Pure Storage: Fiscal 1Q20 Financial Results

CEO of pure AFA player: "We were not satisfied with our results this quarter."

This is a Press Release edited by StorageNewsletter.com on May 23, 2019 at 2:51 pm| (in $ million) | 1Q19 | 1Q20 | Growth |

| Revenue |

255.9 | 326.7 | 28% |

| Net income (loss) | (64.3) | (100.3) |

Pure Storage, Inc. announced financial results for its first quarter ended April 30, 2019.

“Pure continues to gain market share with innovation, a differentiated business model and our laser focus on customer delight,” said Charles Giancarlo, chairman and CEO. “As enterprises embark on their hybrid cloud journeys, Pure is excited to play a role in modernizing their business.”

1FQ20 Key Business and Financial Highlights:

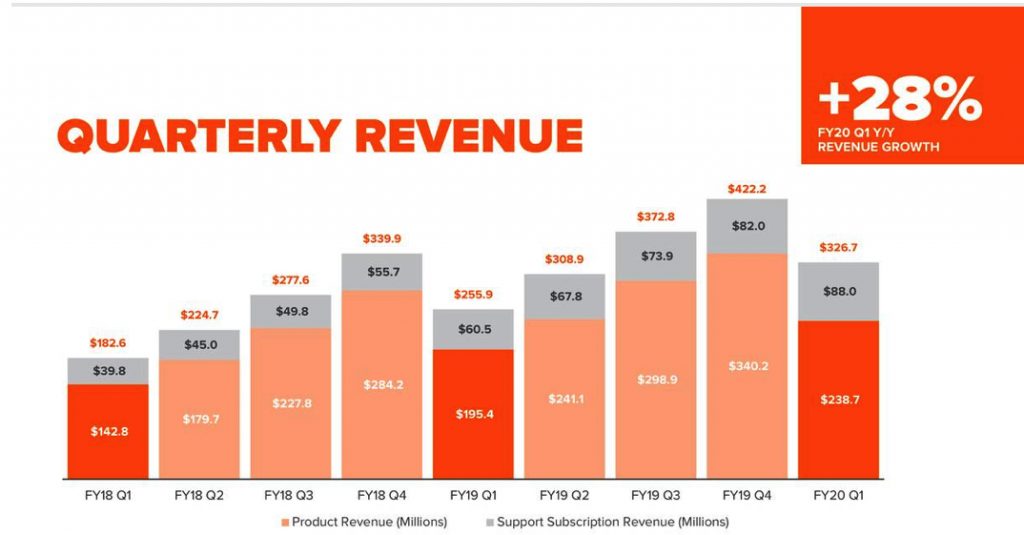

• Revenue: $326.7 million, up 28% Y/Y

• Gross margin: GAAP 66.2%; non-GAAP 68.1%

• Operating margin: GAAP -29.8%; non-GAAP -9.6%

During 1FQ20, the company:

• Announced the acquisition of Compuverde, developer of file software solutions for enterprises and cloud providers. The acquisition will expand Pure Storage’s file capabilities by providing a unified storage offering, as well as empowering customers to implement true hybrid architectures.

• Released ObjectEngine for availability – a data protection platform purpose-built for flash and cloud. ObjectEngine unifies cloud and on-premises with seamless, rapid backup and recovery across both on-prem and the cloud and enables customers to modernize their entire data protection strategy to a ‘flash-to-flash-to-cloud’ model.

• Announced expansion of Evergreen Storage Service (ES2) – to enable a unified subscription model across hybrid environments. This allows organizations to leverage Pure’s storage-as-a-service model on-premises, hosted and in the cloud, without the need to manage multiple subscriptions or purchase separate or overlapping capacity.

“1FQ20 was a solid beginning of the year for Pure,” said Tim Riitters, CFO. “We continued to demonstrate strong growth, industry-leading margins, and innovation across our product portfolio.”

2FQ20 guidance:

• Revenue in the range of $389 million to $401 million, or $395 million at the midpoint

• Non-GAAP gross margin in the range of 65.0% to 68.0%, or 66.5% at the midpoint

• Non-GAAP operating margin in the range of -5.0% to -1.0%, or -3.0% at the midpoint

FY20 guidance:

• Revenue in the range of $1.70 billion to $1.77 billion, or $1.735 billion at the midpoint

• Non-GAAP gross margin in the range of 65.5% to 68.0%, or 66.75% at the midpoint

• Non-GAAP operating margin in the range of 1.5% to 5.5%, or 3.5% at the midpoint

Comments

Charlie Giancarlo, CEO, commented: "We were not satisfied with our results this quarter. Revenue was just below the low end of our guidance, and consequently, profitability was below our guidance."

The pure AFA player missed on revenue for the quarter and announced a relatively disappointing forecast.

Revenue was expected between $327 million to $339 million and was finally $327 million, up 28% Y/Y.

Click to enlarge

What's worth: Pure always tried to increase sales and market share rather than focusing on profitability that it never reached since inception more than 10 years ago. But here, quarterly revenue is lower than the figure of the former quarter ($422 million) and even 3Q19 ($373 million) and 4Q18 ($340 million). Net loss was at more than $100 million and is not going to stop.

For the most recent quarter, product revenue grew 22% yearly to $238.7 million, and support revenue 45% to $88 million.

70% of sales came from the USA and 30% from international markets.

The core of firm's business, cloud, commercial and public sector is strong, growing over 30% Y/Y.

The company finished the quarter with 6,200 total customers, greater than 350 new customers in 1FQ20, equating to more than five new customer additions per day.

Operating profit was less than expected due to lower than expected top line performance.

To increase market share, Pure hired aggressively, adding nearly 40% more capacity to its sales force this last year, including nearly 30% in the past six months.

The firm finished the quarter with cash and investments of $1.17 billion, a decrease of $31 million from the previous one. Quarterly decrease was impacted by a $60 million cash payment as part of the acquisition of Compuverde.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter