3D NAND Flash Memory Market to Reach $100 Billion by 2025 – Allied Market Research

At 35% CAGR from 2018

This is a Press Release edited by StorageNewsletter.com on January 17, 2019 at 2:09 pmIncrease in requirement for storage across consumer electronics & enterprise storage sectors, augmented demand for small-form factor in memory devices, rise in need for lightweight memory design, and high durability of such storage in enterprises and automotive industries are expected to drive the growth of the global 3D NAND flash memory market.

Allied Market Research published a report, titled, 3D NAND Flash Memory Market (255 pages, $3,111) by type (SLC, MLC, and TLC), application (cameras, laptop and PCs, smartphone and tablets, and others), and end users (automotive, consumer electronics, enterprise, healthcare, and others): global opportunity analysis and industry forecast, 2017-2025.

The report provides analyses of the key winning strategies, drivers and opportunities, market share and estimations, top investment pockets, and competitive landscape.

According to the report, the global 3D NAND flash memory market garnered $9.06 billion in 2017 and is expected to reach $99.77 billion by 2025, registering a CAGR of 35.3% from 2018 to 2025.

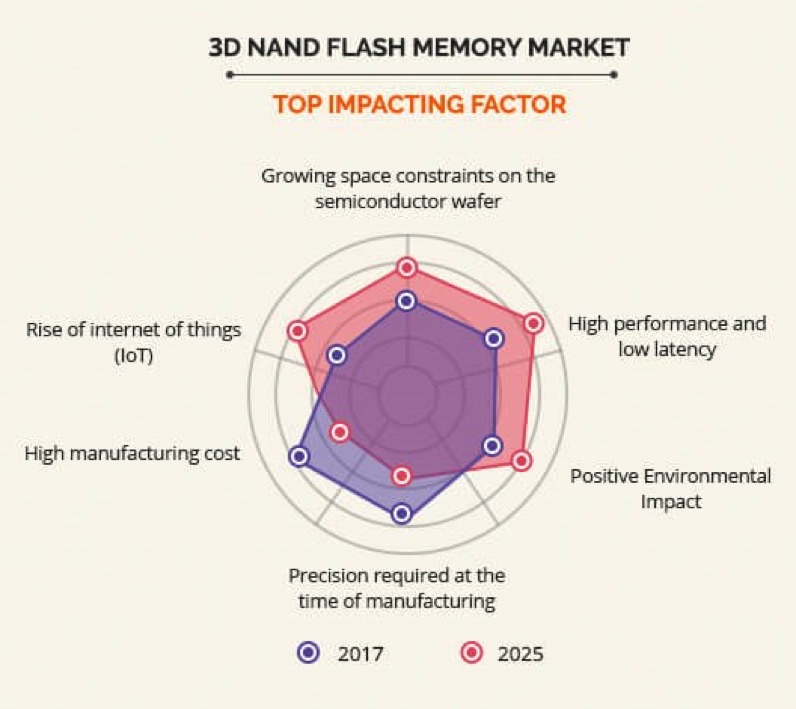

High demand for storage across consumer electronics and enterprise storage sectors coupled with increase in need for small-form factor in memory devices drives the growth of the market. Moreover, aggrandized requirement for lightweight memory design and robustness of enterprise storage systems, especially in automotive industries supplements the growth of the market. However, increased precision required during manufacturing and high manufacturing cost would hinder the market growth. On the other hand, increase in adoption of smart technologies in the AsiaPac region is anticipated to provide lucrative opportunities for the market growth.

TLC segment to be lucrative through 2025

Among types, the TLC segment accounted for more than half of the total market share in 2017 and would continue its dominance through 2025, registering the fastest CAGR of 37.1% from 2018 to 2025. This is because TLC flash offers a lower price per gigabyte as compared to SLC and MLC flash. The other types analyzed in the report include SLC and MLC 3D NAND flash memory.

Smartphone and tablet segment to retain lion’s share

through the forecast period

The smartphone and tablet segment contributed 46.9% of the total market share in 2017 and would remain dominant throughout the forecast period, registering the fastest CAGR of 37.0% through 2025. This is due to advancements in mobile technology and increase in penetration of smartphones. The report also analyzes camera, and laptop and PC, and other applications.

Consumer electronics segment to grab largest share, healthcare segment

to grow fastest through 2025

The consumer electronics segment captured nearly half of the overall market share in 2017 and is expected to maintain its lead throughout the study period. It is the main end user of the 3D NAND flash memory market, because of its increased applications in smartphones, tablets, laptops, and cameras. However, the healthcare sector is expected to grow at the fastest CAGR of 38.2% during the forecast period. This is because 3D NAND flash memory caters to demand for storage of massive amount of data generated during healthcare monitoring.

AsiaPac to remain dominant, LAMEA to grow the fastest through 2025

AsiaPac contributed 44% share of the total market revenue in 2017 and would continue its dominance during the forecast period. This is attributed to the increased demand for lightweight memory design and enhanced durability. However, LAMEA would grow at the fastest CAGR of 37.3% from 2018 to 2025, due to the high adoption of devices integrated with 3D NAND flash memory chip across economies such as Brazil, Chile, Venezuela, Peru, and others. In addition, Israel and Turkey are the major consumers of 3D NAND flash memory in the Middle East.

Leading industry players

The key market players analyzed in the report include Samsung Electronics Co., Ltd., Toshiba Corporation, SK Hynix Semiconductor, Inc., Micron Technology, Inc., Intel Corporation, Apple Inc., Lenovo Group Ltd., Advanced Micro Devices, STMicroelectronics, and SanDisk Corporation.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter