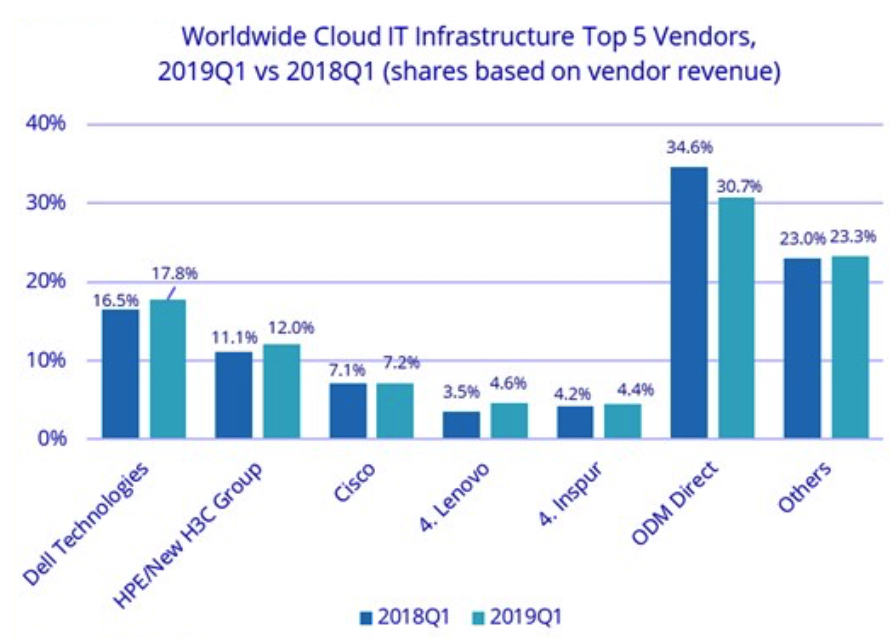

Cloud IT Infrastructure Revenue Grew 11% Y/Y in 1Q19 Reaching $14.5 Billion

Market share: Dell 18%, HPE 12%, Cisco 7%, Lenovo 5%, Inspur 4%

This is a Press Release edited by StorageNewsletter.com on June 21, 2019 at 2:13 pmAccording to the International Data Corporation‘s Worldwide Quarterly Cloud IT Infrastructure Tracker, vendor revenue from sales of IT infrastructure products (server, enterprise storage, and Ethernet switch) for cloud environments, including public and private cloud, grew 11.4% year over year in 1Q19, reaching $14.5 billion.

Analyst firm also lowered its forecast for total spending on cloud IT infrastructure in 2019 to $66.9 billion – down 4.5% from last quarter’s forecast – with slower Y/Y growth of 1.6%.

Vendor revenue from hardware infrastructure sales to public cloud environments in 1Q19 was down 13.4% compared to 4Q18 but increased 8.9% year over year to $9.8 billion. This segment of the market continues to be highly impacted by demand from a handful of hyperscale service providers, whose spending on IT infrastructure tends to have visible up and down swings.

After a strong performance in 2018, the public cloud IT infrastructure segment will cool down in 2019 with vendor revenue dropping to $44.5 billion, a 2.2% decrease from 2018.

Although it will continue to account for the majority of spending on cloud IT environments, its share will decrease from 69.1% in 2018 to 66.5% in 2019.

In contrast, spending on private cloud IT infrastructure has showed more stable growth since IDC started tracking sales of IT infrastructure products in various deployment environments. In 1Q19, vendor revenues from private cloud environments increased 16.9% year over year reaching $4.7 billion. It expects spending in this segment to grow 10.1% Y/Y in 2019.

Overall, the IT infrastructure industry is at a crossroads in terms of product sales to cloud vs. traditional IT environments. In 3Q18, vendor revenues from cloud IT environments climbed over the 50% mark for the first time but has since fallen below this important threshold. In 1Q19, cloud IT environments accounted for 48.8% of vendor revenues. For the full year 2019, spending on cloud IT infrastructure will remain just below the 50% mark at 49.4%. Over the long-term, however, IDC expects that spending on cloud IT infrastructure will grow steadily and will sustainably exceed the level of spending on traditional IT infrastructure in 2020 and beyond.

Spending on the three technology segments in cloud IT environments is forecast to deliver growth for Ethernet switches and storage platforms while compute platforms are expected to decline in 2019. Ethernet switches will be the fastest growing at 20.9%, while spending on storage platforms will grow slightly at 1.9%. Meanwhile, compute platforms will decline by 2.8% in 2019 but will remain the largest category of spending on cloud IT infrastructure at $34.2 billion.

Sales of IT infrastructure products into traditional (non-cloud) IT environments remained flat compared to 1Q18. For the year 2019, WW spending on traditional non-cloud IT infrastructure is expected to decline by 3.5%, as the technology refresh cycle that drove market growth in 2018 is winding down. By 2023, traditional non-cloud IT infrastructure will only represent 42.4% of total WW IT infrastructure spending (down from 51.9% in 2018). This share loss and the growing share of cloud environments in overall spending on IT infrastructure is common across all regions.

“As the overall IT infrastructure goes through a period of slowdown after an outstanding 2018, the important trends might look somewhat distorted in the short term,” said Natalya Yezhkova, research VP, infrastructure systems, platforms and technologies, IDC. “IDC’s long-term expectations strongly back continuous growth of cloud IT infrastructure environments. With vendors and service providers finding new ways of delivering cloud services, including from IT infrastructure deployed at customer premises, end users have fewer obstacles and pain points in adopting cloud/services-based IT.“

Most regions grew their cloud IT Infrastructure revenues in 1Q19. Middle East & Africa was fastest growing at 35.3% Y/Y, followed by Western Europe at 25.4% Y/Y growth. Other growing regions 1Q19 included Central and Eastern Europe (18.3%), Canada and Japan (both at 14.6%), the United States (10.7%), and China (5.4%). Cloud IT Infrastructure revenues were down slightly Y/Y in AsiaPac (excluding Japan) (APeJ) by 1.2% and in Latin America by 0.2%.

Top Companies, WW Cloud IT Infrastructure

Vendor Revenue, Market Share, and Y/Y Growth, 1Q19

(revenue in $million)

Notes:

* IDC declares a statistical tie in the WW cloud IT infrastructure market when there is a difference of one% or less in the vendor revenue shares among two or more vendors.

** Due to the existing joint venture between HPE and the New H3C Group, IDC reports external market share on a global level for HPE as HPE/New H3C Group starting from 2Q16 and going forward.

Spending on cloud IT infrastructure will grow at a 5-year CAGR of 7.5%, reaching $94.5 billion in 2023 and accounting for 57.6% of total IT infrastructure spend. Public cloud infrastructure will account for 66.2% of this amount, growing at an 6.6% CAGR. Spending on private cloud infrastructure will grow at a CAGR of 9.4%.

Taxonomy Notes

IDC defines cloud services more formally through a checklist of key attributes that an offering must manifest to end users of the service. Public cloud services are shared among unrelated enterprises and consumers; open to a largely unrestricted universe of potential users; and designed for a market, not a single enterprise. The public cloud market includes variety of services designed to extend or, in some cases, replace IT infrastructure deployed in corporate datacenters. It also includes content services delivered by a group of suppliers IDC calls Value Added Content Providers (VACP). Private cloud services are shared within a single enterprise or an extended enterprise with restrictions on access and level of resource dedication and defined/controlled by the enterprise (and beyond the control available in public cloud offerings); can be onsite or offsite; and can be managed by a third-party or in-house staff. In private cloud that is managed by in-house staff, ‘vendors (cloud service providers)’ are equivalent to the IT departments/shared service departments within enterprises/groups. In this utilization model, where standardized services are jointly used within the enterprise/group, business departments, offices, and employees are the ‘service users.’

IDC defines Compute Platforms as compute intensive servers. It includes storage intensive servers as well as external storage and storage expansion (JBOD) systems. Storage intensive servers are defined based on high storage media density. Servers with low storage density are defined as compute intensive systems. Storage Platforms does not include internal storage media from compute intensive servers. There is no overlap in revenue between Compute Platforms and Storage Platforms, in contrast with IDC’s Server Tracker and Enterprise Storage Systems Tracker, which include overlaps in portions of revenue associated with server-based storage.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter