WW Enterprise Storage Systems Market Revenue Up Yearly 19% in 3Q18 – IDC

Lenovo +94%, Inspur +65%, Dell +22%, HPE -3%, Hitachi -10%, IBM -21%

This is a Press Release edited by StorageNewsletter.com on December 13, 2018 at 2:22 pmAccording to the International Data Corporation‘s Worldwide Quarterly Enterprise Storage Systems Tracker, vendor revenue in the worldwide enterprise storage systems market increased 19.4% Y/Y to $14.0 billion during 3Q18.

Total capacity shipments were up 57.3% Y/Y to 113.9EB during the quarter.

Revenue generated by the group of original design manufacturers (ODMs) selling directly to hyperscale datacenters increased 45.8% Y/Y in 3Q18 to $3.9 billion. This represents 27.7% of total enterprise storage investments during the quarter.

Sales of server-based storage increased 10.1% Y/Y to $3.8 billion in revenue. This represents 27.3% of total enterprise storage investments.

The external storage systems market was worth roughly $6.3 billion during the quarter, up 12.5% from 3Q17.

“The third quarter results show a continuation of growth realized through the first half of 2018, driven by an ongoing infrastructure refresh cycle, investments in resource intensive next-generation workloads, and expanded use in public cloud services,” said Sebastian Lagana, research manager, infrastructure platforms and technologies, IDC. “Enterprises appreciate the value that data brings to their operations, client engagement, and innovation initiatives. As a result, there is ongoing investment in storage systems that support efficient data consumption and dissemination.”

Total Enterprise Storage Systems Market Results, by Company

Dell Inc. was the largest supplier for the quarter, accounting for 19.2% of total worldwide enterprise storage systems revenue and growing 21.8% Y/Y. HPE/New H3C Group was the second largest supplier with 16.4% share of revenue on a Y/Y decline of 3.3%. NetApp generated a 5.8% share of total revenue, making it the third largest vendor during the quarter. This represented 15.3% growth over 3Q17. Hitachi, Huawei, IBM, Lenovo, and Inspur were all statistically tied* for the number 4 position with shares of 3.0%, 3.0%, 2.9%, 2.6%, and 2.2% respectively.

As a single group, storage systems sales by ODMs directly to hyperscale datacenter customers accounted for 27.7% of global spending during the quarter and grew revenue by 45.8% against 3Q17.

Top 5 Companies, WW Total Enterprise Storage Systems Market, 3Q18

(revenue in $million)

Notes:

a Dell Inc. represents the combined revenues for Dell and EMC.

b Due to the existing joint venture between HPE and the New H3C Group, IDC will be reporting market share on a global level for HPE as HPE/New H3C Group starting from 2Q16 and going forward.

* IDC declares a statistical tie in the worldwide enterprise storage systems market when there is a difference of 1% or less in the share of revenues or unit shipments among two or more vendors.

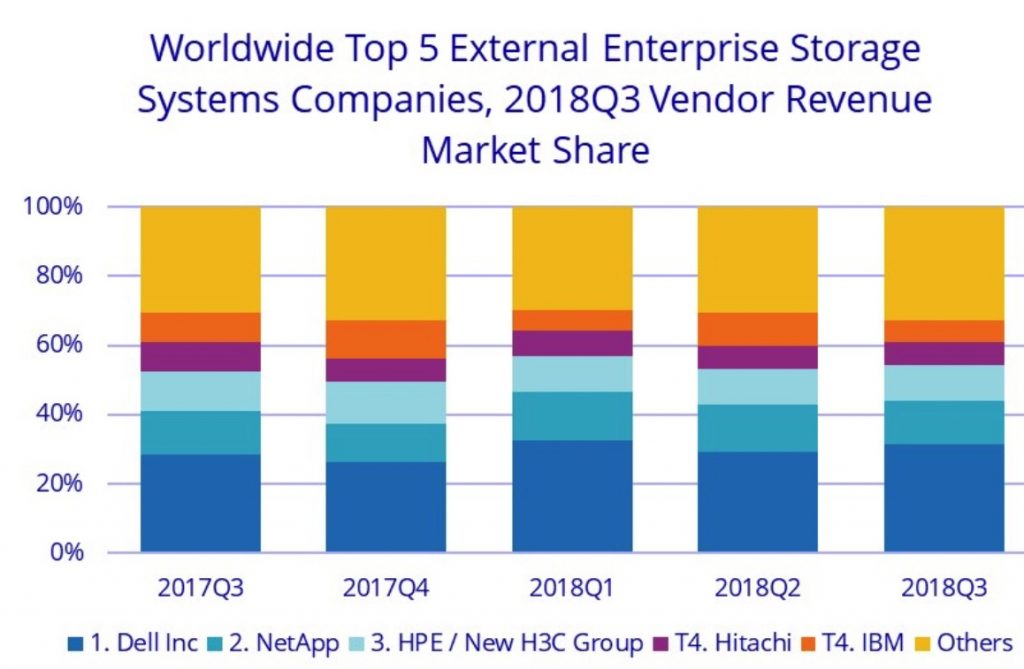

External Enterprise Storage Systems Results, by Company

Dell Inc. was the largest external enterprise storage systems supplier during the quarter, accounting for 31.3% of worldwide revenues. NetApp finished in the number 2 position with 12.8% share of revenue during the quarter. HPE/New H3C Group was the third largest with 10.4% share of revenue. Hitachi and IBM rounded out the top 5 in a statistical tie* with 6.4% and 6.2% market share, respectively.

Top 5 Companies, WW External Enterprise Storage Systems Market, 2Q18

(revenue in $million)

Notes:

a Dell Inc. represents the combined revenues for Dell and EMC.

b Due to the existing joint venture between HPE and the New H3C Group, IDC will be reporting market share on a global level for HPE as HPE/New H3C Group starting from 2Q16 and going forward.

* IDC declares a statistical tie in the worldwide enterprise storage systems market when there is a difference of 1% or less in the share of revenues or unit shipments among two or more vendors.

Flash-Based Storage Systems Highlights

The total AFA market generated just over $2.15 billion in revenue during the quarter, up 39.3% year over year. The hybrid flash array market was worth slightly more than $2.6 billion in revenue, up 16.0% from 3Q17.

Taxonomy Notes

IDC defines an enterprise storage system as a set of storage elements, including controllers, cables, and (in some instances) HBAs, associated with three or more disks. A system may be located outside of or within a server cabinet and the average cost of the disk storage systems does not include infrastructure storage hardware (i.e. switches) and non-bundled storage software.

The information in this quantitative study is based on a branded view of the enterprise storage systems sale. Revenue associated with the products to the end user is attributed to the seller (brand) of the product, not the manufacturer. OEM sales are not included in this study.

Comments

In the WW enterprise storage systems market, the increase is +6% Q/Q and 19% Y/Y.

Inspur is incorporated for first time in IDC report. The company from China said on its Web site it is number one storage seller in China for 13 consecutive years, but others Chinese firms Huawei and Lenovo are here in front of Inspur.

The most impressive firm in storage is Lenovo (now with NetApp) these last months, growing yearly +27% in 2Q18 and here +133% in 3Q18.

The total AFA market generated just over $2.0 billion in revenue during 2Q18, up 41.7% Y/Y, to be compared with $2.15 billion in 3Q18 up 39% Y/Y and 8% Q/Q. The hybrid flash array market is quarterly stable.

3Q18 storage revenue as released by US public companies and IDC

(in $million)

| Company | Quarter ended in | Revenue published for storage revenue | Y/Y growth |

3Q18 revenue for IDC |

Y/Y growth |

Difference with IDC |

| Dell | November | 3,883 | 6% | 2,695 | 22% | -41% |

| HPE | October | 959* | 6% | 2,299 | -3% | 140% |

| NetApp | October | 1,517 | 7% | 808 | 15% | -47% |

| IBM | September | 456* | -6% | 403 | -21% | -22% |

* hardware only

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter