SSD shipments Achieves 18%-Point Upswing in 2Q19 Powered by Surging Client Demand

Impressive Kingston rising by 23% sequentially

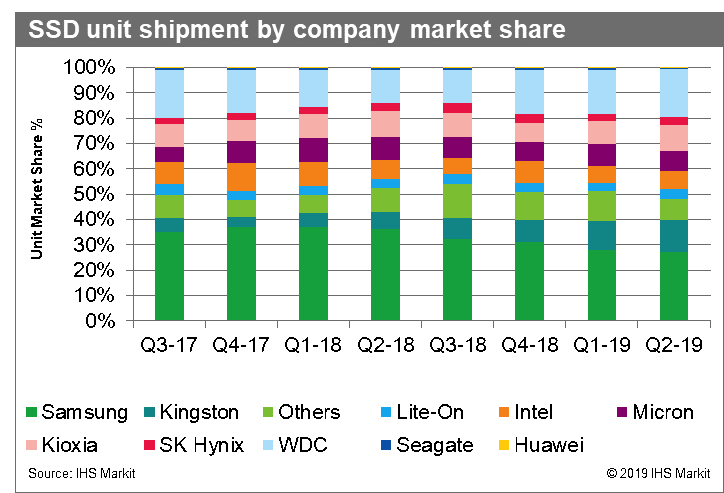

This is a Press Release edited by StorageNewsletter.com on October 23, 2019 at 2:17 pmFollowing a plunge during the first 3 months of the year, global SSD shipments snapped back to growth in 2Q19, as demand from the client system market boosted the performance of third-party suppliers like Kingston, according to IHS Markit | Technology, now a part of Informa Tech, in a report, SSD and HDD Storage Market Tracker.

WW SSD revenue rose to $57.9 billion in 2Q19, up 9.7% from $52.8 billion in the first quarter. Shipments declined by 8.4% sequentially in 1Q19. This dramatic shift from contraction to expansion represents a more than 18%-point swing between the two quarters.

The client SSD segment, which includes devices like mobile and desktop PCs, was the main driver of the rebound, client SSD shipments increased by 11.9% sequentially in 2Q19.

“Falling prices are continuing to fuel SSD demand growth in client systems,” said James Zhao, principal analyst, SSD and HDD, IHS Markit | Technology. “The global ASP for client SSDs declined by 6.7% sequentially in 2Q19, marking the sixth consecutive quarter of ASP contraction in the client segment. These declines are making SSDs more affordable for a larger number of systems.“

In contrast to the strong increase on the client side, the enterprise SSD market attained mild sequential growth of only 1.9%.

NAND price plunge diminishes revenue growth

Despite the vigorous rise in unit shipments, sequential SSD revenue growth in 2Q19 was limited to 1%. That’s because overall SSD ASPs fell by 9.7% in this quarter, stymying revenue growth.

Kingston rides third-party SSD wave

The surge in the client segment disproportionately benefited third-party players that don’t manufacture the NAND flash memory microchips used within their products.

Third-party SSD supplier Kingston exemplified this trend, with the company’s SSD shipments rising by an impressive 23.3% sequentially in the second quarter. This strong performance propelled the company to the ≠3 rank in SSD unit market for the first time in 3 years, after placing fifth in 2017 and 2018 and fourth in 2016. The company has attained six consecutive quarters of double-digit revenue growth.

“Third-party players like Kingston are outperforming the overall market because NAND components are available at such low prices compared to a year ago,” Zhao said. “These companies are able to take advantage of these lower costs and gain market share rapidly.“

Intel leads the enterprise

Intel captured the ≠2 position in SSD revenue share in 2Q19. Because it focuses more on the enterprise market, its SSD ASP is far above average. It shipped more than 4 million SSDs in 2Q19, up 17.5% compared with the previous quarter.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter