Software-Defined, Hyperconverged and Cloud Storage Market Survey – DataCore

Storage availability and avoiding vendor lock-in top concerns for IT professionals

This is a Press Release edited by StorageNewsletter.com on November 7, 2018 at 2:26 pmDataCore Software Corp. announced the results of its 7th consecutive market survey, The State of Software-Defined, Hyperconverged and Cloud Storage, (registration required) which explored the experiences of 400 IT professionals who are currently using or evaluating software-defined storage, hyperconverged and cloud storage to solve critical storage challenges.

The results yield surprising insights from a cross-section of industries over a range of workloads, including the fact that storage availability and avoiding vendor lock-in remain top concerns for IT professionals, and illustrate the status of the industry on its journey to a software-defined future.

The report reveals what respondents view as the primary business drivers for implementing software-defined, hyperconverged, public cloud and hybrid cloud storage. For example, the top results for software-defined storage include: automate frequent or complex storage operations; simplify management of different types of storage; and extend the life of existing storage assets. This portrays the market’s recognition of the economic advantages of software-defined storage and its power to maximise IT infrastructure performance, availability and utilisation.

The report also highlights the capabilities that users would like from their storage infrastructure. The top capabilities identified were BC/HA (which can be achieved via metro clustering, synchronous data mirroring, and other architectures) at 74%; DR (from remote site or public cloud) at 73%; and enabling storage capacity expansion without disruption at 72%.

BC was found to be a key storage concern, whether on-premise or in the cloud. It is first on the list for the primary capability that respondents would like from their storage infrastructure, and was also number one in the previous DataCore market survey. Additionally, BC is the top business driver for those deploying public and hybrid cloud storage (46% and 41%), and similarly ranks high in the complete results for software-defined and hyperconverged storage business drivers, coming in at 45% and 43% respectively.

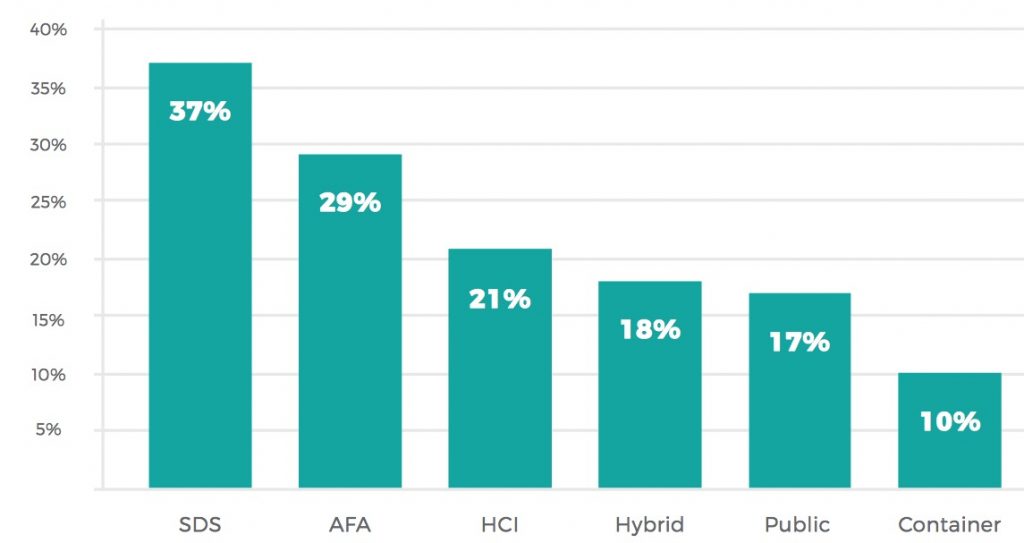

Surprises, False Starts and Technology Disappointments

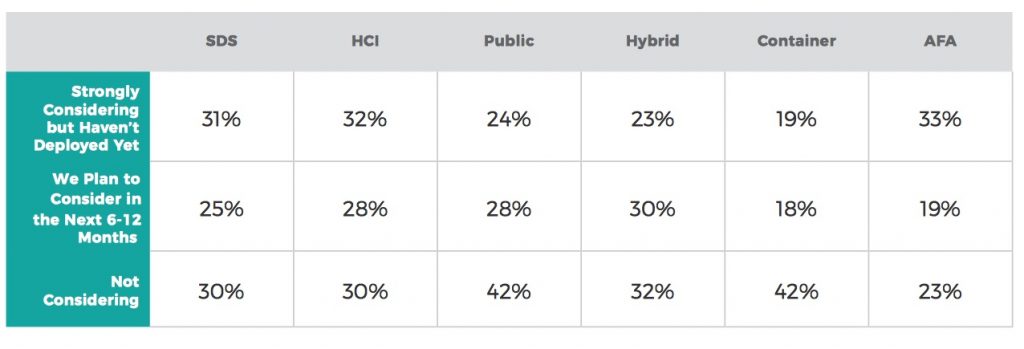

The biggest surprise reported was that there is still too much vendor lock-in within storage, with 42% of respondents noting this as their top concern. Software-defined storage is being used to solve this (management of heterogeneous environments) as well as for automation (lowering costs, fewer migrations and less work provisioning). Therefore, it should not be a surprise that the results also showed adoption of software-defined storage is about double that of hyperconverged (37% vs. 21%), with 56% of respondents also strongly considering or planning to consider software-defined storage in the next 12 months.

The survey further revealed the reality of hyperconverged deployments. While it continues to make inroads, in addition to above, some respondents also said they are ruling out hyperconverged because it does not integrate with existing systems (creates silos), can’t scale compute and storage independently and is too expensive. Hybrid converged technology is a good option for IT to consider in these cases.

Additionally, while AFAs are often viewed as the simplest way to add performance, more than 17% of survey respondents found that adding flash failed to deliver on the performance promise-most likely as flash does not solve the I/O bottlenecks pervasive in most enterprises. Technologies such as Datacore’s Parallel I/O provide a solution for this.

In regards to emerging technologies, many enterprises are exploring containers, however actual adoption is slow primarily due to: lack of data management and storage tools; application performance slowdowns-especially for databases and other tier-1 applications; and lack of ways to deal with applications such as databases that need persistent storage.

NVMe is also still struggling to become mainstream. About half of respondents have not adopted NVMe at all. 30% of survey respondents report that 10% or more of their storage is NVMe, and more than 7% report that more than half of their storage is NVMe.

While adoption is still slow, enthusiasm for the technology does appear strong. Technologies such as software-defined storage with Gen6 HBA support and dynamic auto-tiering with NVMe on a DAS can help simplify and accelerate adoption.

“We see enterprise IT maturing in its use of software-defined technologies as the foundation for the modern data centre,” said Gerardo A. Dada, CMO, DataCore. “DataCore is delighted to be a catalyst that helps IT meet business expectations of availability and performance while reducing costs, as well as enabling users to enjoy architectural flexibility and vendor freedom.“

Where are you in your deployments of following technologies?

Future technologies being considered

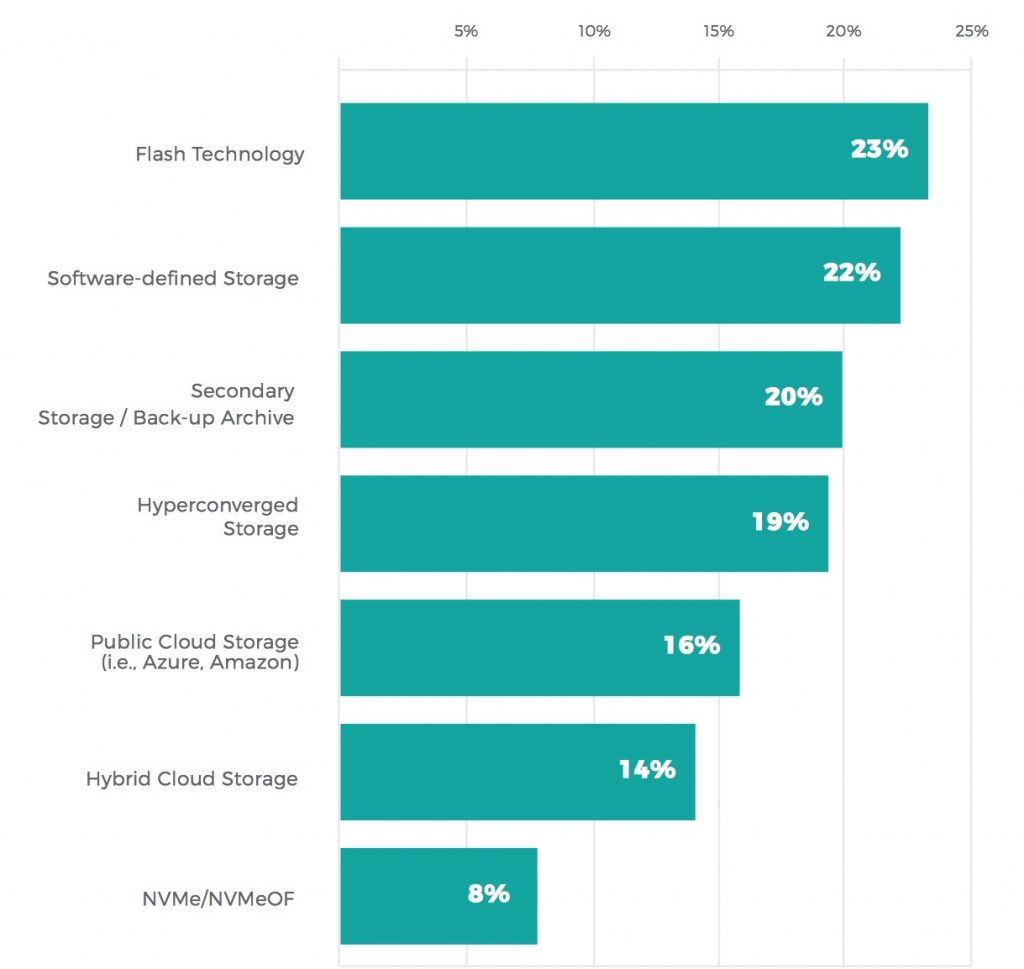

What percentage of your 2018 storage budget is allotted

to each of the technologies listed?

Response = more than 25%?

Additional highlights of the survey include:

- In regards to cloud storage adoption and maturity, many still report security and regulatory concerns as obstacles to deployment. Furthermore, another top surprise reported was that using the cloud failed to reduce storage costs.

- Overall, respondents view requirements, use cases and decision drivers very differently based on where they stand relative to how much and how long they currently are using storage-on-premise or in the cloud.

- For example, databases, consolidation and VDI are the top three use cases reported for on-premise software-defined storage and hyperconverged infrastructure deployments whereas backup, archival and DR, as in past surveys, continue to be the top three use cases for public and hybrid cloud deployments.

- Reducing new hardware costs and adding performance were the main decision drivers in past surveys (prior to 2017) across all types of deployments. There has been a significant shift this year as well as last year, making automation, simplification and extending the life of existing assets top of mind.

Respondents of the survey came from a diverse set of organizations, both in size and industry, providing statistically significant insights into the similarity in needs for software-driven storage over a wide range of IT environments. The 400 participants represent a range of vertical market segments, including financial services, healthcare, government, manufacturing, education, IT services and other related industries from a mix of organization sizes, including those with fewer than 500 employees, between 500 and 5,000 employees, and more than 5,000 employees.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter