CapEx Vs. OpEx in Cloud Storage Realm

To dynamically manage infrastructure to fit within the company's current budget

This is a Press Release edited by StorageNewsletter.com on November 7, 2019 at 2:24 pm Author of this article is Mike Jochimsen, director of alliances, Kaminario Technologies Ltd. and SNIA CSTI member:

Author of this article is Mike Jochimsen, director of alliances, Kaminario Technologies Ltd. and SNIA CSTI member:

CapEx vs. OpEx in the Cloud Storage realm

The new paradigms for acquiring storage have enabled flexible financial models which allow a company to use its financial assets, both CapEx and OpEx, to dynamically manage infrastructure to fit within the company’s current budget.

Financial accounting isn’t normally a topic for discussion in the SNIA Cloud Storage Technologies Initiative (CSTI) because we are all about technology, right? After all, why would a storage architect care about this. Isn’t that why we have accountants? Yes, sort of. However, it is the need to identify the most effective use of the company’s financial position during a cloud transition which drives this discussion.

Disclaimer: the author is not an accountant and is especially not your accountant, so all information contained herein should be considered opinion and you should consult your own accountant for accurate interpretation and application to your company’s strategy. Further, this article does not address the question of how your company should allocate its capital and operational expenditures, but simply points out some options to consider when making that decision. Having said that…

With the advent of the cloud and SDS, the question for business today is whether to categorize a storage purchase as capital expense (CapEx) or operating expense (OpEx). And the paradigm behind that question so far has been that storage purchased for a private data center is usually CapEx and storage capacity rented in the public cloud is usually OpEx. Recent advances in how cloud storage can be acquired for use in a private data center are changing the paradigm behind the question again.

Traditionally, when a business acquired computer storage for use in its operation it was generally considered a fixed or long-term asset, meaning the company needed to account for it as a capital expense. Of course, there were exceptions to this, mainly regarding whether the acquisition cost exceeded the capital limit defined by the company or whether the useful life exceeded one year. With data center storage costs in the tens to hundreds of thousands of $s and minimum life expectancies generally at least 3-5 years, it was safe to assume that purchasing storage fell under the definition of CapEx. On the other hand, the cost to manage and maintain that storage was generally considered to be an operating expense, which covered those expenses deemed necessary for the day-to-day running of the business.

This approach has been standard in business for many years. However, as more businesses either began to migrate workloads into public cloud environments, or build private clouds based on SDS, the lines between CapEx and OpEx expenses became more blurred. At the same time, off-balance sheet financing became popular to keep debt from appearing on the company balance sheet making leverage ratios look more appealing to potential investors or lenders. Operating leases became a popular tool, allowing businesses to treat expensive computer equipment as an operating expense by leasing the equipment for less than its useful life with the right to purchase it at fair market value or return it at the 1/4 end of the lease. Recently, the Financial Accounting Standards Board (FASB) and the International Accounting Standards Board (IASB) have released new guidelines for accounting which require leases spanning more than one year to be accounted for on the balance sheet to more accurately reflect company leverage.

The fundamental question to ask when determining if a storage expense should be CapEx or OpEx is whether the company can or does take ownership of the asset, either at the time of acquisition or at the termination of a lease. Generally, in rental or subscription agreements, the company does not and cannot take ownership of the asset. Off premises public cloud infrastructure is by default a subscription and the company does not take ownership of the asset. It stays in the cloud data center under control of the cloud provider. However, in the spirit of ultimate flexibility, public cloud providers have begun to offer contracts which include a license for the infrastructure that the company is using rather than a subscription, which then qualifies the acquisition cost as a capital expense.

On the other hand, storage brought into a private data center, including its software and maintenance cost, has traditionally been capitalized. As with the flexibility of acquiring public cloud storage, companies can also rent hardware and sign subscription agreements for the accompanying software. In this scenario, even though the storage is physically in the company’s data center the company has not taken ownership of the asset and it is returned at the end of the agreement, qualifying the expense as OpEx. In addition, utility-based storage acquisition models, which combine the hardware and software into a single subscription price which can be billed based on capacity utilized are now becoming de rigueur.

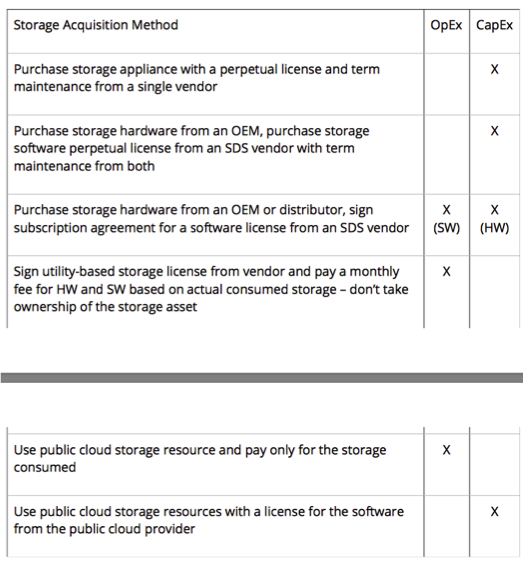

Why should this be a consideration to a company, especially its technical staff? In order to optimize the financial position of the company to achieve its goals, the different instruments described above can be used to achieve your company’s business and financial goals. Therefore, technical staff should be aware of the various models so they can present the appropriate options to their financial team. The following table recaps the various storage acquisition methods described above and their potential CapEx/OpEx impact.

As you can see, acquiring storage for your company’s usage is not quite the straightforward process it used to be. The new paradigms for acquiring storage have enabled flexible financial models which allow a company to use its financial assets, both CapEx and OpEx, to dynamically manage infrastructure to fit within the company’s current budget. As a customer looking at OpEx based offers from multiple vendors, it can often be hard to compare and understand the value each offer would bring to your company.

Following questions can be a starting point for that comparison.

- What is the base value of the hardware and software used to determine the lease or subscription pricing?

- Does the pricing include hardware and software support during the term?

- Is the pricing based on a term lease for the hardware and software (therefore, would the periodic price be fixed for the duration of the contract)?

- If it is a lease, what would be the residual value of the hardware and software at the end of the lease?

- Does the customer have the right to purchase the hardware and software at the end of the term? Is the purchase at or below fair market value?

- If the pricing is subscription based, can the price flex up or down based on utilization during the period?

- If the pricing is based on a utilization metric for the hardware and software (for example, capacity of storage utilized during the period), is the price fluctuation based solely on the utilization metric or are there other factors which can affect pricing (such as floors)?

These are just a few questions which can help identify the strategy used to construct the offer price. As you dive deeper into the analysis, ask lots of questions from your vendors and be sure to ask the same question in various ways if you are not satisfied with answers you get.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter