Seagate Pricing Terms Cash Tender Offers

For certain outstanding debt securities

This is a Press Release edited by StorageNewsletter.com on September 18, 2019 at 2:26 pmSeagate HDD Cayman, a subsidiary of Seagate Technology plc, announced the pricing terms of its previously announced cash tender offers, for:

- (i) up to an aggregate principal amount of $250,000,000 of its 4.250% senior notes due 2022,

- (ii) up to an aggregate principal amount of $200,000,000 of its 4.750% senior notes due 2023, and

- (iii) up to an aggregate principal amount of $170,000,000 of its 4.750% senior notes due 2025

The terms and conditions of the offers are described in the offer to purchase dated September 3, 201 and the related letter of transmittal and remain unchanged, except as amended by the company’s press release dated September 17, 2019 increasing the tender cap for the offer for the 2025 notes.

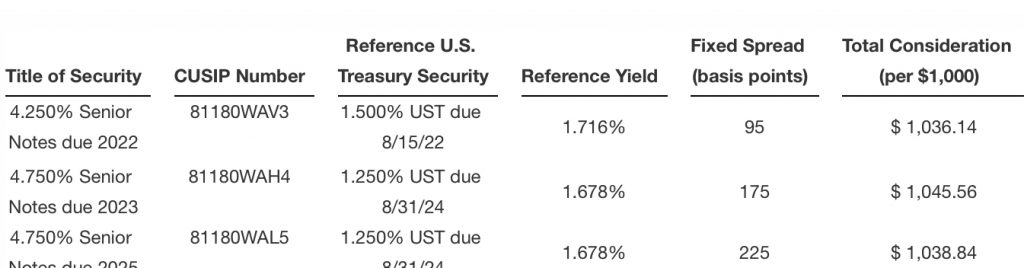

The total consideration for each series of notes is based on the yield to maturity of the applicable U.S. Treasury Security plus a fixed spread, in each case, as set forth in the table below, and is payable to holders of the notes who validly tendered and did not validly withdraw their notes on or before 5:00PM, New York City time, on September 16, 2019 and whose notes are accepted for purchase by the company. The reference yields (as determined pursuant to the offer to purchase) listed in the table were determined at 10:00AM, New York City time, on September 17, 2019, by the dealer managers (identified below). The total consideration for each series of Notes includes an early tender premium of $30.00 per $1,000 principal amount of notes validly tendered and not validly withdrawn by such holders and accepted for purchase by the company.

As announced, the company will accept the notes validly tendered and not validly withdrawn on or before the early tender deadline, subject to proration. Although the offers are scheduled to expire at 11:59PM., New York City time, on September 30, 2019, the company does not expect to accept for purchase any notes tendered after the early tender deadline.

All payments for notes purchased in connection with the early tender deadline will also include accrued and unpaid interest on the principal amount of notes tendered up to, but not including, the early settlement date, which is currently expected to be September 18, 2019.

In accordance with the terms of the offers, the withdrawal deadline was 5:00PM, New York City time, on September 16, 2019.

As a result, tendered notes may no longer be withdrawn, except in certain limited circumstances where additional withdrawal rights are required by law (as determined by the company).

The company reserves the right, subject to applicable law, to:

- (i) waive any or all conditions to the offers;

- (ii) extend or terminate each offer;

- (iii) increase, decrease or eliminate any or all of the tender caps without extending the early tender deadline or the withdrawal deadline; or

- (iv) otherwise amend the offers in any respect.

In connection with the purchase of notes pursuant to the offers, the company requested $500.0 million in aggregate principal amount of term loans under its previously announced term loan facility. Loans under the term loan facility are expected to bear interest at a rate of approximately 3.1% per annum after taking into account the anticipated effect of interest rate hedge transactions we intend to enter into, compared to the weighted average interest rate of notes being purchased pursuant to the offers of approximately 4.6% per annum.

BofA Merrill Lynch and Morgan Stanley are acting as the lead dealer managers for the offers, and SMBC Nikko and Wells Fargo are acting as the co-dealer managers for the offers. The information agent and tender agent for the offers is Global Bondholder Services Corp.

Read also:

Seagate Announces Cash Tender Offers

For certain outstanding debt securities

September 4, 2019 | Press Release

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter