History (1989): WW HDD Revenue Expected to Grow Only 9.5% in 1989

IBM responsible

This is a Press Release edited by StorageNewsletter.com on October 15, 2019 at 2:28 pmWW HDD revenues are only expected to grow 9.5% this year compared with a 23% increase in 1988.

IBM is responsible.

Shipments have grown 32%, but if you consider their capacities, the cost per megabyte has dropped.

The 1989 Disk/Trend Report, an authority in magnetic media industry, is blaming IBM for this small increase in WW Winchester disk market.

James Porter and Robert Katzive started their report by writing: “Captive drive shipments are expected to be up only 6.5% in 1989, with the biggest shortfall caused by IBM’s July postponement of the introduction for a major high-end drive to be used with large mainframes, due to technical problems.”

Big Blue has not denied that this delay has even affected its financial results. IBM’s sales continue to count for more than 40% of the WW total revenue in spite of an unusual 3.5% growth rate this year.

This should all change in 1990, where the two US experts forecast a 25% increase, as IBM has just announced high capacity 3390 drives to replace the 3380 ones for its mainframes, and will introduce new 5.25-, 3.5- and even 2.5-inch units, for PCs and mid-range systems.

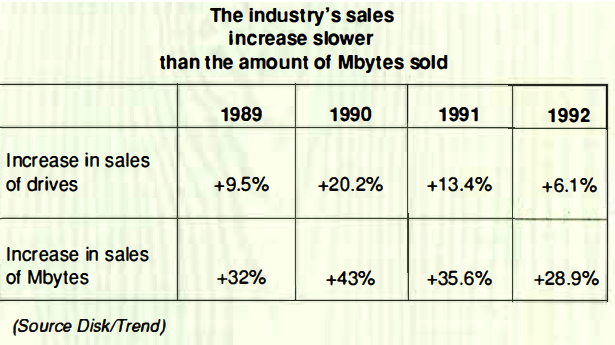

In 1990, the industry should come back to a 20.2% increase compared with this year’s 9.5% one, no longer 14.5% like it was announced in last year’s Disk/Trend Report.

The captive market, that includes manufacturers who make drives for their own computers, with IBM ahead, is responsible of this small increase and affects the whole industry since it counts for 62% of the market.

The other segments have had a better year, OEM and integrators sales that represent one quarter of the activity, have grown 16.3%. Finally reseller market was up 11.4%.

After it acquired Imprimis, Seagate has become the leading independent manufacturer where the main activity refers to Winchester disks. Disk/Trend accredits them with 32.1% of the non-captive market. Considering all size formats, Seagate/Imprimis has undeniably became number two, after Big Blue and just before 58 manufacturers of 800 different drives (five companies less than last year), 31 in USA, 22 in Asia and only 5 in Europe, in a market where the race for larger capacities and smaller formats is crazy, as last Comdex/Fall in Las Vegas, NV proves it.

This activity also has to face new technologies (high-capacity diskettes, magneto-optical disks) and still has to find a secure segment.

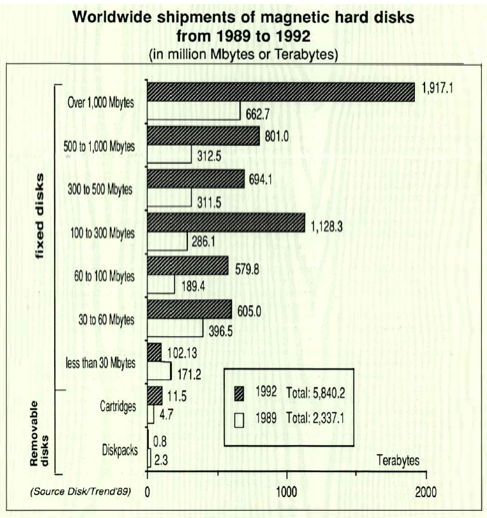

For the first time this year, Disk/Trend had considered not only the financial side of the market but also the amount of megabytes sold, an amazing quantity. In 1988, the equivalent of 1,769.9TB of magnetic capacity on rigid platters were sold. This year more than 32%, next year 43%, etc.

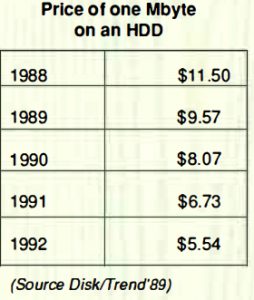

But, revenues will not follow the same growing rates since the price per megabyte has continuously been and will keep on dropping (see figure). Its price ought to be cut in half from 1988 to 1992.

A more detailed report, on all types of disks, shows that for the first time in 1989, shipments of less than 30MB units, are going to fall after continuous increasing in the last years. The biggest shipments apply to 30/60MB drives: 8.2 million in 1989. The fastest growth rate, +122% in 1988 and +60% in 1989, concern 100-300MB products, 1.8 million drives this year with more than half in the 3.5-inch format.

This article is an abstract of news published on the former paper version of Computer Data Storage Newsletter on issue ≠22, published on November 1989.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter