Toshiba Memory Holdings Corporation (Kioxia): Fiscal 4Q18 Financial Results

Gigabyte shipments decreased due to reduction of 15nm NAND production, ASP continued to decline since late 2018

This is a Press Release edited by StorageNewsletter.com on July 22, 2019 at 2:22 pm| (in ¥ billion) | 3FQ18 (TMC) | 4FQ18 (TMCHD-1) | FY17 (former TMC-2) |

FY18 (former TMC-3 and TMCHD -1/3) |

| Revenue | 301.6 | 247.0 | 1,229 | 1,264 |

| Growth | -18% | 3% | ||

| Net income (loss) | 29.9 | (19.3) | 718.6 | 60.5 |

Based on the audited consolidated financial statements of former TMC for FY17, 3QFY18 and 4QFY18, and the unaudited consolidated financial reports of former TMC and TMCHD for FY18. All figures are prepared under IFRS.

1. TMCHD has assumed the financial reports of TMC, which became TMCHD’s wholly-owned subsidiary through a sole-share transfer on March 1, 2019.

2. Based on the financial reports of former TMC as a wholly-owned subsidiary of Toshiba Corporation, before the acquisition by K.K. Pangea.

3. Based on the unaudited consolidated financial reports of TMCHD from April 2018 to March 2019, which includes the income statement impact of K.K. Pangea’s financing activities during the first two months of the period. The period June 2018 to March 2019 is referred to in the table above because the results for April and May 2018 do not include the results of former TMC, which operated the substantive business during those two months.

Toshiba Memory Holdings Corporation announced on May 13, 2019 its financial results for 4Q18 and FY18 ended March 31, 2019.

Recent Sales Trends

• Weak datacenter- and smartphone-related demand due to seasonality

• Gigabyte shipments decreased due to reduction of 15nm NAND production

• Ratio of BiCS Flash production surpassed 90% in March 2019 (bit basis)

• ASP continued to decline since late 2018

Establishment of Toshiba Memory Holdings Corporation

• Under our new structure, TMCHD was established on March 1, 2019, aiming to contribute to the value of TMC and its respective subsidiary companies, including by strengthening governance through enhanced management and oversight of group companies, including TMC, and by assuming responsibility for group strategy including M&A, resource allocation, risk management, fund raising, etc.

Products and Technology Development

• Developed 96-layer BiCS Flash with QLC technology (July 20, 2018)

• Started shipment of SSD XG6 Series utilizing 96-layer BiCS Flash (July 24, 2018)

• Started shipment of NVMeTM SSD BG4 Series which places both 96-layer BiCS Flash and an all-new controller into one package (January 9, 2019)

• Developed new bridge chip utilizing PAM4 for high-speed and high-capacity SSD (February 21, 2019)

• Started shipment of embedded flash memory products for automotive applications utilizing BiCS Flash (March 26, 2019)

PPA Impact Overview

• The company completed the purchase price allocation (PPA) in 3QFY18 based on the fair value as of the date former TMC was acquired (June 1, 2018), which resulted in fair value adjustments that retroactively increased inventory and fixed assets by ¥138.8 billion and ¥429.5 billion, respectively, as of June 1, 2018.

• PPA impact on FY18 results of operations is described in the upper right chart. The firm expects to record additional fixed asset depreciation/amortization costs, etc., due to the effects of PPA of approximately ¥100 billion/year from FY19 to FY21, which together will cover more than 95% of the total depreciation/amortization costs, etc., in relation to PPA.

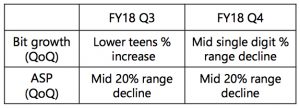

Industry/Market Trends and Outlook

• On the supply side, memory manufacturers reduced flash memory production through lower capital expenditures and lower fab utilization. On the demand side, general market expectations are for inventory levels to begin normalizing from the second half of CY19 driven by an accelerated replacement of HDDs with SSDs and a continued increase in the amount of storage per smartphone due to the decline of ASP and the recovery of datacenter-related demand.

• The company significantly reduced its capital expenditures (order based) in FY18 compared to the previous year in light of trends in the flash memory market. It made investments related to the shift to 96-layer BiCS Flash in Japan at its Fab6 in Yokkaichi, Mie Prefecture and for the construction of our new fab in Kitakami, Iwate Prefecture. The firm views these investments as necessary for the enhancement of cost efficiencies and business competitiveness

Read also:

Toshiba Memory Cuts Bridges With Toshiba, Changing Name in October to Kioxia

Combining Japanese word for memory and Greek word for value

July 19, 2019 | Press Release

Toshiba Memory: Leave of Absence for CEO Yasuo Naruke Until September

Replaced temporary by Nobuo Hayasaka

July 19, 2019 | Press Release

Toshiba Memory Holdings Reorganizes Capital Structure

Refinancing loans from financial banks and issuing non-convertible-bond-type preferred stock as a third-party allotment to Development Bank of Japan

June 19, 2019 | Press Release

Toshiba Memory Holdings to Implement $11 Billion Financing

Through preferred stock and loans

June 3, 2019 | Press Release

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter