Carbonite to Acquire Webroot for $618.5 Million

In cybersecurity

This is a Press Release edited by StorageNewsletter.com on February 8, 2019 at 2:27 pmCarbonite, Inc. and Webroot Inc., a cybersecurity company, entered into a definitive agreement under which Carbonite will acquire Webroot for approximately $618.5 million in cash.

Carbonite will fund the transaction with existing cash on hand and funds secured under a new credit facility. The combined business will address a vulnerability of businesses – the endpoint – with an approach to protection through cloud-based cybersecurity, paired with cloud-based backup and recovery.

The transaction is expected to be immediately accretive on an earnings and cash flow basis, following the close of the transaction.

Founded in 1997, Webroot is a private company that secures endpoints and provides network protection, security awareness training and threat intelligence services. With its technology, experienced team, and go-to-market capabilities, including a network of MSPs and remote monitoring and management (RMM) relationships, the company has established itself in the cybersecurity space. Its fiscal year 2018 revenue was approximately $215.0 million.

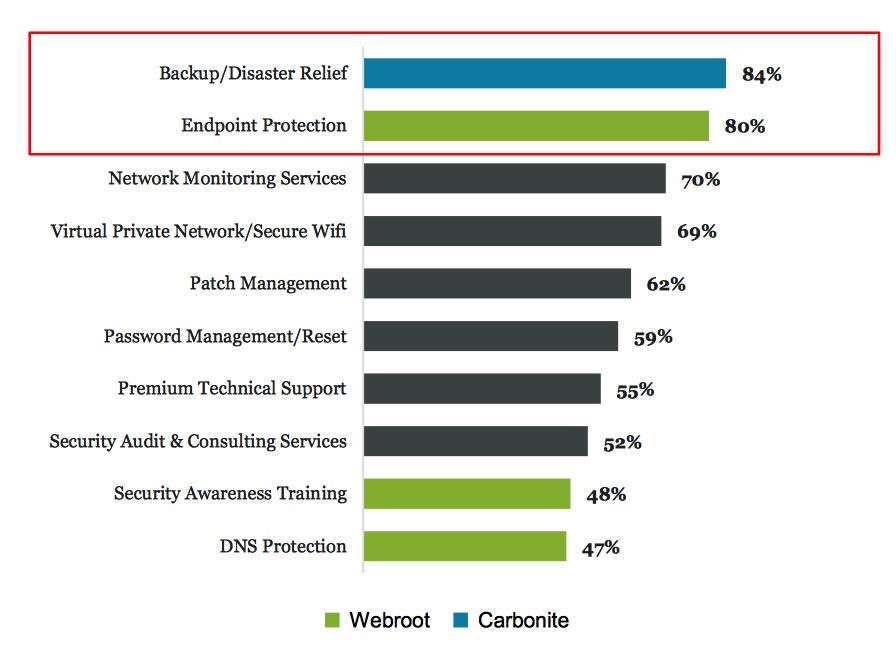

Carbonite and WebRoot Offerings

“The acquisition of Webroot dramatically accelerates our progress towards becoming the leading data protection company,” said Mohamad Ali, president and CEO, Carbonite. “With threats like ransomware evolving daily, our customers and partners are increasingly seeking a more comprehensive solution that is both powerful and easy to use. Backup and recovery, combined with endpoint security and threat intelligence, is a differentiated solution that provides one, comprehensive data protection platform.”

He continued: “The Webroot team has a passion for building technology to simplify the way customers protect their important data, and we are excited to welcome them.”

“Carbonite and Webroot have a common focus on making data protection and cybersecurity solutions accessible and easy to use, as well as a dedication to customer success, and we are thrilled to become part of their team,” said Mike Potts, Webroot CEO. “Together we can deliver tremendous value to our customers and partners.”

Compelling Strategic and Financial Benefits

• Next-Generation Technology Platform: Combining Carbonite’s cloud-based data protection solutions and Webroot’s cloud-based machine learning technology will create a next-generation security platform to serve growing customer needs.

• A Comprehensive Solution, Delivering Better Results: A common set of customers will benefit from an easy-to-use, cloud-based, integrated offering, which includes a ransomware prevention and recovery solution.

• Consistent Routes to Market and Expansion of Addressable Market: The two companies share a go-to-market focus and a complementary ecosystem of channel partners. Webroot’s MSP partners and RMM relationships provide Carbonite with a new channel for increased scale and market expansion.

• Immediately Accretive: Based on Webroot’s current operating plan and existing customer contracts, the transaction is expected to be immediately accretive on an earnings and cash flow basis following the close of the transaction.

Transaction Details

Carbonite will finance the acquisition with committed financing and existing cash on hand. The transaction is expected to close in FQ19, subject to the receipt of regulatory clearance and other customary closing conditions. It has been unanimously approved by the boards of directors of both companies and by the requisite percentage of stockholders of Webroot.

Advisors

RBC Capital Markets, LLC is serving as financial advisor to Carbonite, and Barclays as financial advisor to Carbonite. Skadden, Arps, Slate, Meagher & Flom LLP is serving as Carbonite’s legal counsel. Barclays, Citizens Banks, and RBC Capital Markets, LLC have provided committed financing in support of the transaction and Simpson Thatcher & Bartlett LLP is serving as financing counsel. William Blair & Company, L.L.C. is serving as exclusive financial advisor to Webroot and Goodwin Procter LLP and Holland & Hart LLP as legal counsel.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter