SK Hynix: Fiscal 1Q19 Financial Results

NAND flash ASP decreased by 32%, bit shipments by 6% Q/Q.

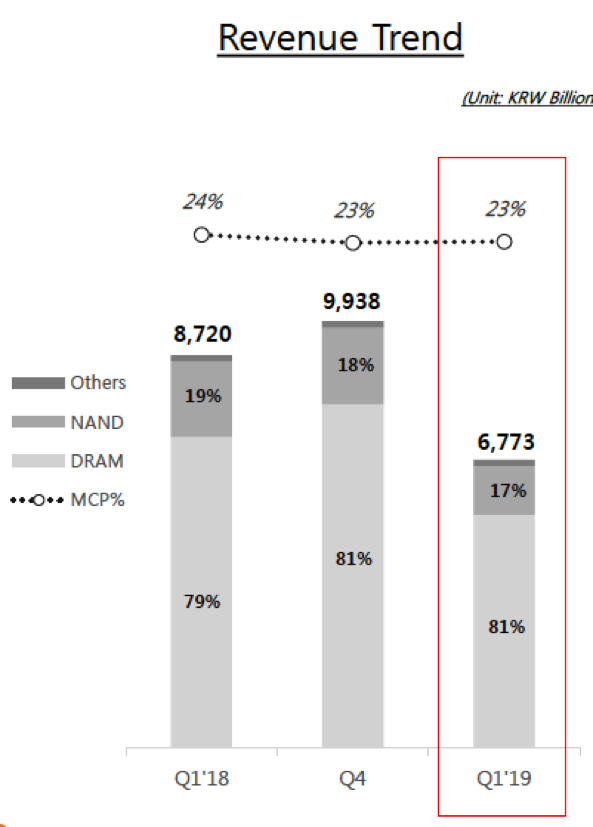

By Jean Jacques Maleval | April 26, 2019 at 2:20 pm| (in billion KRW) | 1Q18 | 1Q19 | Growth |

| Revenue |

8,720 | 6,773 | -22% |

| Net income | 3,121 | 1,102 | -65% |

SK Hynix Inc. announced financial results for its first quarter 2019 ended on March 31, 2019.

The consolidated first quarter revenue was KRM6.77 trillion, down 22% Y/Y, while the operating profit amounted to KRM1.37 trillion and the net income KRM1.1 trillion. Operating margin for the quarter was 20% and net margin was 16%.

Because of a faster-than-expected price decline and lower shipments due to slowing memory demand, the revenue and the operating profit in 1Q19 fell Q/Q by 32% and 69%, respectively.

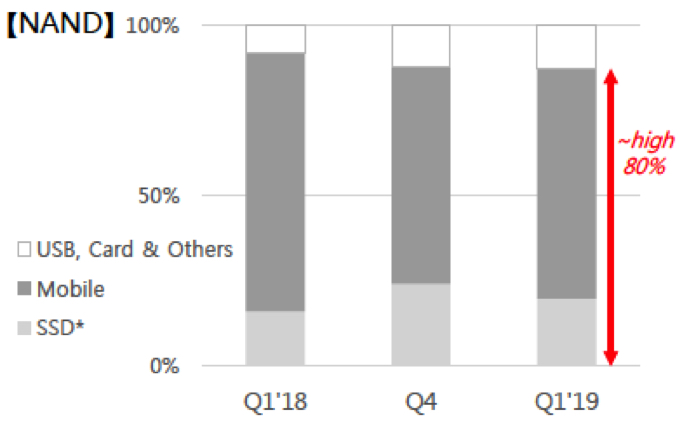

For NAND flash, the ASP decreased by 32% due to high inventory levels and intensifying competition among suppliers. The bit shipments declined by 6% Q/Q.

For NAND flash, the firm will concentrate on improving profitability. The company has stopped producing the 36-layer and 48-layer 3D NAND, initial 3D products which are relatively higher in cost, and will increase the proportion of 72-layer products.

It also plans to strengthen its position in the SSD and mobile market in the second half with its 96-layer 4D NAND. Considering the demand situation, the pace of the ramp-up of the new M15 FAB in Cheongju, Korea, will be slower than planned. As a result, NAND wafer input this year is expected to decrease more than 10% compared to last year.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter