Box: Fiscal 3Q19 Financial Results

Revenue: $156 million, net loss: $40 million

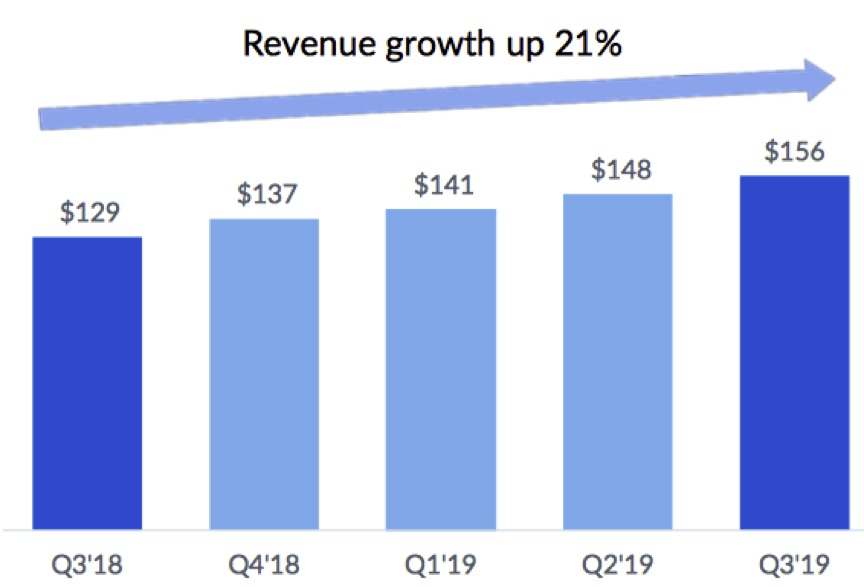

This is a Press Release edited by StorageNewsletter.com on December 3, 2018 at 2:26 pm| (in $ million) | 3Q18 | 3Q19 | 9 mo. 18 | 9 mo. 19 |

| Revenue | 129.3 | 155.9 | 369.5 | 444.7 |

| Growth | 21% | 20% | ||

| Net income (loss) | (42.9) | (40.2) | (122.3 | (114.9) |

Box, Inc. announced financial results for the third quarter of fiscal 2019, which ended October 31, 2018.

“Our solution selling strategy continues to gain momentum with strong attach rates for add-on products and large deal growth in the third quarter. With more than 90,000 customers, including BBVA Compass, National Bank of Canada, and Shiseido company, Box continues to expand its role as a strategic technology partner to power digital transformation for enterprises,” said Aaron Levie, co-founder and CEO. “Businesses need a single, open platform for cloud content management with enterprise-grade security and powerful workflow capabilities, and Box is the only solution with this uncompromising focus.“

“In the third quarter, we delivered solid revenue growth and continued to drive operational efficiencies, and we’re on track to deliver our first quarter of non-GAAP profitability in Q4,” said Dylan Smith, co-founder and CFO. “With more than 40% growth in deals worth more than $100,000 and our attach rate for add-on products increasing to over 80% of these deals, we are capturing our market opportunity while driving continued leverage for long-term growth.”

Fiscal Third Quarter Financial Highlights

• Revenue for the third quarter of fiscal 2019 was a record $155.9 million, an increase of 21% (ASC 606 in fiscal 2019 compared to ASC 605 in fiscal 2018) and 23% (ASC 605 in fiscal 2019 compared to ASC 605 in fiscal 2018) from the third quarter of fiscal 2018.

• Deferred revenue as of October 31, 2018 was $301.2 million, an increase of 19% (ASC 606 to ASC 605) and 20% (ASC 605 to ASC 605) from October 31, 2017.

• Billings for the third quarter of fiscal 2019 were $155.6 million, an increase of 10% (ASC 606 to ASC 605 and ASC 605 to ASC 605) from the third quarter of fiscal 2018.

• GAAP operating loss in the third quarter of fiscal 2019 was $39.5 million, or 25% of revenue (ASC 606), and $42.3 million, or 27% of revenue (ASC 605). This compares to GAAP operating loss of $42.6 million, or 33% of revenue, in the third quarter of fiscal 2018.

• Non-GAAP operating loss in the third quarter of fiscal 2019 was $7.7 million, or 5% of revenue (ASC 606), and $10.5 million, or 7% of revenue (ASC 605). This compares to non-GAAP operating loss of $17.0 million, or 13% of revenue, in the third quarter of fiscal 2018.

• GAAP net loss per share, basic and diluted, in the third quarter of fiscal 2019 was $0.28 (ASC 606) and $0.30 (ASC 605) on 142.4 million shares outstanding. This compares to GAAP net loss per share of $0.32 in the third quarter of fiscal 2018 on 134.6 million shares outstanding.

• Non-GAAP net loss per share, basic and diluted, in the third quarter of fiscal 2019 was $0.06 (ASC 606) and $0.08 (ASC 605). This compares to non-GAAP net loss per share of $0.13 in the third quarter of fiscal 2018.

• Net cash provided by operating activities in the third quarter of fiscal 2019 totaled $6.8 million. This compares to net cash provided by operating activities of $14.1 million in the third quarter of fiscal 2018.

• Free cash flow in the third quarter of fiscal 2019 was negative $4.1 million, compared to positive $6.3 million in the third quarter of fiscal 2018. This result was driven by the timing of cash outflows paid in the third quarter of fiscal 2019 that were originally anticipated to be paid in the fourth quarter of fiscal 2019. Box continues to expect to achieve positive free cash flow for the fourth quarter and full fiscal year 2019.

Business Highlights since Last Earnings Release

• Grew paying customer base to more than 90,000 organizations, including new or expanded deployments with 23andMe, BBVA Compass, BPDA The City of Boston, Mizuho Bank, National Bank of Canada, Radian Group, Shiseido company, and Sunbelt Rentals.

• Hosted eighth annual BoxWorks, which attracted a number of Fortune 1,000 attendees and featured partners such as Google, IBM, Apple, and Microsoft.

• Unveiled a new activity stream and recommended applications, which surfaces relevant activity from other applications when previewing a file in Box.

• Announced updates to Box Tasks and Automations, which will enable customers to create simple triggers for recurring actions around their content.

• Announced support for custom-trained AI models for Box Skills, a framework for applying state-of-the-art AI technologies to content in Box.

• Launched the availability of the Box for Gmail add-on and the beta of the Box for G Suite integration.

• Launched an enhanced integration with Oracle NetSuite, making it even easier for organizations to work faster, more collaboratively, and securely with their content across both systems.

• Welcomed Kimberly Hammonds, former COO of Deutsche Bank AG and CIO for the Boeing company, to Box’s board of directors.

Q4 FY19 Guidance

Revenue is expected to be in the range of $163.5 million to $164.5 million. GAAP basic and diluted loss per share are expected to be in the range of $0.21 to $0.20 based on approximately 144 million weighted average shares outstanding. Non-GAAP diluted earnings per share is expected to be in the range of $0.02 to $0.03 based on approximately 150 million weighted average diluted shares outstanding.

Full Year FY19 Guidance

Revenue is expected to be in the range of $608.2 million to $609.2 million. GAAP and non-GAAP basic and diluted loss per share are expected to be in the range of $1.02 to $1.01 and $0.16 to $0.15, respectively. Weighted average basic and diluted shares outstanding are expected to be approximately 141 million.

Comments

Abstract of the earnings call transcript:

Aaron Levie, CEO:

"We closed 57 deals greater than $1,000 versus 40 a year-ago. 11 deals over $5,000 versus five a year-ago, and three deals more than $1 million versus one a year-ago. More than 80% of these deals included at least one add-on product like Box Governance, Zones, KeySafe or Platform compared to roughly two-thirds of deals greater than $100,000 including these products a year-ago.

"More than 40% of our six figure and above deals involve the reseller, systems integrator, or technology partner."

Dylan Smith, CFO:

"25% of Q3's revenue came from regions outside of the United States compared to 21% a year-ago

"This quarter, 28% of our six figure deals came from international markets."

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter