Commvault: Fiscal 3Q19 Financial Results

Revenue up 2% and more profitable

This is a Press Release edited by StorageNewsletter.com on January 30, 2019 at 2:15 pm| (in $ million) | 3Q18 | 3Q19 | 9 mo. 18 | 9 mo. 19 |

| Revenue | 180.4 | 184.3 | 514.5 | 529.5 |

| Growth | 2% | 3% | ||

| Net income (loss) | (59.9) | 13.4 | (60.2) | 5.7 |

Commvault Systems, Inc. announced its financial results for the third quarter ended December 31, 2018.

N. Robert Hammer, chairman, president and CEO, stated: “With the foundation of Commvault Advance in place, and what we see as a trend of enterprise customers seeking to consolidate their data management solutions, we were able to deliver strong sequential software and products revenue growth of 22%. Our revenue performance, coupled with our continued successful efforts to right-size the business, allowed us to continue to deliver significant Y/Y earnings growth, as evidenced by the 51% year to date growth in non-GAAP operating income. We believe Commvault is well positioned for both our fiscal Q4 and fiscal 2020. During the quarter we also repurchased approximately $54 million of our common stock.”

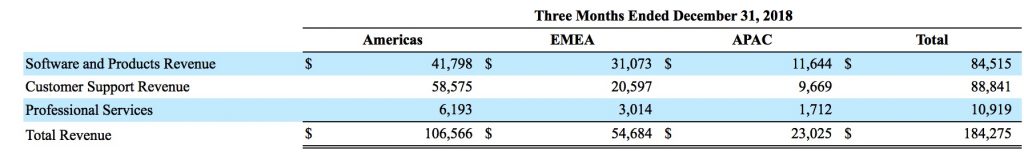

Total revenues for 3FQ19 were $184.3 million, an increase of 2% Y/Y, and 9% sequentially. Total repeatable revenue was $121.0 million, an increase of 15% year-over-year.

Software and products revenue was $84.5 million, an increase of 4% Y/Y, and 22% sequentially. Subscription and utility annual contract value (ACV) more than doubled Y/Y to approximately $90 million.

Services revenue in the quarter was $99.8 million, an increase of 1% Y/Y and flat sequentially.

On a GAAP basis, income from operations (EBIT) was $10.4 million for the third quarter compared to $3.5 million in the prior year. These third quarter GAAP results in fiscal 2019 included $6.3 million of expenses related to a non-routine shareholder matter and restructuring. These expenses have been excluded from our non-GAAP results and are further discussed in Table IV. Non-GAAP EBIT was $33.1 million in the quarter compared to $22.0 million in the prior year, an increase of 50%.

For 3FQ19, the company reported GAAP net income of $13.4 million, or $0.28 per diluted share. Non-GAAP net income for the quarter was $25.4 million, or $0.54 per diluted share.

Operating cash flow totaled $31.1 million for 3FQ19 compared to $31.2 million in the prior year quarter. Total cash and short-term investments were $457.9 million as of December 31, 2018 compared to $462.4 million as of March 31, 2018.

During 3FQ19, the firm repurchased approximately 937,000 shares of its common stock totaling $54.4 million.

Comments

The company has implemented a big restructuration named Commvault Advance but we are waiting to see the real positive financial results of these actions.

But the company is not far from its record historical revenue with 184.3 million, best figure being $184.9 million in 4FQ18, more than one year ago. But Y/Y progression is small, +2%. Net income is also an historical record, $13.4 million. Nevertheless it's hard for the firm to compete in this backup software segment, especially with young and exploding Veeam Software - not far to be $1 billion company while Commvault is supposed to finish the year at $719 million - as well as Veritas or EMC.

Click to enlarge

Revenue from enterprise deals of over $100,000 in software and products revenue in a given quarter represented 65% of such revenue. Sales from these transactions was up 19% Y/Y. The number of enterprise revenue transactions also increased 19% Y/Y. Average enterprise deal size was $268,000 during the quarter.

Subscription-based pricing represented 37% of software products revenue for the quarter, which compares to 21% in same quarter of last year. Software and products revenue from these subscription-based models are up 85% Y/Y. This consists of both committed and often multi-year subscription sales as well as pay-as-you-go utility site arrangements.

ACV (annual contract value) has grown to $90 million more than 2x what it was a year ago.

430PB of data is stored in the public cloud with Commvault's platform.

The company expects next quarter revenue of $189 million, up 2% Y/Y, based on 4FQ19 software revenue of $88.5 million.

Firm's goal is to achieve revenue growth in fiscal 2020 and 2021 of at least 9% while increasing margins to 20% in fiscal 2020 and 25% in fiscal 2021.

To find a new CEO, the search committee of the board has made progress since company's last earnings call and the firm plans to make an announcement in the near future

To read the earnings call transcript

Revenue and net income (loss) for Commvault

| Fiscal period | Revenue | Y/Y growth | Net income (loss) | |

| 1Q15 | 152.6 | 14% | 12.7 | |

| 2Q15 | 151.1 | 7% | 6.5 | |

| 3Q15 | 153.0 | -0% | 3.1 | |

| 4Q15 | 150.7 | -4% | 3.4 | |

| FY15 | 607.5 | 4% | 25.7 | |

| 1Q16 | 139.1 | -9% | (1.3) | |

| 2Q16 | 140.7 | -7% | (9.2) | |

| 3Q16 | 155.7 | 2% | 4.9 | |

| 4Q16 | 159.6 | 6% | 5.8 | |

| FY16 | 595.1 | -2% | 0.1 | |

| 1Q17 | 152.4 | 10% | (2.0) | |

| 2Q17 | 159.3 | 13% | (0.6) | |

| 3Q17 | 165.8 | 7% | (0.0) | |

| 4Q17 | 172.9 | 8% | 3.2 | |

| FY17 | 650.5 | 9% | 0.5 | |

| 1Q18 | 166.0 | 9% | (0.3) | |

| 2Q18 | 168.1 | 5% | (1.0) | |

| 3Q18 | 180.4 | 8% | (59.0) | |

| 4Q18 | 184.9 | 11% | (1.7) | |

| FY18 | 699.4 | 8% | (61.9) | |

| 1Q19 | 176.2 | 6% |

(8.6) | |

| 2Q19 | 169.1 | 1% |

0.9 | |

| 3Q19 | 184.3 | 2% |

13.4 | |

| 4Q19 (estimation) |

189 | 2% |

NA | |

| FY19 (estimation) | 719 |

3% |

NA |

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter