78.6 Million HDDs Shipped in 2CQ19

Corresponding to capacity of 207EB

This is a Press Release edited by StorageNewsletter.com on August 23, 2019 at 2:23 pmIn its SDAS: HDD Information Service, CQ2 ’19 Quarterly Update, published on August 14, 2019, analysts’ company Trendfocus, Inc. wrote:

CQ2 HDD Shipments Rise on Cloud Growth,

Trade/Tariff Concerns; 207EB Shipped

Hyperscale demand for nearline accelerates with latest cloud expansion cycle

but trade fears pull-in demand, weakening near term outlook

ahead of uncertain economic conditions.

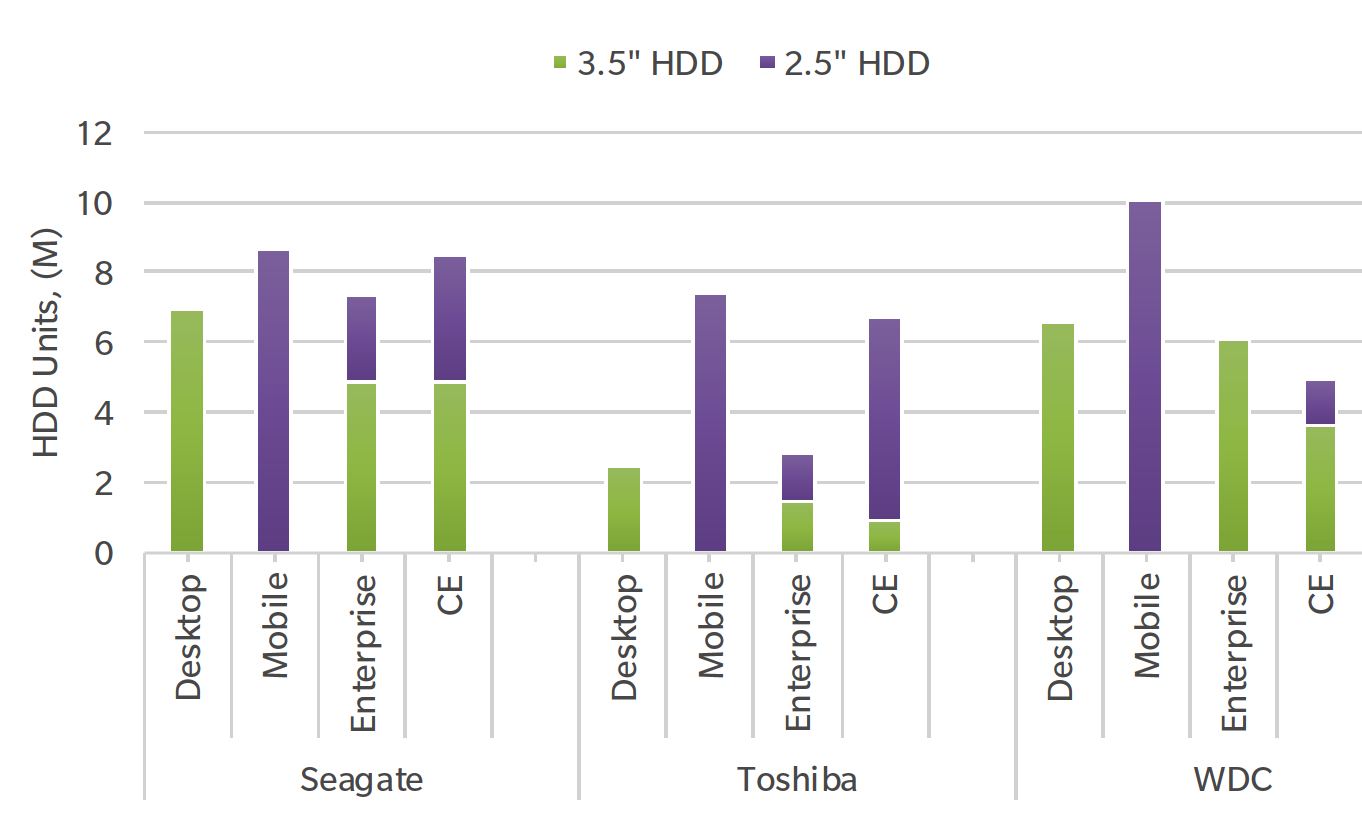

Total 2CQ19 HDD Market Shipments, by Supplier, Units in Million

While 2CQ19 HDD shipment totals of 78.56 million essentially matched the company’s forecast published in May, several factors, both positive and negative, have influenced the near-term HDD forecast published in this report.

On the positive side, nearline demand by cloud customers continued to accelerate from the early recover witnessed in 1CQ19. For 2CQ19, total nearline shipments jumped 13% Q/Q to 12.40 million units and, more importantly, total capacity shipped of 105.72EB advanced 19% over the same period due to a surge in 14TB shipments at two tier-1 hyperscale companies. 12TB, while declining slightly Q/Q, shipped higher volumes than all other nearline capacities as the 14TB transition at other cloud companies commences in 3CQ19.

Client HDD demand, while seasonally weak in 2CQ19, came under additional pressure from accelerating SSD attach rates due to falling SSD pricing caused by NAND oversupply. In addition, seasonally stronger game console HDD sales were muted in 2CQ19 as the current console generations enter their seventh year of existence. While a console refresh from both Microsoft and Sony are expected as early as late 2020, industry chatter indicates that the new platforms will sport SSDs in place of HDDs.

Trade tensions are also high on the list of concerns among both HDD customers and suppliers. While threatened tariff increases in June did not materialize, PC manufacturers and ODMs accelerated system builds in 2CQ19 in order to avoid the potentially higher export tariffs on products shipping out of China. Due to the system build-aheads, PC OEMs are cutting builds in early CQ3 to manage inventory, an action that will temper seasonal HDD demand further.

The uncertainties caused by continued tariff threats weigh on overall spending across numerous economies, spreading fears that a broader global economic slowing is beginning to take hold. As a result, the 2019 HDD forecast has been reduced slightly to account for a weaker PC forecast projected for the year.

At the same time, nearline demand remains essentially unchanged from prior forecasts in terms of annual exabyte growth. A slightly faster recovery of nearline demand by cloud customers in the 1H19 marginally reduces the nearline unit forecast a bit in 1H19, but the impact is fairly small relative to the total HDD TAM.

Over the revised long-term forecast, total HDD demand has been reduced primarily due to a change in the game console HDD outlook. With the next generation of Sony PlayStation and Microsoft Xbox converting from HDD storage over to SSDs based on current market information, the long-term game console HDD shipments will decline at a faster rate than in the previous forecast. In all likelihood, both companies will continue to sell current HDD-enabled platforms as a lower priced option until such time that SSD pricing falls to a point when HDDs can be displaced across the entire console line-up.

Higher-capacity client HDDs will continue to serve markets that value low-cost, high capacity solutions, such as surveillance and external retail HDDs. The external HDD market will remain steady while demand for surveillance HDDs will continue to grow over the long-term; however, other applications such as PCs and most distribution HDDs will have limited demand for high-capacity HDDs greater than 2TB. While the long-term HDD unit forecast remains relatively unchanged in total, the capacity growth for total client HDDs has been reduced slightly from a 25% five-year CAGR to 24%.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter