History (1995): Major Contest Between Removable Storage Units

Fastest growing product group expected to be high capacity floppy drives

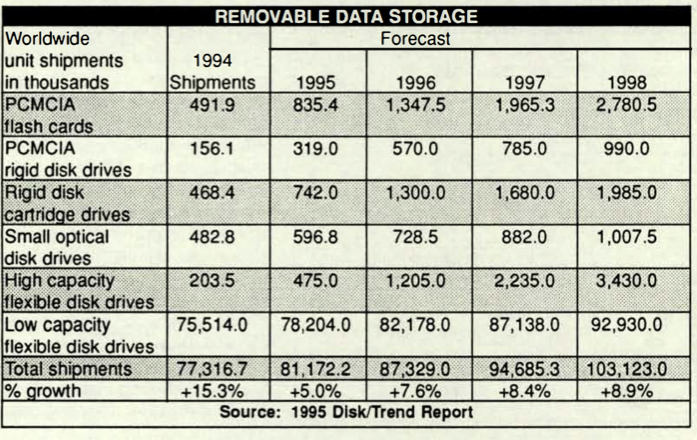

By Jean Jacques Maleval | September 27, 2019 at 2:17 pmGrowing shipments are expected for all types of products covered in the new report on removable storage ($1,875) published by Disk/Trend (Mountain View, CA), but extreme rivalries are being created as manufacturers of several different types of disk drives target the same markets.

A major contest is emerging, as rigid disk cartridge drives, small optical disk drives and high capacity floppy disk drives all take aim at the burgeoning markets for mid-range removable disk capacities between 100MB and 1GB.

In addition to the traditional demand for such drives in graphics, security and printing production, the new generation of higher capacity drives at lower prices has opened the door to new markets for which removable disks provide improved operating convenience.

Drives that are already shipping and those expected to be soon available have generated a strong response for use in multimedia content preparation, video production, storing files downloaded from Internet, backing up PC HDDs and a variety of other growing applications.

Although overall sales revenue growth for the removable storage products included in the report is expected to increase only from $2.9 billion to $3.1 billion in the 5-year period ending in 1998, the increase in unit shipments during the same period is projected to accelerate many fold for a large majority of the product groups.

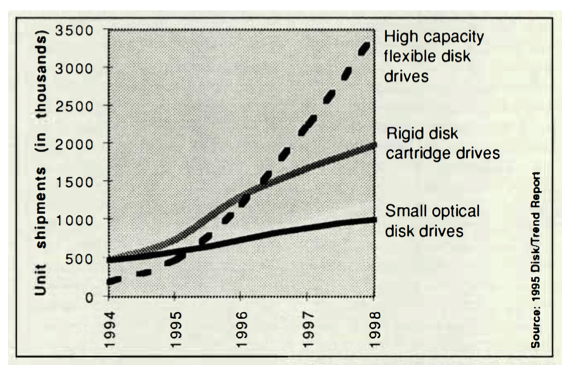

The fastest growing product group is expected to be high capacity floppy drives, forecasted to jump from 203,500 drives in 1994 to 3.4 million in 1998. New 3.5-lnch floppy drives with capacities of 100MB or more are stimulating rapid growth for high capacity flexible disk drives.

Shipments of older high-end floppy drives are declining, but new low cost drives are finding immediate acceptance in a much broader market, including home computers, for many applications which did not exist a few years ago.

Iomega’s Zip drive and other high capacity floppy drives expected in the market by early 1996 provide a convenient storage alternative for many personal computer users now becoming nervous about their risks in failing to backup their new higher capacity HDDs, or who need affordable removable storage devices which are suitable to keep individual projects on individual disks, ready to be loaded when needed.

By 1998, 99.6% of all high capacity floppy drives are forecasted to be 3.5-inch models.

Rigid disk cartridge drives are also in contention in the emerging market for low cost drives in the 100+MB range, and continue to hold their own in the contest for professional markets which need higher capacity removable disk drives. 1998 WW shipments are projected at almost 2 million drives. SyQuest Technology’s 5.25-inch disk cartridge drives set the prepress standard for graphics and typography interchange, but current sales growth is driven by 3.5-inch drives, including new models priced for head-on competition with 100+MB high capacity floppy drives. By 1996, SyQuest and other manufacturers will have 3.5-inch rigid disk cartridge drives in the 500MB to 1GB range and will be locked in competition with producers of small optical disk drives with similar capacities.

2.5- and 3.5-inch small optical disk drives continue to face difficult competition from rigid disk cartridge drives, plus new threats from high capacity floppy drives.

Erasable 3.5-inch optical disk drives in the 600+MB range are expected to be available from several manufacturers by early 1996. Disk/Trend’s forecast of modest shipment growth for small optical disk drives assumes a steady reduction in drive prices to match aggressive rigid disk drive pricing, with slightly over one million drives projected for 1998.

Low capacity floppy drives are included in the report on removable storage for the first time this year, providing extremely high shipment levels, but very low pricing. The 1994 total for 8-, 5.25- and 3.5-inch floppy drives was 75.5 million drives, with the 1998 total projected at 92.9 million.

Total 1994 sales revenues of $2.3 billion for all types of low capacity floppy drives are destined to slump to $1.7 billion in 1998, as average prices decline faster than shipments increase and as older drive models sold at higher prices disappear from the market.

By 1998, 3.5-inch drives are expected to provide 99.8% of the low capacity flexible disk drive total.

The industry’s expectations for PCMCIA rigid disk drives have been lowered during the past year, as targeted markets such as personal digital assistants, personal communicators and subnotebook computers turned out to be much smaller than expected.

Despite sales disappointments and the departure of some 1.8-inch HDD manufacturers, shipments of PC Card drives are on a growth trend, fueled by usage with pen-based computers, electronic typewriters, some notebook computers, and a variety of specialized applications. 1994 shipments of only 156,100 PC Card drives are expected to grow to 990,000 in 1998, pushed by availability of higher drive capacities and increasing usage with small notebook computers.

PCMCIA flash card shipments are forecasted to grow from 491,900 in 1994 to 2.8 million in 1998. Currently, the majority of flash cards sold are in the 2 to 4MB range, and are typically used with PDAs, organizers, industrial equipment and numerous other specialized applications, while higher capacity cards tend to be used in vertical market applications such as real estate, finance or insurance. As flash card average capacities increase through 1998, prices will continue to decline, but will remain many times higher than rigid disk drive prices.

However, direct price comparisons between flash cards and disk drives are not seen as relevant to most markets, since the technologies tend to be used for different applications.

This article is an abstract of news published on the former paper version of Computer Data Storage Newsletter on issue ≠93, published on October 1995.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter