WW AFA Revenue Decreased by 1.7% Q/Q in 2Q19

While increasing 21% Y/Y

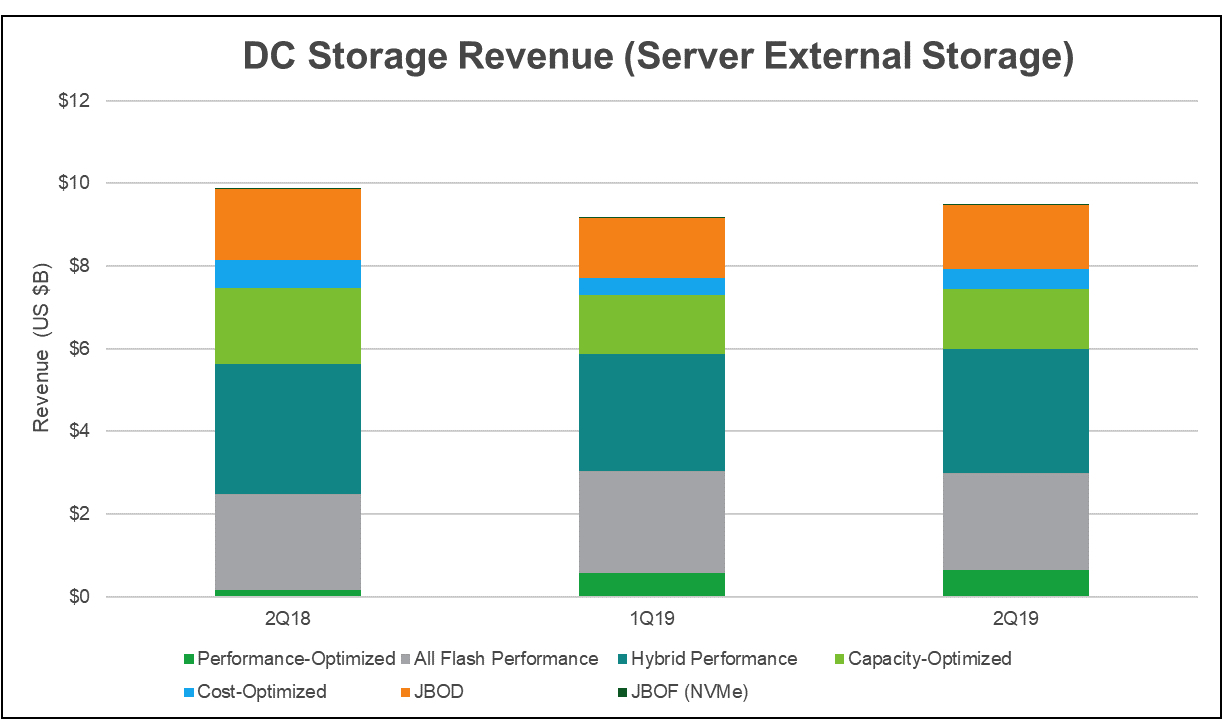

This is a Press Release edited by StorageNewsletter.com on November 8, 2019 at 2:57 pmGlobal revenue in the server external storage market declined by 4% Y/Y in 2Q19, while unit shipments dropped by 10%, reflecting another weak quarter compared to the robust results of 2018.

With 2 quarters left in 2019, the market is expected to contract by 1.5% for the entire year – a massive downswing from 25% growth in 2018, according to the Data Center Storage Equipment Market Tracker from IHS Markit | Technology, now a part of Informa Tech LLC.

On a Q/Q basis, storage revenue in 2Q19 rose 3%, while units increased 9%. However, these increases reflected normal seasonal patterns, and didn’t represent a strong rebound from weak conditions in 1Q19.

AFA storage decreased Q/Q, but all-flash NVMe-drive based versions rose

In the overall AFA storage sector, revenue decreased by 1.7% Q/Q, while the Y/Y revenue increased 21% in 2Q19. The AFA sector is comprised of all flash performance and performance-optimized arrays.

In all flash performance arrays, which is the larger category based on SAS drives, revenue fell. For performance-optimized arrays, a new category based on flash NVMe drives, revenue rose during the quarter.

“Adoption of NVMe SSDs in AFAs is starting to ramp up, and the use of NVMe inside arrays will continue at a surprisingly strong pace,” said Dennis Hahn, principal analyst, IHS Markit | Technology.

Global revenue for data-center storage will increase to $62 billion in 2023, up from $40 billion in 2019, representing a CAGR of 9%.

While the forecast for the next few quarters still leaves 2019 short of 2018, the long-term outlook for the market remains strong. The demand for storage will continue to grow, thanks to the continuous proliferation of digital data and data-intensive workloads such as the IoT, video streaming, industrial automation and AI.

In 2Q19, shipments of all flash performance array units were flat compared to 1Q19. This flatness indicates that several of the all flash leaders struggled to expand shipments in the second quarter.

NetApp, for one, was down 2 points in overall storage market share in 2Q19, after reporting a 24% Y/Y drop in all-flash company revenue in 2Q19.

In 2018, the data-center storage business undertook a broad transition away from high-performance spinning-disk technology and toward all flash storage to achieve vastly increased storage workload performance. The much higher ASPs associated with all flash storage are causing revenues to grow more strongly than units in 2019. However, these same higher ASPs also translate into major capital expense investments, which caused large enterprise to pause their buying in 2Q19, especially in high-end arrays. In the long run, as flash pricing continues to decline, we expect the transition to all flash will continue for at least the next year.

Additional data center storage highlights

• Total server external data center storage will reach $62 billion by 2023, up from $40 billion in 2018, with a 5-year CAGR of 9%.

• Revenue for the all flash performance array category grew 1.8% Y/Y in 2Q19, while hybrid performance arrays declined 4.8% Y/Y, and capacity-optimized arrays declined 21.6% Y/Y.

• Dell EMC maintained its market revenue leadership for array storage, with a 29% share in 2Q19. White box vendors took the ≠2 spot with a 22% share. HPE swapped places with NetApp, giving HPE took the ≠3 spot with 7% share.

• The report expects white-box vendors to reach a 30.5% revenue share in 2023, up from 27% in 2019, with Open Compute Project-certified products set to increase to a 10% share and traditional storage to drop to a 59% share in 2023.

• It forecast cloud service provider revenue share growth will moderate, but still will account for a 43% share in 2023, with telco service providers ramping to a 12% share and enterprise dropping to 45%.

Vendors tracked in the report include Dell EMC, NetApp, HPE, IBM, Huawei, Lenovo, Pure Storage, Hitachi.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter