External Storage Market in India Grew 21% Y/Y at $85 Million in 2Q18 – IDC

Dell surpasses HPE, and then NetApp, IBM and Hitachi.

This is a Press Release edited by StorageNewsletter.com on September 28, 2018 at 2:32 pmAs per IDC‘s latest AsiaPac Quarterly Enterprise Storage Systems Tracker 2Q18 release, India’s external storage market witnessed a growth of 21.1% Y/Y (by vendor revenue) and stood at $84.7 million in 2Q18.

The growth in 2Q18 was mainly driven by increased demand from professional services organizations. Professional services, banking, manufacturing, telecommunications and government industries contributed to close to 80% of overall external storage market in 2Q18.

“Increased acceptance of emerging technologies and DX acceleration across organizations led to investments on new age external storage hardware technologies and evaluation of storage optimizing solutions such as software defined storage,” says Dileep Nadimpalli, research manager, enterprise infrastructure, IDC India.

All flash array and hybrid flash array segments saw a significant Y/Y growth in 2Q18 while all HDD drive segment continued to decline. Across industries, there was an increased consumption of SSDs over HDDs for better performance of different workloads.

Mid-range external storage segment continued to lead the market constituting more than 60% of the total 2Q18 market while high-end storage segment declined Y/Y in 2Q18. Availability of enterprise features in mid-range storage systems is propelling the growth for mid-range storage arrays.

“IT departments are facing challenges in accommodating the LOB demands on scalability and agility for faster time to market and better customer experience. Organizations are creating more ‘data value’ and ‘monetization’ means by leveraging new architectures/storage solutions,” says Ranganath Sadasiva, director, enterprise, IDC India.

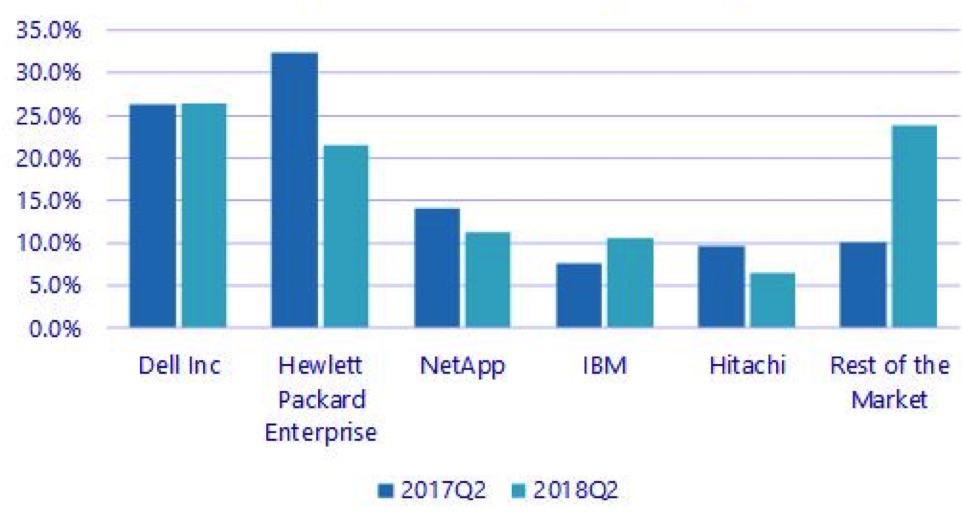

India External Storage Systems by Market Share in 2Q18

(vendor revenue)

Dell continued to be the market leader with a 26.5% market share by vendor revenue, followed by Hewlett Packard Enterprise with 21.5% market share in 2Q18. Overall market grew backed by a large multi-million-dollar deal for capacity storage in professional services industry.

Forecast

The external enterprise storage systems market is expected to grow at a single digit CAGR for the 2017-2022 time-period. Expecting incremental business from banking vertical for AI and government initiatives around digitalization, smart cities, make in India, e-governance projects in the near future.

Read also:

External Storage Market in India Up 13% Y/Y – IDC

And stood at $84 million in 1Q18 due to banking industry.

2018.07.05 | Press Release

Comments

India is growing slowly in external storage market, from $84 million in 1Q18 to $85 million in 2Q18, but 21% Y/Y. For TechSci Research, storage market will grow there at CAGR of 7% until 2021.

Nevertheless this country is active in storage.

Storage giants (Dell, Fujitsu, HDS, HPE, IBM, Lenovo, NetApp, Oracle) have subsidiaries there as overall in the world but also there are in India a community of excellent software experts being subcontractors of foreign IT firms, and furthermore some local vendors.

To give another example of the weight of India in storage, it's the third country in number of visitors of StorageNewsletter.com with 4.91% behind USA (59.97%) of course, just behind UK (5.10%), and in front of Germany (3.55%), Japan (3.15%) and France (3,03%).

The is no big storage actors in India.Two exceptions: Druva Software, born in 2007 and launched by Jaspreet Singh is the most well-known Indian storage company originally in Pune, and now based in Sunnyvale, CA, having raised as much as $198 million. Moser Baer historically the king of disappearing floppy discs and then optical disc media now becoming a fast decreasing market.

India also is the location of a lot of online backup companies and storage distributors.

Storage start-ups based in India:

Druva Software (Sunnyvale, CA, and Pune)

Fractalio Data (Bangalore)

NanoArk Technologies India (Hyderabad)

QUADStor Systems (Bangalore)

StorNetware Systems (Bangalore)

Vaultize (Pune Maharashtra)

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter