History (1988): WW HDD Industry to Top $20 Billion in Revenue for 1988

Up 23% from last year

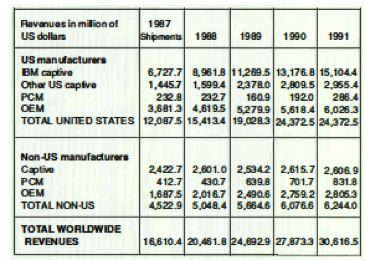

By Jean Jacques Maleval | June 14, 2019 at 2:27 pmMany disk drive manufacturers have found it difficult to keep up with the continuing transition to smaller drives and higher recording densities, but the WW rigid disk drive industry will top $20.4 billion in revenues for 1988, up 23% from last year, according to the recently released Disk/Trend Report.

The report from Disk/Trend Inc. (Mountain View, CA) forecasts average revenue growth during the next three years at 14.5%, with the revenue total for 1991 reaching $30.6 billion, representing 29.6 million drives of all types. The most rapidly growing product group will be mid-range disk drives used with high-end personal computers and technical workstations.

Here are other highlights from the report:

- The total number of active disk drive manufacturers grew by three companies in 1988, reversing several years of industry consolidation. Most of the new entrants are concentrating on small diameter low-end drives.

- Increasing usage of rigid disk drives with personal computers continues to stimulate growth in low-end drive shipments. WW 1988 shipments of drives with capacities under 100MB are estimated at 15 million units, with 3.5-inch models setting the pace. However, the ongoing movement to higher disk capacities in the personal computer market will mean flat revenue growth for drives below 30MB.

- The shrinkage in typical disk diameters is continuing, with 3.5-inch drives forecasted to account for 98% of 1991 unit shipments of 30-60MB drives, 94% of 60-100MB drives and 84% of 100-300MB drives. 3.5-inch models are also expected to lead in shipments of drives with less than 30MB capacity, but by 1991 even smaller drives, mostly 2.5-inch models, will have grown to almost 14% of the group’s total.

- One of the most crowded disk drive market places in 1988 is the rapidly growing market for 300-500MB 5.25-inch drives, now widely used with minicomputers and technical workstations. 14

manufacturers from the US, Europe and Japan are in production, resulting in excess capacity and severe price competition in OEM markets. However, shipments have increased rapidly, from

45,100 drives in 1987 to an estimated 372,700 in 1988, and will grow to 1.2 million in 1991. - IBM’s captive drive shipments, always the industry’s biggest money winner, will produce an estimated $8.9 billion in 1988 and climb to $15.l billion in 1991. Current highlights are shipments of an estimated 1.8 million 3.5-inch drives in 1988 for PCs and forecasted first shipments next year of new high end drives for mainframe applications.

- Seagate Technology maintained its lead in OEM rigid disk drive revenues, with 19.8% of 1987’s worldwide total. Imprimis Technology, formerly Control Data’s storage products group, was second with 14.9%, followed by Fujitsu with 9.8%.

In addition to individual revenue end unit shipment projections for rigid disk drives in eight separate product groups, Disk/Trend Report provides statistics and analysis on cumulative shipments, average OEM selling prices, competitive market shares of manufacturers, and a review of competing storage technologies.

The report ($1,440) also contains basic specifications on 746 rigid disk drives and profiles over 63 manufacturers, worldwide.

WW Revenue of All Magnetic Rigid Disk Drives

Notes:

1. Revenue is reported at the price level at which drives are actually sold: Captive, PCM or OEM.

2. Revenue for leased drives is reported on an ‘if sold’ basis.

3. PCM means drives sold by manufacturers of plug compatible products, and OEM means drives sold to original equipment manufacturers and other system integrators.

This article is an abstract of news published on the former paper version of Computer Data Storage Newsletter on issue ≠9, volume ≠1, published on October 1988.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter