NetApp: Fiscal 3Q19 Financial Results

Disappointing revenue only up 2% Q/Q

This is a Press Release edited by StorageNewsletter.com on February 15, 2019 at 2:23 pm| (in $ million) | 3Q18 | 3Q19 | 9 mo. 18 | 9 mo. 19 |

| Revenue | 1,539 | 1,563 | 4,275 | 4,554 |

| Growth | 2% | 7% | ||

| Net income (loss) | 504 | 319 | (174) | 773 |

Highlights

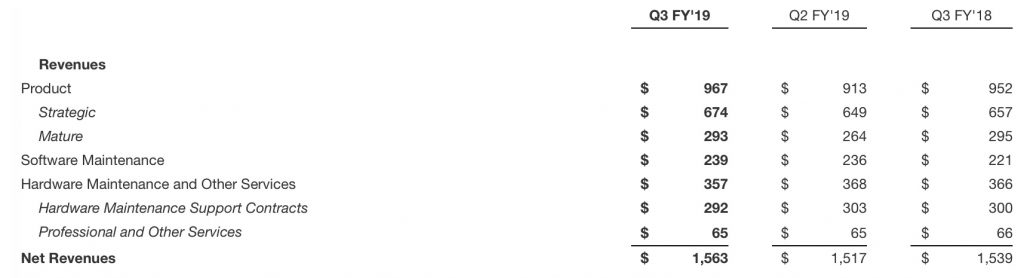

• Net revenues of $1.56 billion grew 2% Y/Y

• Product revenue of $967 million grew 2% Y/Y

• All-flash array annualized net revenue run rate of $2.4 billion increased 19% Y/Y

• $649 million returned to shareholders in share repurchases and cash dividends

NetApp, Inc. reported financial results for the third quarter of fiscal year 2019, which ended January 25, 2019.

“Although I am disappointed that revenue came in at the low-end of our guidance range, we continue to demonstrate discipline in how we manage the business. We are playing into the big market transitions from a position of strength and are focused on execution to maximize our opportunity in an uncertain macroeconomic environment,” said George Kurian, CEO. “Our flash, hybrid cloud infrastructure, and AI solutions are serving as pillars of customers’ new architectures and we are seeing adoption of our cloud offerings as part of our customers’ foundation for moving applications and data to the cloud. We have conviction in our strategy to drive long-term growth.”

3FQ19 Financial Results

• Net Revenues: $1.56 billion, increased 2% Y/Y from $1.54 billion in 3FQ18

• Net Income: GAAP net income of $249 million, compared to GAAP net loss of $479 million in 3FQ18; non-GAAP net income of $305 million, compared to non-GAAP net income of $289 million in 3FQ18

• Earnings per Share: GAAP net income per share of $0.98 compared to GAAP net loss per share of $1.79 in the 3FQ18; non-GAAP net income per share of $1.20, compared to non-GAAP net income per share of $1.05 in 3FQ18

• Cash, Cash Equivalents and Investments: $4.0 billion at the end of 3FQ19

• Cash from Operations: $451 million, compared to $420 million in 3FQ18

• Share Repurchase and Dividend: Returned $649 million to shareholders through share repurchases and cash dividends

The company provided the following financial guidance for next quarter: Net revenues in the range of $1.590 billion to $1.690 billion or 2% to 8% sequentially.

Next cash dividend of $0.40 per share to be paid on April 24, 2019, to shareholders of record as of the close of business on April 5, 2019.

Third Quarter Fiscal Year 2019 Business Highlights

• Announced new data services and solutions that empower customers to innovate in the cloud. These new offerings include the expanded availability of the Microsoft Azure NetApp Files preview.

• Announced NetApp Element 11.0 software, which introduces new functionality for their NetApp HCI customers with Protection Domains. In addition, Element 11.0 has the ability to manage storage clusters running Element software on IPv6 networks, 16TiB volume support, and QoS histograms to help understand the user’s environment.

Strengthens Strategic Partnerships

• Announced NetApp Cloud Volumes Service for Google Cloud Platform will soon be available in Europe to help even more customers handle the configuring and managing of their storage infrastructures.

• Announced VMware Validated Design for Private Cloud with HCI, NetApp Verified Architecture for VMware End-User Computing with HCI and NVIDIA GPUs and NetApp Technical Report for Object Storage with NetApp HCI.

Recognition for Products

NetApp’s AFF A800 took the top spot in the latest SPEC SFS2014 swbuild result at the time of publication in November 2018. it delivered performance that was 3 times as fast as the nearest competitor. These results also highlighted the fact that ONTAP with FlexGroup volumes can do more work at lower latencies and higher throughput.

Comments

2% is the company's lowest sequential quarterly growth for revenue since 2FQ18.

Sales during this last three-month period fell below expectations as large enterprise customers pulled back in January amid economic uncertainty.

The Federal government shutdown in the U.S. caused big customers to pare back spending.

AFAs are going well and will continue to succeed as only 15% of firm's installed base already adopts them.

Based on the last month of 3FQ19, cloud data services annualized recurring revenue is $33 million, up 22% from the former quarter.

Software maintenance and hardware maintenance revenue of $531 million increased 2% Y/Y.

Similar to 2FQ19, the company saw healthy growth in deferred and financed unearned services revenue, which increased 7% Y/Y and was up $151 million sequentially.

In the phase of a slower demand environment, NetApp bets by on three key market transitions already engaged: flash, private cloud and cloud data services.

| Fiscal Period | Revenue | Y/Y Growth | Net income (loss) |

| FY16 | 5,546 | -9% | 229 |

| FY17 | 5,519 | -0% | 509 |

| 1Q18 | 1,325 | -11% | 136 |

| 2Q18 | 1,422 | 7% | 175 |

| 3Q18 | 1,523 | 7% | (506) |

| 4Q18 | 1,641 | 8% | 271 |

| FY18 | 5,911 | 7% | 75 |

| 1Q19 |

1,474 | 12% |

283 |

| 2Q19 |

1,517 | 7% |

241 |

| 3Q19 |

1,563 | 2% |

319 |

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter