Company Profile: Kingston

Not far to enter into $10 billion club

By Jean Jacques Maleval | October 25, 2019 at 2:23 pm

Headquartered in Fountain Valley, CA, Kingston Digital, Inc., the flash memory affiliate of Kingston Technology Company, Inc., is involved in memory, SSDs, USB keys, memory cards and flash readers.

HyperX is the product division of Kingston Technology for sports and games.

The manufacturer has established offices in Hsin-Chu, Taiwan; Dublin, Ireland; Sydney, Australia; Paris, France; Munich, Germany; Beijing, China; and Mexico City, Mexico to provide localized sales support and service.

History

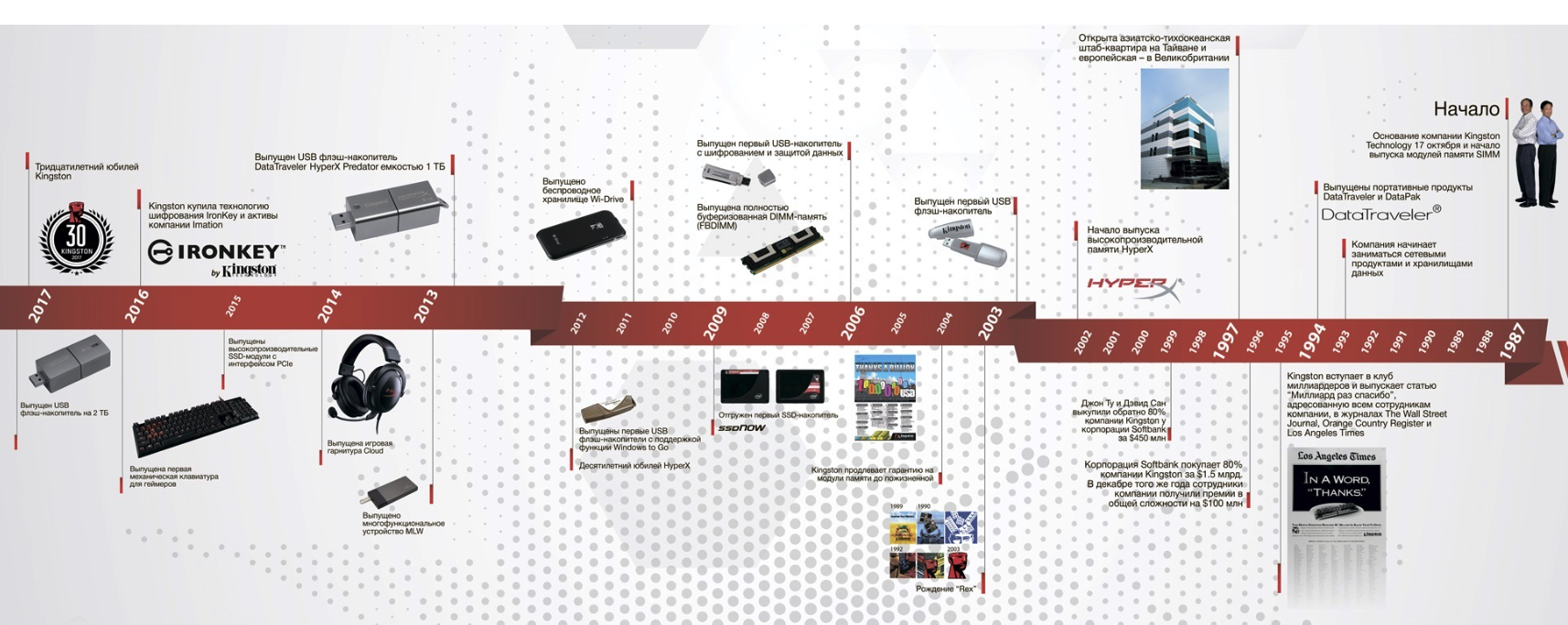

- 1987: founded by John Tu and David Sun, first designing a Single In-Line Memory Module (SIMM) that utilized readily available, older through-hole component

- 1989: entering into manufacturing removable disk drive storage products in its Kingston storage products division

- 1993: expanding into networking and storage product lines

- 1995 King of memories Kingston recording milestone, joining the $billion club with sales reaching $1.3 billion

- 1996 80% of the company acquired by Softbank Corporation of Japan for $1.5 billion

- 1997: establishing a turnkey logistics hub in Dublin, Ireland, to support OEMs in Europe and established Far East facility in Hsin-Chu, Taiwan

- 1999: the two founders buying back the 80% of Kingston owned by Softbank for $450 million to become a private company, Tu being president and Sun COO; acquiring a controlling stake of Powertech Technology, Inc. which became the world’s largest enterprise for assembly of chips

- 2000: deciding to spin off the product line and becoming a sister company, StorCase Technology, Inc. that ceased operations in 2016 after selling the designs and rights to manufacture its products to competitor CRU-DataPort

- 2005: opening the world’s largest memory module manufacturing facility in Shanghai, China

- 2018: HyperX shipping over 60 million memory modules, equivalent of billions of bytes of memory

Acquisition

Buying IronKey assets (encrypted flash key solutions) from Imation in 2016

Investments

Made 4 investments: the most recent one was on 2018, $29.7 million into Nantero in NRAM, after Liqid in 2015 ($9.5 million) and 2017 ($11.7 million) focused on on-demand composable infrastructure technologies, and Amplify.net in 1999 ($6.1 million) dedicated to bandwidth management software solutions for corporate IT departments, ISPs, and content providers.

Company’s revenue

(estimation from different sources)

| Year | Revenue in $ |

| 1987 | 12.8 million |

| 1990 | 87.8 million |

| 1991 | 140.7 million |

| 1993 | 433 million |

| 1994 | 800 million |

| 1995 | 1.3 billion |

| 1999 | 1.5 billion |

| 2003 | 1.8 billion |

| 2004 | 2.4 billion |

| 2005 | 3.0 billion |

| 2006 | 3.7 billion |

| 2007 | 4.5 billion |

| 2008 | 4.0 billion |

| 2009 | 4.1 billion |

| 2010 | 6.5 billion |

| 2015 | 7 billion |

| 2017 | 6.7 billion |

Current market shares

- TrendForce: ranked this year the firm ≠1 for WW shipments of branded SSDs in 2018 with a 25% market share largely in front of Adata and Tigo. In 1H19 delivered more than 13.3 million SSDs, being ≠3 behind Samsung and WD with 11.3% market share. Kingston position in a segment of client 2.5-inch SSD is especially strong as the company is ahead of all other producers and occupies an essential market share in the amount of 27.3%. Furthermore, it has been among the top 3 brands by market share in USB drives and memory cards for many years. The company owned 72.2% of global revenue ranking of DRAM module makers in 2018 with $12 billion in revenue, being the top leader, and growing by nearly 50% to create a new historical record. Kingston has made outstanding progress in China’s markets, pushing market penetration up to a new 72% high.

- Trenfocus: classified Kingston ≠3, behind Intel and WD, in NAND SSDs in 2Q19 with 11.5% of total units, and ≠1 in clients SSDs, even as 2.5″ client SATA SSDs continue to erode. Ships 13.3 million SSDs in 1H19, 11.3% of the total number of SSDs shipped among all manufacturers. Considering the entire client SSD market, which shipped 55.6 million units in 2Q19, Kingston held just over 13% share from a unit perspective. But looking at 2.5″ client SSDs alone, share jumps to 30% of the market. Even as certain market segments continue to migrate to M.2, Kingston has been capitalizing on the segments that have maintained 2.5″ as the dominant form factor. Kingston has shown that it can play in the top tier of the SSD market today – placing in the top 3 in terms of both units and exabytes shipped in the latest reported quarter.

- IHS Markit: SSD shipments rising by an impressive 23.3% sequentially in 2Q19. This performance propelled the firm to the ≠3 rank in SSD unit market for the first time in 3 years, after placing fifth in 2017 and 2018 and fourth in 2016. The company has attaining 6 consecutive quarters of double-digit revenue growth.

Most recent products

The latest ones are KC600 and 450R SSDs.

The KC600 Series 3D TLC NAND technology, ensuring a long run through next year as newer QLC-based NAND SSD solutions continue to struggle to find their place in the market in 2.5-inch form factor. Up to 2TB with 6Gb SATA and up to 550/520MB/s R/W transfer speeds, it will ship soon with hardware SED. Prices are €49,68 for 256GB and €81,72 for 512GB. 2TB is not a record as recently Virtium reached twice this capacity on its industrial StorFly 25 with the same form factor and interface, and Micron 5300 SATA series of SSDs are available up to 7.68TB.

The enterprise-grade 450R 2.5-inch 6Gb SATA SSD offers capacities of 480GB, 960GB, 1.92TB and 3.84TB on 3D TLC with ECC protection. The 3.84TB model, with sequential R/W reached 560/525MB/s, costs €575.

Our comments

Now private, Kingston does not reveal anymore its financial results but is probably in the $10 billion club in revenue. It was $6.7 billion in 2017 according to Forbes, +1.5% from 2016, $10 billion for Wikipedia, the same year, $8.3 billion for Owler with a workforce estimated at 3,000 employees.

Consequently, it’s one of the biggest storage companies in the world behind Micron, Dell, WD and Seagate.

The firm has currently a big advantage against some competitors: it does not manufacture its NAND flash memory microchips integrated into its products and their prices are currently constantly declining, furthermore buying them in huge quantities.

It has apparently does not have its own controllers, taking them in the past from Seagate/LSI/Avago/Sandforce, Phison, Marvell, and Silicon Motion for its last SSDs.

All Kingston SSDs

(Source: StorageNewsLetter.com)

| Released in |

Model | Form factor |

From (GB) | To (GB) | Max. transfer rate read (MB/s) | Max. transfer rate write (MB/s) | Interface | Price in $ |

For | Price/ GB |

Comments |

| 2009 | SSDNow E | 2.5 | 32 | 250 | 170 | SATA | 865 | 32 | 27 | Intel product | |

| 2009 | SSDNow M | 2.5 | 80 | 250 | 70 | SATA | 635 | 80 | 7.9 | Intel product | |

| 2009 | SSDNow V+ | 2.5 | 64 | 256 | 220 | 180 | SATA | 992 | 256 | 3.9 | |

| 2009 | SSDNow V Series 40GB Boot Drive | 2.5 | 40 | 170 | 40 | SATA | 115 | 40 | 2.9 | ||

| 2010 | SSDNow V100 | 2.5 | 64 | 256 | 250 | 230 | SATA 1.5 | 490 | 256 | 1.9 | |

| 2010 | SSDNow V+180 | 1.8 | 64 | 256 | 230 | 180 | Micro SATA | 778 | 128 | 6.1 | |

| 2010 | SSDNow V+100 | 2.5 | 96 | 512 | 230 | 180 | SATA 1.5 | 1,900 | 512 | 3.7 | MLC |

| 2010 | HyperX MAX 3.0 | 73x119x12mm | 64 | 256 | 195 | 160 | USB 3.0 | ||||

| 2011 | HyperX SSD | 2.5 | 120 | 240 | 525 | 480 | 6Gb SATA | SandForce controller | |||

| 2011 | SSDNow KC100 | 2.5 | 120 | 480 | 510 | 450 | 6Gb SATA | 1,280 | 480 | 2.7 | SandForce controller |

| 2011 | SSDNow V200 | 2.5 | 64 | 256 | 300 | 230 | 6Gb SATA | For consumers | |||

| 2012 | HyperX 3K | 2.5 | 90 | 480 | 555 | 510 | 6Gb SATA | 240 | 320 | 1.3 | SandForce controller |

| 2012 | SSDNow V+200 | 2.5 | 60 | 480 | 535 | 480 | 6Gb SATA | 985 | 480 | 2.1 | SandForce controller |

| 2012 | SSDNow E100 Enterprise | 2.5 | 100 | 400 | 535 | 500 | 3/6Gb SATA | ||||

| 2012 | mSATA MMP30 | mSATA | 32 | 128 | 520 | 320 | 6Gb SATA | ||||

| 2012 | SSDNow V300 | 2.5 | 60 | 240 | 450 | 450 | 6Gb SATA | LSI/SandForce controller | |||

| 2013 | Enterprise SSDNow E50 | 2.5 and M.2 | 100 | 480 | 530 | 500 | 6Gb SATA | LSI/SandForce controller | |||

| 2013 | SSDNow KC300 | 2.5, 7mm | 60 | 480 | 525 | 500 | 6Gb SATA | LSI/SandForce controller | |||

| 2014 | M.2 2280 SATA SSD | M2 22x80mm | 120 | 480 | 550 | 520 | 6Gb SATA | Phison controller | |||

| 2014 | SSDNow V310 | 2.5, 7mm | 960 | 450 | 450 | 6Gb SATA | |||||

| 2015 | KC310 | 2.5, 7mm | 960 | 550 | 520 | 6Gb SATA | Phison controller | ||||

| 2015 | KC300 | 2.5, 7mm | 60 | 480 | 450 | 450 | 3Gb SATA | SandForce SF2281 controller | |||

| 2016 | DC400 | 2.5, 7mm | 400 | 1,800 | 555 | 500 | 6Gb SATA | ||||

| 2016 | KC400 | 2.5, 7mm | 128 | 1,000 | 550 | 530 | 6Gb SATA | ||||

| 2017 | Data Center PCIe 1000 SSD | 168x69x18mm | 800 | 3,200 | 6,800 | 6,000 | PCIe NVMe | ||||

| 2017 | DCU1000 | 2.5 U.2 | 800 | 3,200 | 6,800 | 6,000 | NVMe PCIe | ||||

| 2017 | KC1000 | M.2 2280 | 240 | 960 | 2,700 | 1,600 | NVMe PCIe | Phison controller | |||

| 2018 | A1000 | M.2 2280 | 240 | 960 | 1,500 | 1,000 | NVMe PCIe | 3D TLC, Phison controller | |||

| 2018 | UV500 | 2.5, M.2 2280,mSATA | 120 | 1,920 | 520 | 500 | 6Gb SATA | 3D TLC, Marvell controller | |||

| 2019 | DC1000M | U2 | 800 | 3,200 | 6,800 | 6,000 | NVMe PCIe 3.0 x8 | ||||

| 2019 | DC500 | 2.5 | 480 | 3,840 | 560 | 528 | 6Gb SATA | ||||

| 2019 | DC500R/DC500M | 2.5 | 480 | 3,840 | 555 | 525 | 6Gb SATA | 3D TLC | |||

| 2019 | KC2000 | M.2 2280 | 250 | 2,000 | 3,200 | 2,200 | NVMe PCIe 3.0 x4 | 96-layer 3D TLC | |||

| 2019 | A2000 | M.2 2280 | 250 | 1,000 | 2,200 | 2,000 | NVMe PCIe | 3D NAND | |||

| 2019 | DC500 | 2.5 | 480 | 3,840 | 555 | 520 | 6Gb SATA | TLC NAND | |||

| 2019 | DC1000M | U.2 | 960 | 7,680 | NVMe PCIe | TLC NAND | |||||

| 2019 | 450R | 2.5 | 480 | 3,840 | 560 | 525 | 6Gb SATA | €575 | 3,840 | €0,15 | TLC NAND |

| 2019 | KC600 | 2.5 | 256 | 2,000 | 550 | 520 | 6Gb SATA | €82 | 512 | €0,16 | TLC NAND, Silicon Motion controller |

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter