Carbonite: Fiscal 4Q18 Financial Results

Revenue of $296 million up 24% Y/Y, slightly down Q/Q

This is a Press Release edited by StorageNewsletter.com on February 11, 2019 at 2:23 pm| (in $ million) | 4Q17 | 4Q18 | FY17 | FY18 |

| Revenue | 61.7 | 77.0 | 239.5 | 296.4 |

| Growth | 25% | 24% | ||

| Net income (loss) | (1.6) | 0.7 | (4.0) | 7.6 |

Carbonite, Inc. announced financial results for the quarter and full year ended December 31, 2018. Carbonite also announced that Linda Connly, a sales and marketing veteran, has joined its board of directors.

Full Year 2018 Highlights:

• Revenue of $296.4 million increased 24% year-over-year.

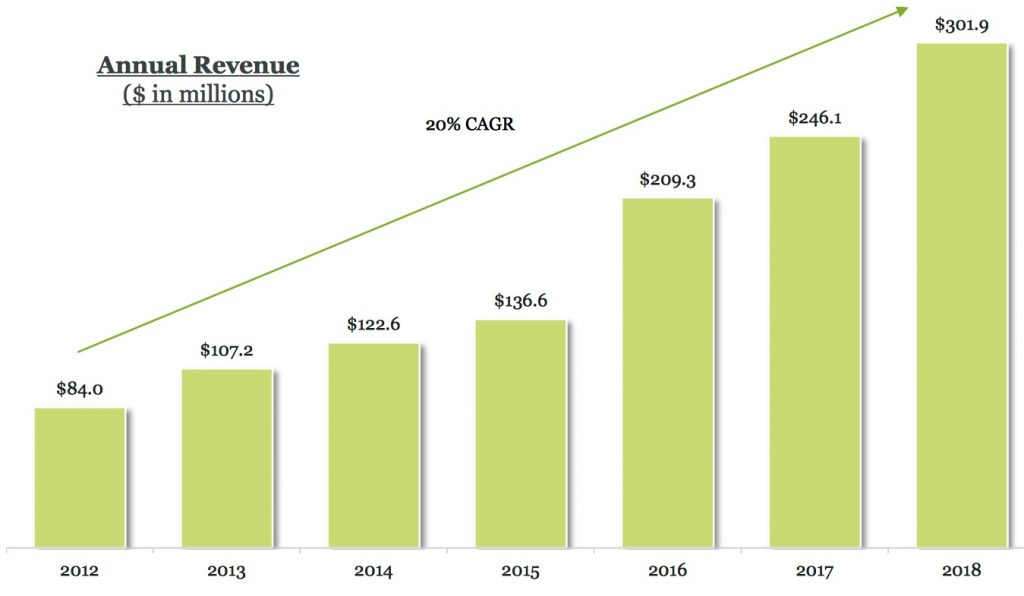

• Non-GAAP revenue of $301.9 million increased 23% year-over-year.

• Net income was $7.6 million, compared to net loss of ($4.0) million in 2017.

• Net income (loss) per share was $0.24 (basic) and $0.22 (diluted), as compared to ($0.14) in 2017 (basic and diluted).

• Non-GAAP net income per share was $1.80 (basic) and $1.66 (diluted), as compared to $0.82 (basic) and $0.79 (diluted) in 2017.2

• Adjusted EBITDA of $77.0 million, or 26% of non-GAAP revenue, compared to $38.9 million, or 16% of non-GAAP revenue in 2017.3

“We delivered on our strategic priorities in 2018,” said Mohamad Ali, president a,nd CEO. “We strengthened our product platform and introduced one of the most complete software-as-a-service data protection portfolios in the market; we did this while successfully continuing our acquisition integration work and driving meaningful improvements in profitability. In 2019 we plan to build upon these efforts, further expanding our data protection platform and delivering a broader set of solutions to our customers, while we invest aggressively in our distribution channels with a focus on driving continued growth and profitability.“

Recent Highlights:

• In a separate announcement, the company announced that it has entered into a definitive agreement to acquire Webroot, Inc., a cybersecurity company, for approximately $618.5 million in cash. The company will fund the transaction with existing cash on hand and funds secured under a new credit facility. Following closing, expected in the first quarter of 2019, the transaction is expected to be immediately accretive on an earnings and cash flow basis.

• Linda Connly, a sales and marketing veteran with more than 25 years of experience, was appointed to the board of directors as a class II director.

Fourth Quarter 2018 Results:

• Revenue was $77.0 million, an increase of 25% from $61.7 million in the 4FQ17. Non-GAAP revenue for th fourth quarter was $78.0 million, an increase of 24% from $62.8 million in 4FQ17 of 2017.

• Bookings were $78.8 million, an increase of 31% from $60.2 million in 4FQ17.

• Net income was $0.7 million, compared to net loss of ($1.6) million in 4FQ17. Non-GAAP net income was $16.2 million, compared to non-GAAP net income of $8.8 million in 4FQ17.

• Net income per share was $0.02 (basic and diluted), compared to net loss per share of ($0.06) (basic and diluted) in 4FQ17. Non-GAAP net income per share was $0.47 (basic) and $0.45 (diluted), compared to non-GAAP net income per share of $0.31 (basic) and $0.30 (diluted) in 4FQ17.

• Adjusted EBITDA was $20.8 million, compared to $13.0 million in 4FQ17.

• Gross margin was 71.2%, compared to 72.8% in 4FQ17. Non-GAAP gross margin was 77.9% compared to 77.6% in the 4FQ17.

• Cash flow from operations was $19.8 million, compared to $13.9 million in 4FQ17. Adjusted free cash flow was $17.1 million, compared to $9.7 million in 4FQ17.

Full Year 2018 Results:

• Revenue was $296.4 million, an increase of 24% from $239.5 million in 2017. Non-GAAP revenue for the full year was $301.9 million, an increase of 23% from $246.1 million in 2017.

• Bookings were $307.0 million, an increase of 25% from $245.9 million in 2017.

• Net income was $7.6 million, compared to net loss of ($4.0) million in 2017. Non-GAAP net income was $55.9 million, compared to non-GAAP net income of $22.8 million in 2017.

• Net income per share was $0.24 (basic) and $0.22 (diluted), compared to net loss per share of ($0.14) (basic and diluted) in 2017. Non-GAAP net income per share was $1.80 (basic) and $1.66 (diluted), compared to non-GAAP net income per share of $0.82 (basic) and $0.79 (diluted) in 2017.

• Adjusted EBITDA was $77.0 million, compared to $38.9 million in 2017.

• Gross margin was 71.2%, compared to 70.7% in 2017. Non-GAAP gross margin was 77.4%, compared to 75.5% in 2017.5

• Cash flow from operations was $53.6 million, compared to $31.2 million in 2017. Adjusted free cash flow was $50.1 million, compared to $20.1 million in 2017.

About Linda Connly

She has experience leading go-to-market transformations within technology organizations. She currently serves as the interim MD, Americas, at Rackspace, a managed cloud computing company, and is the founder and CEO of The Connly Advisory Services, a consulting practice that provides go-to-market advisory services. Prior to these roles, she led the sales integration for Dell and EMC and led EMC’s global inside sales.

She has experience leading go-to-market transformations within technology organizations. She currently serves as the interim MD, Americas, at Rackspace, a managed cloud computing company, and is the founder and CEO of The Connly Advisory Services, a consulting practice that provides go-to-market advisory services. Prior to these roles, she led the sales integration for Dell and EMC and led EMC’s global inside sales.

In addition to her corporate experience, she has been awarded a number of industry accolades, including the Boston Chamber of Commerce Pinnacle Award for Achievement in Management, and VAR Business Magazine‘s 50 Most Powerful Women in Technology.

“Ms. Connly is an exceptional addition to our board and brings a powerful combination of sales, marketing, and technology experience to Carbonite,” said Ali. “She has expertise in optimizing the go-to-market strategies for some of the most successful technology organizations today and she will play a key role in helping Carbonite execute on our long-term vision.“

Business Outlook

Based on the information available as of February 7, 2019, the company expects small increase revenue, between $77.0 and $78.0 million, for next quarter, and between $488 and $502 million (+64% to 69%) for FY19 including nine months of WebRoot.

Comments

Bookings

(and not revenue as indicated in this official table from Carbonite)

Abstract of the earnings call transcript:

Mohamad Ali, president and CEO:

"To date about 25,000 customers have been migrated from the Mozy infrastructure to Carbonite.

"Carbonite and Webroot saw impressive growth throughout FY2018 with total revenue growth of 23% for Carbonite and 14% for Webroot, both with operating margins around 20%.

"At the closing of the transaction, Carbonite's pro forma net leverage is expected to be slightly above 4x, and over the next three years, we have identified cost synergies of more than $20 million."

Anthony Folger, CFO and treasurer:

"The primary reason for this dynamic in 4Q18 was a more back-end loaded quarter than what we expected with a bigger percentage of larger deals closing very late in the quarter. As a result, revenue was a bit lower than expected, even though bookings came in slightly higher than expected.

"(...) we've had a successful track record, driving a combination of organic and inorganic revenue growth with the revenue CAGR of about 20% since 2012 (...)

"(...) we ended 2018 with a $198 million in cash and an outstanding convertible note (...)"

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter