History (1988): Shipments of 3.5-Inch FDDs Surpass 5.25-Inch Units for First Time in 1988

Total of 30 million drives sold in 1987, up 24% from 1986

By Jean Jacques Maleval | July 4, 2019 at 2:22 pmMicrofloppy drive shipments surpass 5.25-inch floppy drives in 1988, this is the main conclusion of the 1988 report on flexible disk drives published by Disk/Trend Inc. (Mountain View, CA).

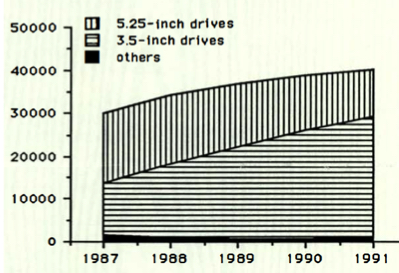

Strong growth for floppy drives is continuing, with 1987 up 24% to 30.3 million drives and 1988 estimated at 34.6 million drives, a 14% increase.

Microfloppy drives are pushing up the industry’s worldwide shipment totals, with annual increases during 1987 and 1988 averaging 69%.

The continuing market momentum of PC/AT clones has generated a slight shipment increase for two-sided 5.25-inch drives in 1988, but an even stronger market has boosted microfloppies into the lead for the first time. Microfloppy unit shipment doubled in 1987, totaling 12.3 million drives, and the outlook for 1988 is 17.1 million drives.

The 3.5-inch format has benefited from usage with IBM’s PS/2 personal computer family, plus strong growth for the Apple Macintosh, portable computers and other new systems.

Here are other highlights from the report:

- Major changes are also underway within the 3.5-inch microfloppy format, now composed mostly of two sided models. Until recently, most 3.5-inch drives were 1.625 inches high, the same height as half-high 5.25-inch drives. But the newer one-inch high models composed almost half of 1987’s two sided 3.5-inch drive shipments, and are forecasted to top 99% in 1991. And while the drives are becoming physically smaller, capacities are becoming larger. 1MB drives had 78 product development activity in percent of 1987 shipments, but 2MB drives are expected to announced products ranging up capture 69% of 1991 shipments.

- Two-sided 5.25-inch floppy drives became the industry’s leading format after selection by IBM for the personal computer XT and AT families, but the introduction of newer computers using 3.5-inch microfloppies has held down growth in recent years. 1988 is expected to be the peak year for shipments of two sided 5.25-inch drives, with 15.3 million units, dropping to 10.8 million drives in 1991. Shipments of one side 5.25-inch drives are already below one million drives per year.

- Much of the floppy drive new product development involves high capacity drives, with announced products ranging up to 44MB in formatted capacity. While 59% of 1987 shipments in the product group covering floppy drives over format after selection by IBM for 5MB were 8-inch drives, mostly Iomega Bernoulli drives, 1988 shipments are expected to be 71% 5.25-inch drives. With the advent of 3.5-inch high capacity floppies promised for shipment in 1989, the report predicts 93% of 1991 shipments will be 3.5-inch models.

- There are now 56 floppy drive manufacturers WW, with little change in the total during the last few years. Japanese firms are most numerous, totaling 21 active floppy drive manufacturers.

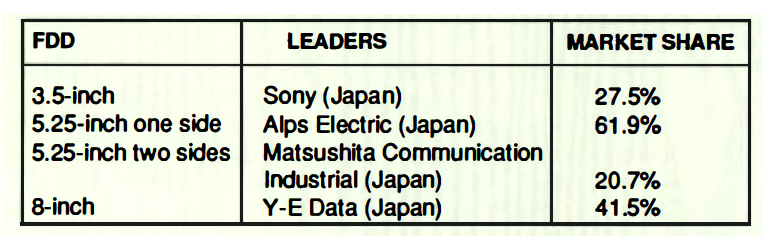

- 94% of WW floppy drive revenues were generated by non-US companies, and 70% of the WW revenue total was represented by the sale of OEM drives. Sony leads in OEM microfloppy drives with 27.5% of WW unit shipments, Matsushita Communication Industrial in two-sided 5.25-inch drives with 20.7%, Alps Electronics in one side 5.25-inch drives with 61.9%, and Y-E Data in 8-inch drives with 41.5%.

In addition to individual revenue and unit shipment projections for flexible disk drives in 6 separate product groups, the 1988 Disk/Trend Report on flexible disk drives ($1,140) provides statistics and analysis on cumulative shipments, average OEM selling prices, competing storage technologies. The report also contains basic specifications on 312 flexible disk drives and profiles on 62 existing and former manufacturers of FDDs, worldwide.

FDD WW shipments by all manufacturers

(in million of units)

This article is an abstract of news published on the former paper version of Computer Data Storage Newsletter on issue ≠11, volume ≠1, published on December 1988.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter