Cloudera: Fiscal 2Q19 Financial Results

69 customers exceeding $1 million of annual recurring revenue, representing half of software revenue

This is a Press Release edited by StorageNewsletter.com on September 7, 2018 at 2:46 pm| (in $ million) | 2Q18 | 2Q19 | 6 mo. 18 | 6 mo. 19 |

| Revenue | 89.8 | 110.3 | 169.4 | 213.0 |

| Growth | 23% | 26% | ||

| Net income (loss) | (64.2) | (33.4) | (286.5) | (84.4) |

Cloudera, Inc. reported results for its second quarter fiscal 2019, ended July 31, 2018.

Total revenue was $110.3 million, an increase of 23% as compared to the second quarter of fiscal 2018.

Subscription revenue was $93.1 million, an increase of 26% as compared to the second quarter of fiscal 2018. Subscription revenue represented 84% of total revenue, up from 82% in the second quarter of fiscal 2018.

“In Q2 we made substantial progress in our product and go-to-market transitions, delivering strong financial results in the quarter and accomplishing many of our goals for sustained success in our market,” said Tom Reilly, CEO. “We continue to innovate in highly differentiating ways. With three new modern data warehouse offerings, we are well-positioned to disrupt the legacy data warehouse industry.”

- GAAP loss from operations for 2Q19 was $33.9 million, compared to a

- GAAP loss from operations of $65.7 million for 2Q18. Non-GAAP loss from operations for 2Q19 was $12.7 million, compared to a non-GAAP loss from operations of $25.3 million in 2Q18.

- Operating cash flow for 2Q19 was negative $23.6 million compared to operating cash flow of negative $22.8 million in 2Q18.

- GAAP net loss per share for 2Q19 was $0.22 per share, based on weighted-average shares outstanding of 149.5 million shares, compared to a GAAP net loss per share in 2Q18 of $0.48 per share, based on weighted-average shares outstanding of 134.5 million shares.

- Non-GAAP net loss per share for 2Q19 was $0.08 per share, based on non-GAAP weighted-average shares outstanding of 149.5 million shares, compared to non-GAAP net loss per share in 2Q18 of $0.17 per share, based on non-GAAP weighted-average shares outstanding of 136.5 million shares.

- As of July 31, 2018, the company had total cash, cash equivalents, marketable securities and restricted cash of $458.2 million.

Recent Business and Financial Highlights

- Subscription revenue was up 26% year-over-year to $93.1 million

- Subscription revenue represented 84% of total revenue, up from 82% in the second quarter of fiscal 2018

- Non-GAAP subscription gross margin for the quarter was 87%, up from 85% in the second quarter of fiscal 2018

- Customers with annual recurring revenue greater than $100,000 were 568, up 30 for the quarter

- Dollar-based net expansion rate was 128% for the quarter

- Non-GAAP operating loss improved more than 16 percentage points in the second quarter compared to the year-ago period

- Introduced Altus Data Warehouse, a data warehouse as-a-service, available on Microsoft Azure and AWS

- Introduced Data Warehouse, a data warehouse for self-service analytics, built with a hybrid cloud-native architecture that handles 50PB data workloads and enables hybrid compute, storage, and control for workload portability across public clouds and enterprise data centers

- Introduced Workload XM, an intelligent workload experience management cloud service that provides end-to-end visibility across the entire data warehouse, helping improve performance, reduce downtime and optimize utilization across the complete lifecycle of analytics workloads

The outlook for 3FQ19, ending October 31, 2018, is:

- Total revenue in the range of $113 million to $114 million, representing approximately 20% Y/Y growth

- Subscription revenue in the range of $96 million to $97 million, representing approximately 24% Y/Y growth

- Non-GAAP net loss per share in the range of $0.12 to $0.10 per share

- Weighted-average shares outstanding of approximately 152 million shares

The outlook for fiscal 2019, ending January 31, 2019, is:

- Total revenue in the range of $440 million to $450 million, representing approximately 21% Y/Y growth

- Subscription revenue in the range of $372 million to $377 million, representing approximately 24% Y/Y

- Operating cash flow of approximately negative $35 million

- Non-GAAP net loss per share in the range of $0.53 to $0.50 per share

- Weighted-average shares outstanding of approximately 151 million shares

Comments

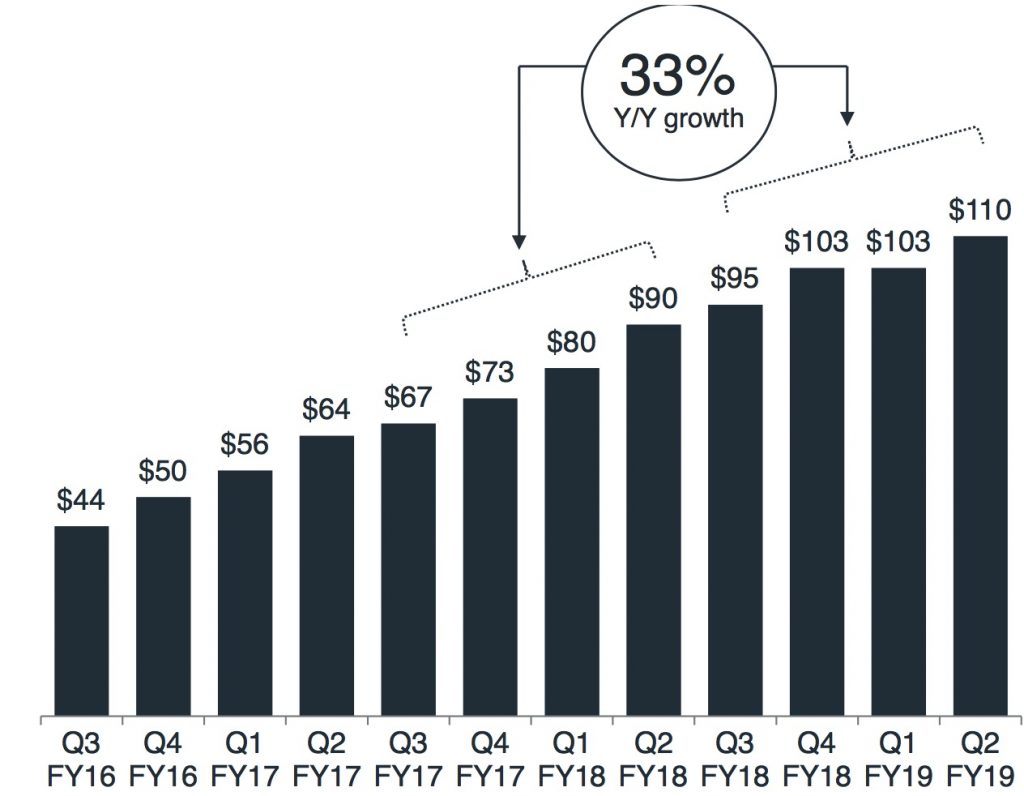

Historical quarterly revenue

(in $million)

Abstract of the earnings call transcript:

Tom Reilly, CEO:

"We now have 69 customers exceeding $1 million of annual recurring revenue, representing half of all our software revenue. Also, our in-quarter net expansion was higher than expected for a reported net expansion rate of 128%."

Mike Olson, co-founder, chairman and chief strategy officer:

"In Q2, new customers started at approximately $87,000 versus a historical average of $65,500, an increase of 33%."

Read also:

Cloudera Raises $225 Million in IPO

Stock surges 20%.

2017.05.01 | Press Release

All Facts and Figures on Cloudera, in Data Management Solutions for Analytics

Ready for IPO

by Jean Jacques Maleval | 2017.04.20 | News

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter