Commvault: Fiscal 2Q19 Financial Results

Revenue down 4% Q/Q, up 1% Y/Y, back to slighty profitable

This is a Press Release edited by StorageNewsletter.com on October 31, 2018 at 2:36 pm| (in $ million) | 2Q18 | 2Q19 | 6 mo. 18 | 6 mo. 19 |

| Revenue | 168.1 | 169.1 | 334.1 | 345.3 |

| Growth | 1% | 3% | ||

| Net income (loss) | (1.0) | 0.9 | (1.3) | (7.7) |

Commvault Systems, Inc. announced its financial results for the second quarter ended September 30, 2018.

N. Robert Hammer, chairman, president and CEO, stated: “During the quarter, we completed the majority of the operational initiatives of our Commvault Advance transformation. Our second quarter financial results partly reflect the temporary disruption from the implementation of these changes. These in-quarter actions were critical to implement our transformation strategy and, as a result, most of the major changes have now been completed and our entire company is focused on go-forward execution. The actions we took to align our cost structure were evidenced in the 61% year-over-year growth in non-GAAP operating income. Now that the foundation of Commvault Advance is largely in place, we believe we are seeing increased momentum as our channel strategy, go-to-market initiatives and alliance partnerships are starting to show positive traction.”

Total revenues for the second quarter of fiscal 2019 were $169.1 million, an increase of 1% year-over-year, and a decrease of 4% sequentially.

Software and products revenue was $69.5 million, a decrease of 3% year-over-year, and 7% sequentially. Subscription software and product revenue comprised a record 43% of total software and products revenue, an increase of 136% year-over-year. Subscription and utility annual contract value (ACV) grew over 90% year-over-year to approximately $76 million.

Services revenue in the quarter was $99.6 million, an increase of 4% year-over-year and a decrease of 2% sequentially.

On a GAAP basis, income from operations (EBIT) was $1.0 million for the second quarter compared to a loss of $4.7 million in the prior year. These second quarter GAAP results in fiscal 2019 included $6.1 million of expenses related to a non-routine shareholder matter, a litigation settlement and restructuring. These expenses have been excluded from non-GAAP results. Non-GAAP EBIT was $25.1 million in the quarter compared to $15.6 million in the prior year, an increase of 61%.

For the second quarter of fiscal 2019, Commvault reported a GAAP net income of $0.9 million, or $0.02 per diluted share. Non-GAAP net income for the quarter was $19.1 million, or $0.40 per diluted share.

Operating cash flow totaled $17.8 million for the second quarter of fiscal 2019 compared to $9.7 million in the prior year quarter. Total cash and short-term investments were $484.1 million as of September 30, 2018 compared to $462.4 million as of March 31, 2018.

During the second quarter of fiscal 2019, Commvault repurchased approximately 201,000 shares of its common stock totaling $13.3 million. On October 18, 2018, the board of directors authorized an increase to the repurchase program so that $200 million was available for ongoing repurchases and they extended the expiration date of the program to March 31, 2020.

Recent Business Highlights

Innovation on Display at Commvault GO in Nashville

Aligned with the key foundational emphasis of Commvault Advance – to keep the company’s innovation front and center – the firm successfully delivered another sold-out customer event at Commvault GO earlier this month. The event showcased innovation with announcements made possible by the Commvault Advance initiatives on product and go-to-market organizational focus.

Announcements included:

• A new industry-benchmark user interface known as Commvault Command Center;

• The launch of as-a-service options for the company’s hallmark Commvault Complete Backup & Recovery Product

• An expanded portfolio of appliances including a new larger scale-out appliance for large enterprise and MSPs, and a smaller backup appliance for remote and small offices;

• Expanded relationships with partners NetApp and Hewlett-Packard Enterprise; and

• A differentiated offering with Commvault Activate to help customers solve a CIO priority to discover and know their data across their environments.

“In summary, the announcements and information shared with IDC at Commvault GO left us feeling positive about Commvault’s progress,” said Archana Venkatraman, research manager, and Phil Goodwin, research director, storage systems and software, IDC.

“In conversations with IDC, many of Commvault’s customers iterated the benefit of simplification, consolidation, and analytics that the platform offers. What differentiates Commvault is that its commitment and focus across multiple geographies including Europe and Asia are on par with its North American focus. This was evident in Commvault’s strategies around European regulations such as GDPR and its cognizance of Ali cloud and Asian regulatory dynamics. The vendor’s frank discussion about its strategic direction, combined with ongoing commitment to its new product architecture and pricing, and the potential of new products like Commvault Complete Backup and Recovery as a Service, were all positive developments,” he said. “Looking forward, Commvault’s ability to slowly increase its indirect and partner-driven sales revenue, combined with its ability to gain share in the mid-market, will be important, quantitative signs of success. In conclusion, GO 2018 presented us with a self-assured and driven Commvault. If the vendor maintains this drive with its developers, customers, and regional teams, Commvault will be able to scale its business to new levels.”

The analyst comments are part of a IDC Perspective, entitled Commvault GO 2018 Highlights.

“Commvault GO reinforced the power of partnership and how true tech industry leaders don’t just deliver you the technology you need to realize your business objectives,” said Barry Hubbard, senior director of global Infrastructure, TiVoo Corp. “They work with you to understand these business objectives, and invest time and resources in helping you determine how to best use both their own technology and other technologies to realize these objectives. That’s what Commvault has done with TiVo. By collaborating with us on our strategic initiatives, we have been able to determine how we can better activate our data so we can provide our customers with information they can use to build even more meaningful relationships with their audiences.”

Customer Business Validates Commvault Value Proposition

The software publisher also announced a list of new and existing customers who had purchased products and/or services during its fiscal second quarter, across many industry segments and geographies from around the world:

Ace Hardware Corporation

B. Riley

Banner Bank

BriteSky

Cisco Systems Inc.

City of Kent

Cork County Council

Essilor

Fnz Ltd.

Gaylord Hospital

Hunter Douglas

International Christian Hospital

JFK Medical Center

L.L. Bean, Inc.

Medical College of Wisconsin

Metropolitan Atlanta Rapid Transit Authority

Milliken & company

Mitchell International

Neixar Systems

Haitian International

Ningbo International Logistics Development company Ltd.

Parkland Fuel Corporation

PresiCarre Corporation

Rochester Regional Health

Sony Network Communications, Inc.

Swinerton Incorporated

Synthos Group S.A.

U.S. Dept. of Commerce

US Army

US Department of the Treasury

WEG

Western Maryland Health System

WINOV Solucoes em Tecnologia SA

Comments

The company has implemented a big restructuration named Commvault Advance but we are waiting to see the positive financial results of these actions as revenue continues to stabilize since 2FQ17.

CEO Bob Hammer said: "Another key strategy is to drive significantly improved distribution leverage through a combination of products better aligned to routes to market, which include our appliances and Commvault Complete, reallocation of sales resources from direct selling to supporting our partners and the expansion of our alliance relationships."

Last quarter the storage software company expects 2Q19 revenue to be $179 million. It's finally only $169 million with goal to reach $181 million next quarter (+7% Q/Q) and $189 million for the fourth fiscal quarter revenue (+4% ), resulting in total FY 2019 revenues of $715 million (+2% Y/Y).

These expectations are based on Q3 and Q4 software revenue of approximately $82 million and $86.5 million, respectively.

FY20 objective is to grow revenue by at least 9% while achieving 20%-plus operating margins with target to achieve 80% repeatable revenue in FY21. The goal is to drive an increasing proportion of subscription and utility licenses with the goal of approximately $240 million of ACV (Annual Contract Value) by the end of FY21.

Major re-organization of sales and marketing was implemented in early 2Q19.

Commvault Advance Phase 1 began during 1FQ19, instituting operating expense reductions and reducing workforce by ~200 heads (7% of total) in 1H19, for a total of 2,644 employees at the end of the quarter.

But the firm acted swiftly to implement these changes. The implementation of the Commvault Advance initiatives in Q2 resulted in disruption that did not allow to achieve top line objective. And while there was a higher level of disruption than anticipated, the most significant changes are now completed and Commvault is focused on go-forward execution throughout the remainder of FY19.

During the 1FH19, the firm shifted a material portion of its sales and marketing resources from direct sales to supporting channel and strategic partners and strengthening its relationship with partners including HPE, NetApp, Cisco, Microsoft, and AWS. It also have continued to develop strategic relationships with Hitachi Vantara, Huawei, and Fujitsu

Revenue from enterprise deals, defined as deals over $100,000 in software and product sales in a given quarter, represented 66% of such revenue for the most recent three-month period. Sales from these transactions was up 8% Y/Y. The number of enterprise revenue transactions increased 10% Y/Y. Average enterprise deal size was approximately $284,000.

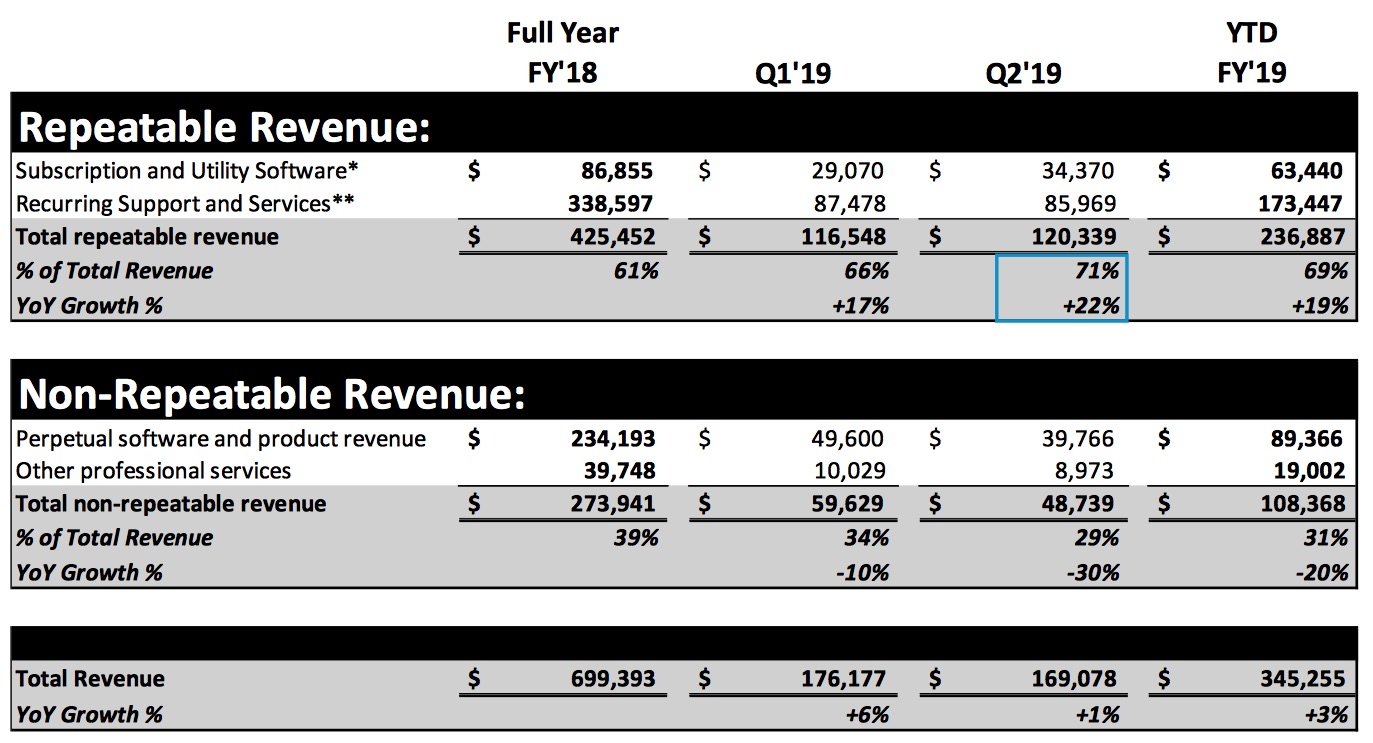

71% of Q2 total revenue was repeatable in nature. This repeatable revenue has been growing in excess of its legacy pricing models, and were up 22% Y/Y in Q2.

As of Q2, ACV has grown to $76 million after only a short period of selling subscription licenses. It is accelerating and achieved approximately 90% Y/Y growth this quarter.

Repeatable revenue transition

Historical repeatable revenue stratification (in ‘000s)

* Inclusive of revenue recognized as maintenance and support associated with these transactions

** Primarily maintenance and support on perpetual transactions

To read the earnings call transcript

Revenue and net income (loss) for Commvault

| Fiscal period | Revenue | Y/Y growth | Net income (loss) |

| 1Q15 | 152.6 | 14% | 12.7 |

| 2Q15 | 151.1 | 7% | 6.5 |

| 3Q15 | 153.0 | -0% | 3.1 |

| 4Q15 | 150.7 | -4% | 3.4 |

| FY15 | 607.5 | 4% | 25.7 |

| 1Q16 | 139.1 | -9% | (1.3) |

| 2Q16 | 140.7 | -7% | (9.2) |

| 3Q16 | 155.7 | 2% | 4.9 |

| 4Q16 | 159.6 | 6% | 5.8 |

| FY16 | 595.1 | -2% | 0.1 |

| 1Q17 | 152.4 | 10% | (2.0) |

| 2Q17 | 159.3 | 13% | (0.6) |

| 3Q17 | 165.8 | 7% | (0.0) |

| 4Q17 | 172.9 | 8% | 3.2 |

| FY17 | 650.5 | 9% | 0.5 |

| 1Q18 | 166.0 | 9% | (0.3) |

| 2Q18 | 168.1 | 5% | (1.0) |

| 3Q18 | 180.4 | 8% | (59.0) |

| 4Q18 | 184.9 | 11% | (1.7) |

| FY18 | 699.4 | 8% | (61.9) |

| 1Q19 |

176.2 | 6% |

(8.6) |

| 2Q19 |

169.1 | 1% |

0.9 |

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter