Everspin: Fiscal 3Q19 Financial Results

Shtrinking and huge loss, but record STT-MRAM revenue

This is a Press Release edited by StorageNewsletter.com on November 8, 2019 at 2:55 pm| (in $ million) | 2Q19 | 2Q20 | 6 mo. 19 | 6 mo. 20 |

| Revenue | 11.5 | 9.2 | 37.1 | 27.9 |

| Growth | -20% | -25% | ||

| Net income (loss) | (5.6) | (3.7) | (14.3) | (11.6) |

Everspin Technologies, Inc. announced financial results for the third quarter ended September 30, 2019.

3FQ19 and Recent Highlights

- Total revenue was $9.2 million, up 6% sequentially and above the high-end of guidance

- Achieved record STT-MRAM revenue, which included both 256Mb and 1Gb devices

- Signed IP assignment and cross-licensing agreement with Seagate, demonstrating the strength of its MRAM intellectual property portfolio

- Expanded Toggle product portfolio with additional densities targeting new market applications

- Reduced cash used for operations to $770,000 from $1.8 million in the prior quarter

“Revenue in the quarter was above the high-end of our guidance range, driven by record revenue from our STT-MRAM products combined with a return to growth for our Toggle products,” stated Kevin Conley, president and CEO. “Furthermore, our ongoing focus on closely managing expenses and cash utilization have contributed to continued improvements in our operating results and positions us to benefit from increased leverage as revenue grows. Also during the quarter, we made further progress on customer qualifications for our 1Gb STT-MRAM device, while continuing to gain traction on our efforts toward advancing the MRAM ecosystem with enterprise storage controller companies. Looking forward, our priority remains on growing our design win pipeline and targeting new opportunities in secular growth markets with an expanded product portfolio based on both Toggle and STT-MRAM technologies.“

3FQ19 Results

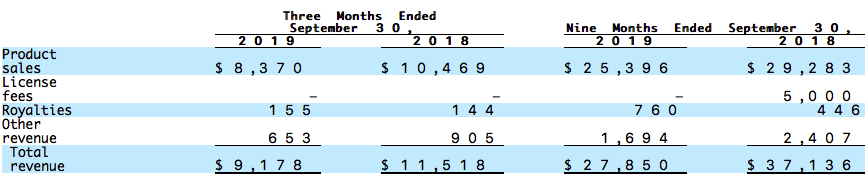

- Total revenue was $9.2 million, compared to $11.5 million in 3FQ18 and $8.6 million in 2FQ19.

- Gross margin was 47.4%, and compares to 47.0% in 3FQ18 and 46.5% in 2FQ19.

- Operating expenses were $7.9 million, compared to the $10.9 million in 3FQ18 and $7.6 million in 2FQ19.

- Net loss was $3.7 million, or ($0.21) per share, based on 17.3 million weighted-average shares outstanding, compared to a net loss of $5.6 million, or ($0.33) per share, in 3FQ18, and a net loss of $3.7 million, or ($0.21) per share in 2FQ19.

- Cash and cash equivalents were $14.8 million, compared to $15.3 million at the end of 2FQ19. During the quarter, the company issued new shares through its at-the-market equity facility, resulting in net proceeds $2.2 million.

Business Outlook

For 4FQ19, Everspin expects total revenue in the range of $9.3 million and $9.7 million. Net loss per share is expected to be between ($0.18) and ($0.14) based on a weighted-average share count of 17.4 million shares outstanding.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter