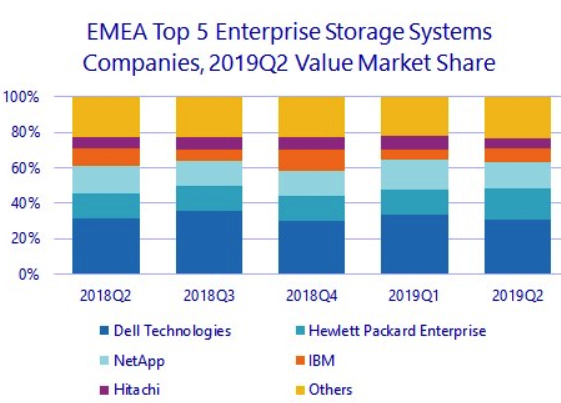

EMEA External Storage Systems Market Led by Dell EMC Down 3.4% Y/Y in 2Q19

First negative figure in past 8 quarters

This is a Press Release edited by StorageNewsletter.com on September 16, 2019 at 2:30 pmThe EMEA external storage systems market in 2Q19 recorded the first negative quarter in the past 8 quarters, with a 3.4% year-on-year decline in value in dollars, according to International Data Corporation‘s EMEA Quarterly Disk Storage Systems Tracker.

Top 5 Vendors, EMEA External Enterprise Storage Systems Value ($ million)

However, the market increased 2.5% Y/Y in euros, showing the negative impact of exchange rates.

The AFA market represented 36.5% of total external storage shipments in the region, while hybrid arrays (HFAs) remained the most popular array type, accounting for almost 46% of total shipments in value terms for the quarter. HDD-only shipments continued to lose ground, registering only 17.6% of value.

Western Europe

The Western European market value declined by 5.1% in dollars but remained afloat with a 0.7% increase in euros.

AFAs suffered a temporary setback in the subregion, representing 34% of total shipments, compared with 37% a year ago. They declined more than 13% Y/Y, the first decline on record, with consumers showing a marked preference for hybrid arrays. HFAs, in fact, accounted for 48% of shipments, and were the only array type with a Y/Y increase in dollars, at almost 4%.

Storage spending in the region has been impacted by a major slowdown in the German economy, while the UK recorded a single-digit decline.

“Unstable macroeconomic conditions and unfavorable exchange rates have taken a toll on the European market, with enterprises showing cautiousness in investments compared with the previous quarters’ increased datacenter refreshment activities,” said Silvia Cosso, research manager, European storage and datacenter research, IDC. “A bright spot in the quarter has been the hyperconverged/HCI segment, increasingly the system of choice to support a multicloud environment for emerging and complex workloads.”

Central and Eastern Europe, the Middle East, and Africa

In 2Q19, CEMA storage market value increased 2.2% in dollars on the back of AFA shipments, which partially offset the negative trend in Western Europe. Central and Eastern Europe (CEE) outperformed both the Middle East/Africa and Western Europe in growth.

The AFA segment was the bright spot that kept the market on the positive side, managing to achieve 11% Y/Y growth and a 32% share, mostly due to momentum in Central European countries that had previously lagged in AFA penetration.

The MEA region again had a mixed performance, with Gulf countries benefiting from the large projects taking place there, while other major countries’ storage demand suffered from an economic slowdown, lack of datacenter refreshment, and technology shifts to converged infrastructure.

“The slowdown in storage growth demonstrates the higher maturity level of the CEMA markets but also some discrepancies in supply vs demand of storage solutions. Even the lucrative AFA market saw a shift to NVMe-based systems rather than an expansion of the installed base,” said Marina Kostova, research manager, storage systems, IDC CEMA. “Storage vendors’ readiness to supply the solutions to meet end users’ digital transformation needs varies and is the reason for the mixed performance of the entire market.”

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter