Micron: Fiscal 1Q19 Financial Results

NAND revenue down 2% Q/Q and up 17% Y/Y, weak near-term supply-demand entering calendar 2019

This is a Press Release edited by StorageNewsletter.com on December 20, 2018 at 2:17 pm| (in $ million) | 1Q18 | 1Q19 | Growth |

| Revenue |

6,803 | 7,913 | 16% |

| Net income (loss) | 2,678 | 3,296 | 23% |

Micron Technology, Inc. announced results for its first quarter of fiscal 2019, which ended November 29, 2018.

Fiscal Q1 2019 Highlights

• Revenue of $7.91 billion, up 16% compared with the same period last year

• GAAP net income of $3.29 billion, or $2.81 per diluted share

• Non-GAAP net income of $3.51 billion, or $2.97 per diluted share

• Operating cash flow of $4.81 billion compared with $3.64 billion for the same period last year

• Share repurchases of $1.80 billion under the authorized buyback program

“Micron reported strong profitability in the fiscal first quarter, highlighted by double-digit year-over-year revenue growth across our major markets and solid business execution,” president and CEO Sanjay Mehrotra said. “Despite weak near-term industry supply-demand dynamics entering calendar 2019, Micron is well-positioned to deliver healthy profitability throughout the year. We remain bullish on the long-term secular growth trends driving the memory and storage industry.”

Investments in capital expenditures, net of amounts funded by partners, were $2.48 billion for the first quarter of 2019, which resulted in adjusted free cash flows of $2.33 billion. Micron repurchased an aggregate of 42 million shares of its common stock for $1.80 billion during the quarter in connection with its $10 billion share repurchase authorization.

The company ended the first quarter in a record net cash position of $3.07 billion with cash, marketable investments, and restricted cash of $7.21 billion.

Comments

Total revenue is up 16% Y/Y and -6% Q/Q because of CPU shortage and slow sales of high-end smartphones impact DRAM and NAND shipments, but with strong profitability.

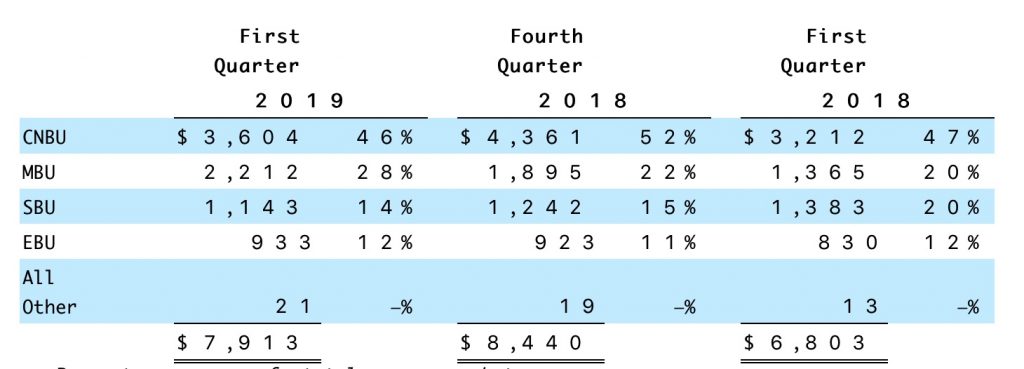

CNBU: Compute and Networking Business Unit, includes memory products sold into cloud server, enterprise, client, graphics, and networking markets.

MBU: Mobile Business Unit, includes memory products sold into smartphone and other mobile-device markets.

SBU: Storage Business Unit, includes SSDs and other storage products, including component-level solutions sold into enterprise and cloud, client, and consumer SSD markets, other discrete storage products sold in component and wafer forms to the removable storage markets, and sales of 3D XPoint memory.

EBU: Embedded Business Unit, includes memory and storage products sold into automotive, industrial, medical, and consumer markets.

Here we comment only on NAND business representing 28% of global sales in 1FQ19 compared to 68% for DRAM.

For the storage business unit or SBU, fiscal first quarter revenue was $1.1 billion, down 17% Y/Y and 8% Q/Q. The sequential decline was driven by weaker pricing and the ongoing transition from SATA to NVMe SSDs. The impact of this transition will continue through calendar 2019. Firm's strategy to move bits from SBU components to high-value solutions in mobile is also contributing to a decline in revenue for SBU.

Sales of NAND products for 1FQ19 increased 15% from 1FQ18 and decreased 3% from 4FQ18 primarily due to a 70% increase in sales volumes driven by increases in sales of high-value mobile managed NAND products enabled by strong demand and company's transition to products featuring 64-layer TLC 3D NAND, partially offset by decreases in ASPs of 30%.

Decline in sales of SSD storage products is the result of pricing decreases, partially offset by higher shipment volumes of managed NAND products into mobile markets, which increased more than 50% due to firm's execution in delivering products featuring advanced 3D NAND technologies combined with strong customer acceptance.

During the most recent quarter, the vendor introduced QLC NAND for NVMe SSDs and enterprise SATA SSDs, and started shipping 96-layer products, with yields ahead of plant.

Looking ahead, it is expected that the SSD market opportunity will continue to shift from SATA to NVMe.

Sales volumes of NAND products for 1FQ19 increased by a low to mid-teen percent as compared to the 4FQ18, which mitigated a similar decline in ASPs.

NAND industry demand growth of about 5% and industry supply output growth exceeds demand growth, according to Micron, and consequently is taking actions to lower NAND output and now expects NAND bit shipment growth to be around 35%.

The company expects NAND demand to accelerate in the second half of the calendar year as demand elasticity kicks in for the mobile, enterprise, and client markets.

High-value solutions, driven by managed NAND products, now represent over 50% of NAND bits, helped the firm to maintain overall NAND gross margins above 45%, despite industry oversupply. Here Micron is gaining about three percentage points of market share sequentially according to industry reports.

Micron continue to progress in developing high-value solutions using its 3D XPoint technology and plans to introduce differentiated products towards the end of calendar 2019.

Global sales guidance for 2FQ19 is only $5,700 billion to $6,300 billion or -28% to -21%.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter