be launched in 2020.

“While, I am very proud of the team for the Y/Y billings growth FalconStor has delivered over the last 2 quarters, and the product innovation in progress, I am also intent on ensuring we are generating consistent profitability. During the quarter, we reduced total non-GAAP expenses by approximately $600,000 (12%), compared to 2FQ19, largely due to restructuring completed in China. Over the balance of 2019, we will continue to see operating expenses decline as adjustments we made in 2FQ19 and 3FQ19 of 2019 are fully reflected in our results.“

Additional Financial Highlights for 3FQ19

- Total sales for 3FQ19 increased to $3.2 million compared to $2.9 million in the prior year.

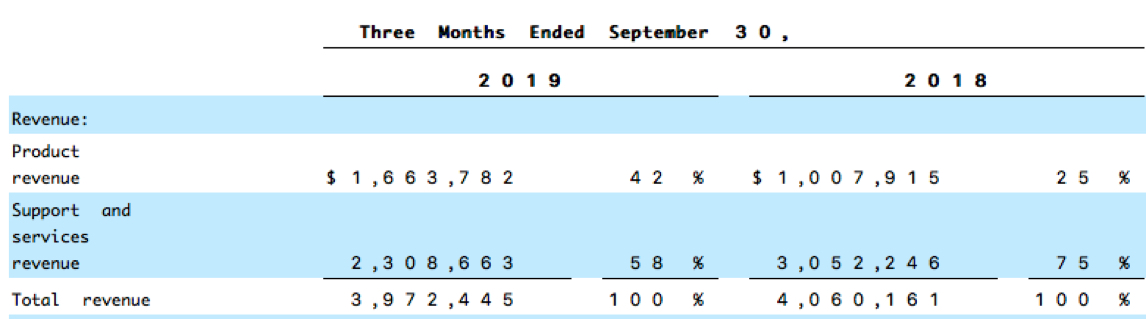

- Despite the total sales increase, total revenue for the three months ended September 30, 2019 was $4.0 million compared to $4.1 million in 2FQ19. Revenue recognition on sales is driven by several factors. First, the volume of new product licenses and maintenance sales, both for expansion of existing installed base and the acquisition of new customers. Second, customer retention, which sustains maintenance renewal revenue over long term sales arrangements.

- During 3FQ19, we recorded a GAAP net loss of $1.0 million, compared to a GAAP net loss of $0.7 million for the prior year period. Despite growth in sales, results were constrained by product mix, as a result of higher than anticipated hardware and appliance sales during the current period, which yield significantly less prof it margins, compared to key proprietary software license offerings. Results also include $0.2 million of severance expense incurred in connection with 2019 restructuring plan.

On August 6, 2019, following stockholder approval, the company filed a certificate of amendment (which was effective August 8, 2019) to the company’s Restated Certificate of Incorporation, as amended, with the Delaware Secretary of State to reduce the authorized shares of common stock, $.001 par value per share, to 30,000,000. In connection with this event, the company effected a 100-for-1 reverse stock split of its issued and outstanding common stock. The par value and authorized shares of common stock were not adjusted as a result of the reverse stock split.

All of the share and per share information in the financial statements have been adjusted to reflect, unless otherwise stated: the reverse common stock split on a retroactive basis for all periods and as of all dates presented.

The firm ended the quarter with $1.0 million of cash and cash equivalents, as compared to $3.1 million at December 31, 2018.

Comments

Since three quarters, revenue remains at only around $4 million and will largely decreased for entire FY19, with losses also continuing.

But CEO Todd Brooks commented the most recent quarter especially with this phrase:" I'm pleased by the progress that FalconStor has made thus far in 2019."

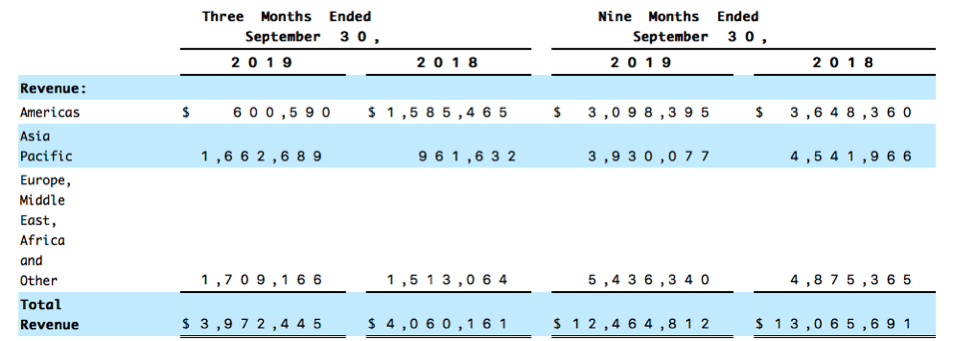

One positive aspect is that the company closed this period with $3.2 million in billings as compared to 2.9 million for the same period of the previous year. This Y/Y 11% growth was driven by record sales in the Americas where billings increased 40% as compared to the prior year.

On a product-specific basis, it also reflects progress with VTL where billings for 3FQ19 grew by 65% as compared to the previous year.

FalconStor has no choice that to diminish expenses to survive. During the quarter, it reduced quarterly operating expenses by $600,000 compared to 2QFQ9 and will see additional expense savings reflected in its coming 4FQ19 results.

The storage software firm now has only $1.0 million of cash and cash equivalents compared to $2.4 million at the end of 2FQ19 and $3.1 million at December 31, 2018.

During the most recent three-month period, the company adopted what is called the 2019 Plan eliminating 23 positions worldwide.

No guidance was revealed as it's now a habit.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter