Hoya: Fiscal 3Q18 Financial Results

Glass disks manufacturer suffering from HDD business slowdown, especially for 2.5-inch disks

This is a Press Release edited by StorageNewsletter.com on February 14, 2019 at 2:24 pm| (in ¥ million) | 3Q17 | 3Q18 | 9 mo. 17 | 9 mo. 18 |

| Revenue | 136.8 | 143.4 | 535.6 | 564.0 |

| Growth | 5% | 5% | ||

| Net income (loss) | 27.7 | 33.1 | 99.5 | 120.0 |

Hoya Corporation announced its financial results for the third quarter ended December 31, 2018.

During the quarter, revenue increased 4.9% Y/Y, reaching ¥143,425 million. Profit before tax amounted to ¥39,676 million with ¥33,143 million in net profit, representing Y/Y increases of 14.4% and 19.5%, respectively. Profit before tax ratio was 27.7%, representing a Y/Y increase of 2.3 points.

In the life care segment, Eyeglass lens sales were strong in Japan. At the same time, steady sales growth in the Americas and other factors drove overseas sales increases on a local currency basis. However, the overall impact of currency exchange rates resulted in sales level with the same period in the prior fiscal year. New store openings of our Eyecity contact lens specialty stores, as well as new customer expansion efforts at existing stores, resulted in higher Y/Y sales for contact lenses. Medical-use endoscope sales were higher Y/Y, supported by strong performance in the U.S. and Europe in response to measures to strengthen our sales systems, as well as to our introduction of new products. Sales of intraocular lenses for cataracts in Japan were solid. Although performance was strong overseas as well, our capture of a major project in the prior year led to results that underperformed year on year. As a result, sales for the Life Care segment grew 4.2% Y/Y, reaching ¥93,902 million. Segment profit rose 12.9% Y/Y to ¥19,144 million.

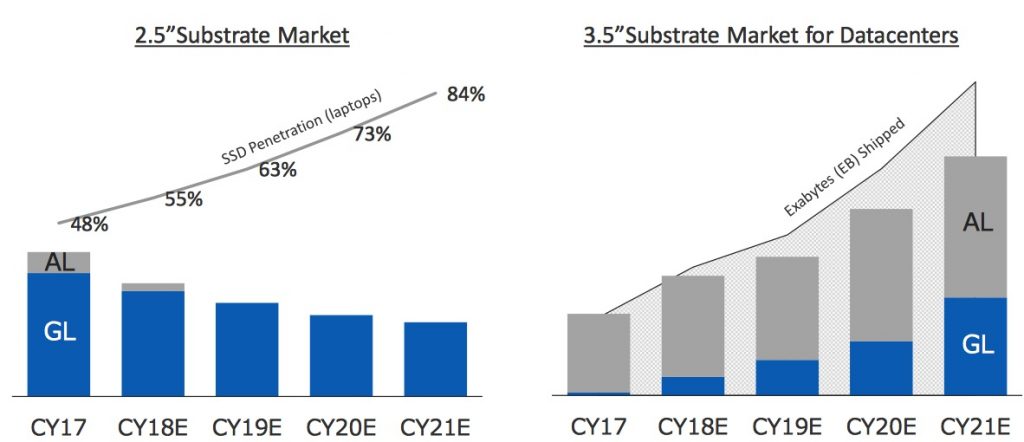

In the information technology segment, sales of mask blanks for semiconductors rose, owing mainly to active development demand for a next-generation semiconductor production technology called extreme ultraviolet lithography (EUVL). Sales revenues of photomasks for LCDs rose as the company captured R&D demand, mainly for LCDs used in smartphones and other products. Sales of 2.5-inch glass substrates for HDD drives were lower Y/Y. While 2.5-inch products make up the majority of sales in this area, falling prices for NAND flash memory led to the greater erosion of 2.5-inch sales by SSDs. Sales revenues of 3.5-inch products grew, adopted for use in data centers, which are the end users of these products. As a result of these and other factors, the company was able to maintain glass substrate sales level with the same period in the prior fiscal year. Smartphones and other developments continue to erode the digital camera market, driving our sales lower. The impact of market adjustments in China led to lower sales of our products for use in surveillance cameras and overall lower sales of imaging-related products. As a result, information technology segment sales revenues rose 6.2% year on year, reaching ¥48,275 million. Segment profit rose 18.3% to ¥21,510 million.

“We are less impacted by the cyclicality of the semiconductor and datacenter market, enabling us secure growth on relevant products. Also, our life care business is showing great stability,” said Hiroshi Suzuki, CEO. “This quarter is again a good example of our business portfolio system which allows us stable growth.”

Comments

The manufacturer of glass disks, among other activities, is suffering from HDD business slowdown, especially for 2.5-inch disks.

The markets related to HDDs for PCs, servers and data center is in bad shape. Inventory has increased and production has fallen off. Hoya expects demand for the next six months will continue to be sluggish.

For the company, 3.5-inch substrate sales have not been as impacted by the low demand as much as the rest of the market because the firm has grown its share as customers move from traditional aluminum to glass. Also, data centers are replacing low-capacity HDDs to higher capacity products, and glass substrates are used in these units. 3.5-inch revenue almost tripled, now accounting for 19% of sales. The manufacturer will benefit in the future from the replacement of 12TB products by 14TB and 16TB capacities. At present, up to nine aluminum substrates are used for one hard drive. It is even expected that HDD manufacturers will use glass substrates beginning at 10 platters (for 18TB), which is likely to happen sometime in 2021, according to the Japanese company. Consequently Hoya is working to put manufacturing equipment into production during the first half of 2020 for these 3.5-inch HDD substrates.

Falling NAND prices have caused sales of company's 2.5-inch disks continuing to decline, as HDDs are being replaced by SSDs in PCs and mission-critical servers. They represent 50% of Hoya's 2.5-inch substrate sales.

Electronics related products (glass substrates for semiconductors, LCD-related products and HDDs) sales amounted to ¥38.3 billion up ¥4.0 billion (+12%) Y/Y.

Company's outlook for combined sales of 2.5-inch and 3.5-inch substrates - with only 1% Y/Y growth for the current three-month period - in the next quarter and beyond indicates a likely phase of overall decline for the second half of fiscal 2019, as the drop in 2.5-inch substrates outpaces the growth of 3.5-inch substrates.

Hoya projects quarterly global revenue of ¥139.7 million next quarter, down 3% sequentially.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter