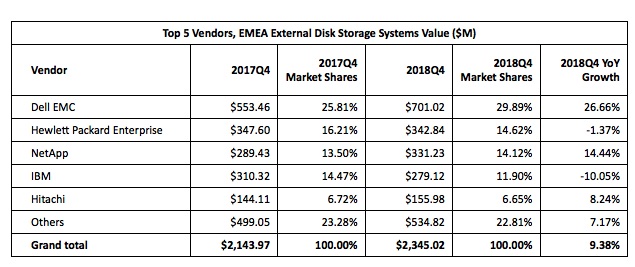

EMEA External Storage Market Up 9% Y/Y in 4Q18 at $2.3 Billion

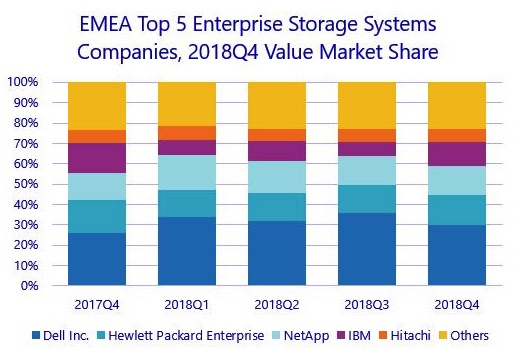

Dominated by Dell EMC (30%), HPE(15%), NetApp (14%), IBM (12%) and Hitachi (7%)

This is a Press Release edited by StorageNewsletter.com on March 15, 2019 at 2:44 pmThe EMEA external storage systems market recorded another positive quarter in 2018Q4, with 9.4% year-on-year growth in dollars (12.9% in euros), according to International Data Corporation‘s EMEA Quarterly Disk Storage Systems Tracker.

The segment closed the year with record growth (+16.4% in dollars, +11.8% in euros) on the back of strong investments.

The AFA market is steadily edging toward 40% of total shipments in value (37% in the fourth quarter alone and 35% for the full year) and is about to overtake hybrid arrays (HFAs) as the most popular array type. HFAs still accounted for 45.1% of total shipments in value terms for the full year (43.8% for the quarter), though with slower year-on-year growth (+5.8% in 4Q18 versus 32% growth in AFAs).

The growth in flash-powered arrays is happening at the expense of HDD-only arrays, which remain mostly confined to secondary workloads. HDD-only arrays lost 12.8% Y/Y for the quarter and 18.4% for the full year.

Western Europe

This market grew 10.1% in dollars and 13.6% in euros in value terms. AFAs played a big part in this increase, at just shy of 38% of total shipments with a yearly increase of nearly 25%.

“Storage spending has so far demonstrated great resiliency in the face of political and economic instability hitting the region, with digital transformation-led investments progressing unscathed,” said Silvia Cosso, research manager, European storage and datacenter research, IDC. “Companies are updating their datacenters for the new wave of IT transformation coming from AI workloads and edge-to-core-to-cloud integration, adopting emerging technologies such as NAFA, or NVME-AFA, arrays to take advantage of the great workload consolidation such arrays enable.“

Central and Eastern Europe, the Middle East, and Africa (CEMA)

This market recorded single-digit growth in external storage spending (7.5% Y/Y). Similarly to Western Europe, AFAs drove the entire market up, with 60% Y/Y growth and a 35% increase in share.

The regional growth came on the back of flourishing growth in the Central and Eastern European (CEE) storage market (20.5% Y/Y), where almost all individual markets, except Central Europe, recorded growth. Performance in the Middle East and Africa (MEA) was more varied (-4.2% Y/Y) as the smaller countries saw a significant increase in storage shipments while the bigger countries, such as Turkey and South Africa, lagged.

“The external storage market in CEMA is strongly supported by refresh cycles in CEE and large-scale digital projects run by governments across MEA,” said Marina Kostova, research manager, storage systems, IDC CEMA. “The boost also comes from vendors expanding their presence in the region and by the entrance of hyperscalers that did not have datacenters in the region until now.“

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter