Qualstar: Fiscal 3Q18 Financial Results

Tape-based storage up 27% Y/Y down 5% Q/Q

This is a Press Release edited by StorageNewsletter.com on November 9, 2018 at 2:23 pm| (in $ million) | 3Q17 | 3Q18 | 9 mo. 17 | 9 mo. 18 |

| Revenue | 2.8 | 3.2 | 7.5 | 9.3 |

| Growth | 15% | 25% | ||

| Net income (loss) | (0.1) | 0.4 | (0.0) | 1.5 |

Qualstar Corporation announced its financial results for the three and nine months ended September 30, 2018.

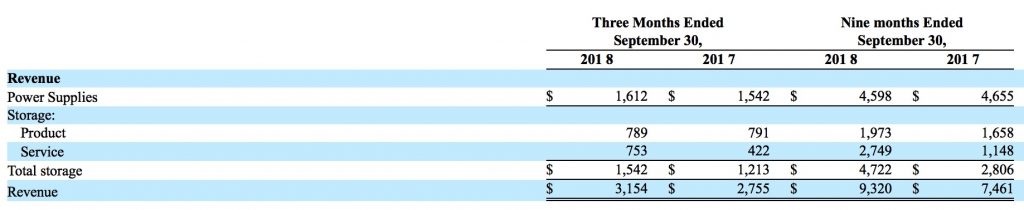

(All amounts are in thousands, except per share data)

Results for the Three Months Ended September 30, 2018 vs. 2017

- Net revenue increased 14.5% to $3,154 from $2,755

- Total operating expenses decreased 29.7% to $848 from $1,206

- Net income of $405 or $0.20 per basic and diluted share vs. net loss of $148 or $(0.07) per basic and diluted share

Results for the Nine Months Ended September 30, 2018 vs. 2017

- Net revenue increased 24.9% to $9,320 from $7,461

- Total operating expenses decreased 8.4% to $2,634 from $2,876

- Net income of $1,469 from a loss of $31, or $0.72 per basic and $0.70 per diluted share vs. ($0.02) per basic and diluted share

Highlights for the Three and Nine Months Ended September 30, 2018

- Strong balance sheet and no debt

Cash, restricted cash and cash equivalents increased by 2.8% to $4,931 from $4,798 as of December 31, 2017 - Revenue growth in the storage segment is strong for both products and services, as the company continues to defend market share in a very competitive landscape

- Improved gross margin for the three months ended September 30, 2018 to 39.7% versus 38.4% from the same period last year, and for the nine months ended September 30, 2018, gross margin improved to 44.0% compared to 38.1% for the same period last year

Click to enlarge

“We are pleased with the strong results of the third quarter, as we continue to execute our plan for revenue growth and product expansion throughout the major markets around the world,” Bronson stated. “Despite the competitive pressures that challenge our industry, Qualstar continues to maintain a very lean operating structure, and our cost control remains a key element of our strategy,” he continued. “We continue to be optimistic with the continued success of the company, as we pursue new opportunities in both our storage segment and our power supply business. Overall, we believe we are well positioned to exploit new projects and strategic initiatives, aimed at increasing long term value for our shareholders.”

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter