Pure Storage: Fiscal 2Q19 Financial Results

Pure AFA player growing 37% Q/Q but huge net loss continuing

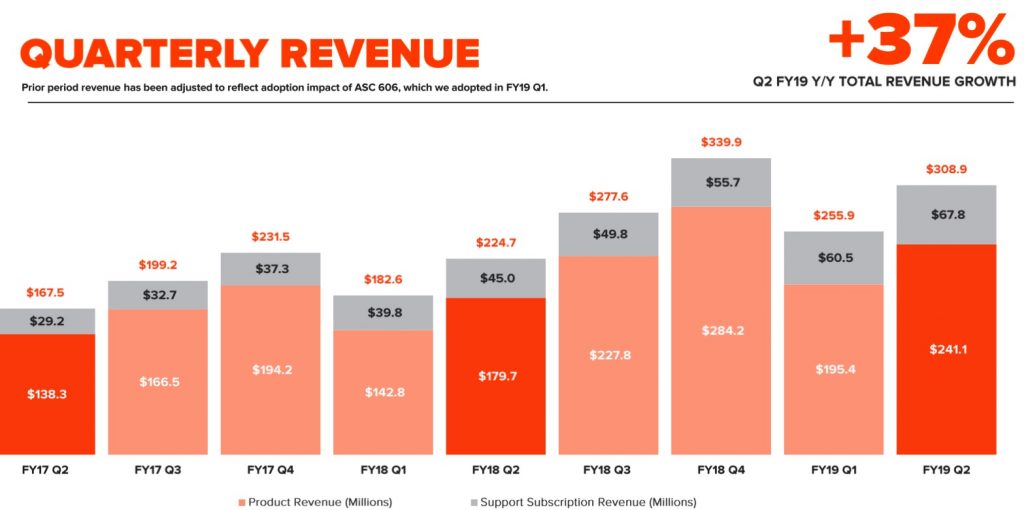

This is a Press Release edited by StorageNewsletter.com on August 22, 2018 at 2:16 pm| (in $ million) | 2Q18 | 2Q19 | 6 mo. 18 | 6 mo. 19 |

| Revenue | 224.7 | 308.9 | 407.3 | 564.8 |

| Growth | 37% | 39% | ||

| Net income (loss) | (58.4) | (60.1) | (115.6) | (124.4) |

Pure Storage, Inc. announced financial results for its second quarter ended July 31, 2018.

Key quarterly business and financial highlights include:

• Revenue: $308.9 million, up 37% Y/Y, exceeding the high end of guidance;

• Gross margin: 66.7% GAAP; 68.0% non-GAAP, all-time high in history;

• Operating margin: -17.9% GAAP; 0.3% non-GAAP, up 9.2 ppts and 10.6 ppts Y/Y, respectively;

• Acquired StorReduce, Inc., a cloud-first software-defined storage solution (see another today’s news).

“Pure has delivered another exceptional quarter, with all measures exceeding our Q2 guidance ranges,” said Charles Giancarlo, CEO. “Our continued focus on enabling customers to succeed in a data-centric world is working and validated, maintaining Pure’s lead in the storage market.”

Nearly 400 new customers joined Pure Storage in the quarter, increasing the total to more than 5,150 organizations. New customer wins in the quarter include: Dustin Sverige, Honda Federal Credit Union, Fresenius Medical Care, Lufthansa Aero Alzey Gmbh, New York Genome Center, Syntax, TaxSlayer, The University of Texas MD Anderson Cancer Center, and Zeiss Vision Care France.

“Q2 was another strong quarter for Pure,” said Tim Riitters, CFO. “Growth was strong, gross margins were the highest in history, and we achieved another profitable quarter.“

Outlook for 3FQ19

- Revenue in the range of $361 million to $369 million

- Non-GAAP gross margin in the range of 64.5% to 67.5%

- Non-GAAP operating margin in the range of 4.0% to 8.0%

Outlook for FY19

- Revenue in the range of $1.350 billion to $1.380 billion

- Non-GAAP gross margin in the range of 65.5% to 67.5%

- Non-GAAP operating margin in the range of 2.5% to 4.5%

Comments

Pure all-flash array player, Pure Storage is the only one able to seriously compete with storage giants in AFA but behind them.

Company records a good quarter with revenue exceeding guidance at $309 million - up 37% Y/Y and 21% Q/Q, but not a record as it was $340 million in 4FQ18 - as well as gross margin and operating margin.

Click to enlarge

Product revenue was $241.1 million up 34% Y/Y. Support subscription sales were $67.8 million increasing yearly 51%.

For the quarter, more than 50% of shipments were all-NVMe where the firm in pioneer for AFAs.

Geographically, 74% of revenue came from USA and 26% from international markets.

Cloud segment continues to represent approximately 30% of the overall business and enjoys the highest win and repeat purchase rates across customers.

The manufacturer ended the quarter with cash and investments of $1.1 billion, up slightly from the former three-month period.

Headcount is up 550 Y/Y to 2,450.

Firm expects sales up between 17% and 19% for next quarter, and between 32% and 35% for fiscal year.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter