Magic Quadrant for Distributed File Systems and Object Storage

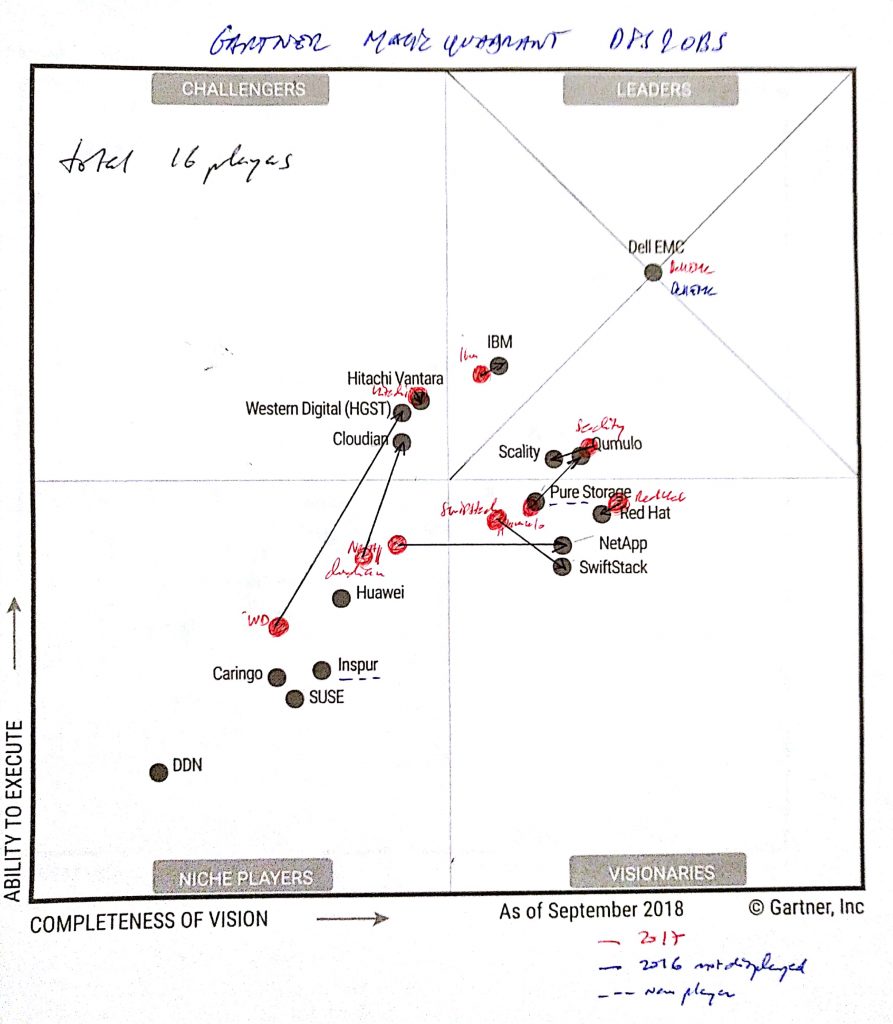

Dell EMC, IBM, Qumulo and Scality lead the pack.

By Jean Jacques Maleval | October 24, 2018 at 2:29 pmThe report Magic Quadrant for Distributed File Systems and Object Storage (ID G00338327, $1,995)) was published 18 October 18, 2018 by Gartner, Inc.

He is the chart publicly available showing the leaders:

Comments

Comment by Philippe Nicolas:

Comment by Philippe Nicolas:

Gartner just released this new Magic Quadrant ont Distributed File Systems and Object Storage and again, it continues to be a surprise and a bizarre report as we indicated last two years. We had some hope last year and we're again disappointed.

The team has changed at Gartner Last year report was written by Julia Palmer, Arun Chandrasekaran, Raj Bala and this year Arun is replaced by John McArthur. Does it explain some changes in the vendor position, in the criteria?

We made an exercise to comparing position between 2017 and 2018 and the result is the image below.

The first surprising remark is the position of Dell EMC exactly the same for the last three reports (2016, 2017 and 2018) and if you check the picture the position is exactly at the intersection of the two diagonals of the top right sub-quadrant. Funny right? it seems that this is a given and works as a reference for others that finally are positioned relative to Dell EMC.

In red, we have added the position from the previous 2017 Quadrant (not for all players sorry), as the dynamic is probably more important than a year snapshot on position. We see a few super moves with Western Digital, Cloudian, NetApp and Qumulo plus the direct arrival of Pure Storage FlashBlade. We notice also three back movements that illustrate some market difficulties.

We're also surprised that some companies are only considered with one product and some others with two. This is the case for IBM with Spectrum Scale and COS or Dell EMC with Isilon and ECS, but DDN, even if they refused to participate, are listed and the study only covered WOS, their object storage storage. Thus DDN position is not the right one as some products are not included like GRIDscaler (based on IBM Spectrum Scale) or EXAscaler (base don Lustre). And DDN, in addition to the Intel Lustre business, has also acquired Tintri recently that enrich their file systems IP and portfolio.

Gartner includes a revenue criteria but doesn't consider an other key metric which is the adoption rate based on community effect. It was one of the reason Gluster got acquired by Red Hat in 2011.

Here they continue to omit Minio, the probably most deployed, integrated and adopted object storage. Veritas is not listed either and the company has its own object storage solution named Cognitive Object Storage for one year and of course Infoscale, these two fit perfectly.

We understand that Gartner considers only shared nothing architecture so HPE CXFS coming from the SGI acquisition can't be considered. But where are Oracle, NEC, Cohesity, Hedvig, Fujitsu, Microsoft or even Cray?

In the 'vendor to watch' paragraph, Quobyte is missing. How Gartner can miss that player? They mention MapR probably for its file sharing capability, in that case Cloudera and Hortonworks should be added, especially as they merge and it's even bigger now, and Hadoop HDFS. Nutanix is also listed in that paragraph. Why? Again if Nutanix is added, what about Datrium, Pivot3, Scale Computing, HPE SimpliVity, Maxta... In fact, Hadoop stuff and things around HCI should be out of this report.

And finally, why does Gartner continue to mix distributed file systems and object storage?

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter