Pure Storage: Fiscal 2Q20 Financial Results

Always growing and always not profitable

This is a Press Release edited by StorageNewsletter.com on August 22, 2019 at 2:37 pm| (in $ million) | 2Q19 | 2Q20 | 6 mo. 19 | 6 mo. 20 |

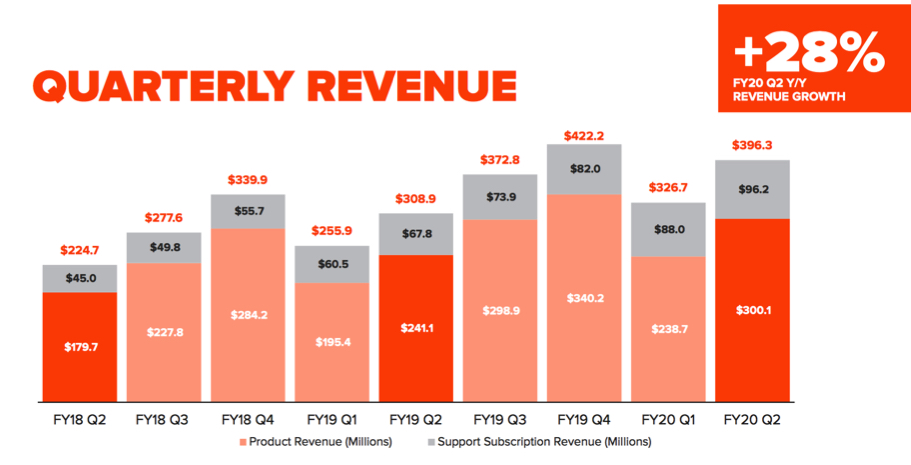

| Revenue | 308.9 | 396.3 | 564.8 | 723.0 |

| Growth | 28% | 28% | ||

| Net income (loss) | (60.1) | (66.0) | (124.4) | (166.4) |

Pure Storage, Inc. announced financial results for its second quarter ended July 31, 2019.

“Our significant growth this quarter and continued market share gains are the result of creating a modern data experience for our customers,” said Charles Giancarlo, chairman and CEO. “Pure frees enterprises to leverage their data rather than locking it away.”

Key Financial Highlights:

• Revenue: $396.3 million, up 28% Y/Y

• Gross margin: GAAP 67.7%; non-GAAP 69.4%

• Operating margin: GAAP -16.4%; non-GAAP -0.8%

Recent Company Highlights:

Second quarter yielded momentum as customers are selecting Pure’s modern approach that enables organizations to better utilize all data today and for the future direction of their hybrid IT environment.

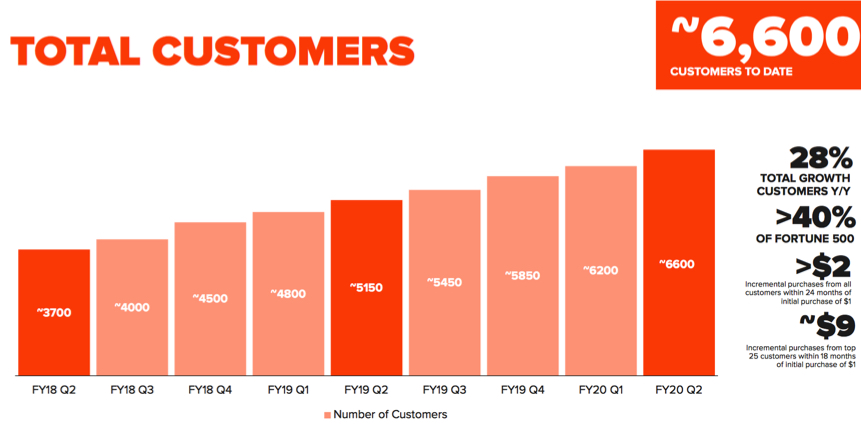

• Customer Traction: Added more than 450 new customers in 2Q20, the highest number in any 2Q of firm’s history.

• Technology: The subscription-based Cloud Block Store beta as part of Pure Cloud Data Services, is oversubscribed and early customer feedback has been overwhelmingly positive.

• Repurchase Program: Board of directors authorized a $150 million share buy-back program.

“Pure’s strong growth in 2Q20 has separated us from the legacy vendors,” said Tim Riitters, CFO. “Our fundamentals remain strong, and our innovative product cycle is helping customers leverage their data in a powerful way.”

Organizational Update

CFO Tim Riitters will be departing the company this year after a five-year tenure. He will remain on into the Fall as the company undergoes the search for a replacement CFO. He first joined the firm in August 2014, assuming leadership of the company’s WW financial and accounting operations. In that time, he has helped drive an increase in revenue of nearly 10x, while also helping the company achieve profitability.

“Tim has been an integral part of the Pure Storage leadership team for the last five years. As our CFO, the success of his tenure is in the numbers and the numbers speak for themselves,” said Giancarlo. “Everyone at Pure has the utmost respect for what Tim has accomplished and we wish him well.”

3FQ20 guidance:

• Revenue in the range of $434 million to $446 million, or $440 million at the midpoint

• Non-GAAP gross margin in the range of 66.0% to 69.0%, or 67.5% at the midpoint

• Non-GAAP operating margin in the range of 3.0% to 7.0%, or 5.0% at the midpoint

FY20 guidance:

• Revenue in the range of $1.645 billion to $1.715 billion, or $1.680 billion at the midpoint

• Non-GAAP gross margin in the range of 67.0% to 69.0%, or 68.0% at the midpoint

• Non-GAAP operating margin in the range of 2.25% to 4.75%, or 3.5% at the midpoint

Comments

Will Pure ever be profitable as the company recorded net losses along all its history since its inception ten years ago?

On the other side, revenue was always growing rapidly. For the most recent quarter, at $396 million, it's up 28% Y/Y and 21% Q/Q.

Click to enlarge

Product revenue grew 24% Y/Y to $300.1 million, and support and subscription revenue were up 42% Y/Y to $96.2 million.

Click to enlarge

74% of sales came from USA and 26% from international markets for the quarter.

President David 'Hat' Hatfield said:" Pure is growing approximately 10x faster than any competitor and their rate of spending on innovation is on average 2x less than Pure's R&D investment. (...) This quarter, we closed a number of large transactions, including a 50% increase in million-dollar deals from 1FQ20. We were particularly pleased with the progress in our enterprise and public sector segments, as both outpaced the growth of our overall business."

CEO Giancarlo commented on NAND market: "What we do see is a significant transitory NAND supply/demand imbalance which impacted component prices and the storage industry as a whole. We expect this situation to continue to affect us for the balance of the year given the natural lag between component costs and storage market pricing. However, we are already seeing NAND pricing rise in the spot market, and suppliers are delaying additional fab capacity. We believe these signals point to an improving market next year."

Pure finished the quarter with cash and investments of $1.18 billion, an increase of $16 million from the previous one.

The company recorded a total of 6,600 customers.

Head account increased from 2,450 to 3,300 Y/Y.

Pure Storage disappoints on guidance for 3FQ20 with revenue supposed to be $440 million at the midpoint or up only 11% Q/Q, but increasing 24% at $1.680 billion for FY20.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter