Intevac: Fiscal 2Q18 Financial Results

One thin-film HDD equipment expected to ship later this year, two in backlog for 2019

This is a Press Release edited by StorageNewsletter.com on August 2, 2018 at 2:31 pm| (in $ million) | 2Q17 | 2Q18 | 6 mo. 17 | 6 mo. 18 |

| Revenue | 31.0 | 26.1 | 61.4 | 44.1 |

| Growth | -16% | -28% | ||

| Net income (loss) | 1.1 | (0.2) | 3.0 | (5.3) |

Intevac, Inc. reported financial results for the quarter and six months ended June 30, 2018.

“Our second-quarter results were stronger than forecast, with higher upgrade revenues in HDD equipment, favorable gross margin performance in both Thin-film Equipment (TFE) and Photonics, and close control of expenses, leading to a net loss of one cent per share,” commented Wendell Blonigan, president and CEO. “We announced the receipt of multiple orders for our industry-leading 200 Lean system for the HDD industry, with one system expected to ship later this year, and two in backlog for 2019. These orders demonstrate the close partnerships we have with our HDD customers to support their technology roadmaps, and the new orders also provide confidence for continued strong results in our HDD equipment business.“

“We continued to make progress in our Thin-film Equipment growth initiatives during the second quarter. A global top-3 cellphone maker is now shipping handsets that incorporate our oDLC protective coating, which protects the vibrant decorative color deposited on the back cover glass of a portion of their flagship models. In Photonics, we have secured additional government funding for the development of our next-generation night-vision sensor, which is important validation of our industry-leading position to provide digital night-vision technology to the U.S. Military. In all, our outlook for 2018 is consistent with our last quarterly update, reflecting a pause in our growth after three straight years of increasing revenues, orders and earnings,” he concluded. “Our technology leadership positions and future growth story remain very much intact, and we believe the execution of our growth initiatives in 2018 will drive the resumption of growth in 2019.”

Second Quarter 2018 Summary

The net loss for the quarter was $167,000, or $0.01 per diluted share, compared to net income of $1.1 million, or $0.05 per diluted share, in 2FQ17. The non-GAAP net loss was $158,000 or $0.01 per diluted share, compared to 2FQ17 non-GAAP net income of $1.1 million or $0.05 per diluted share.

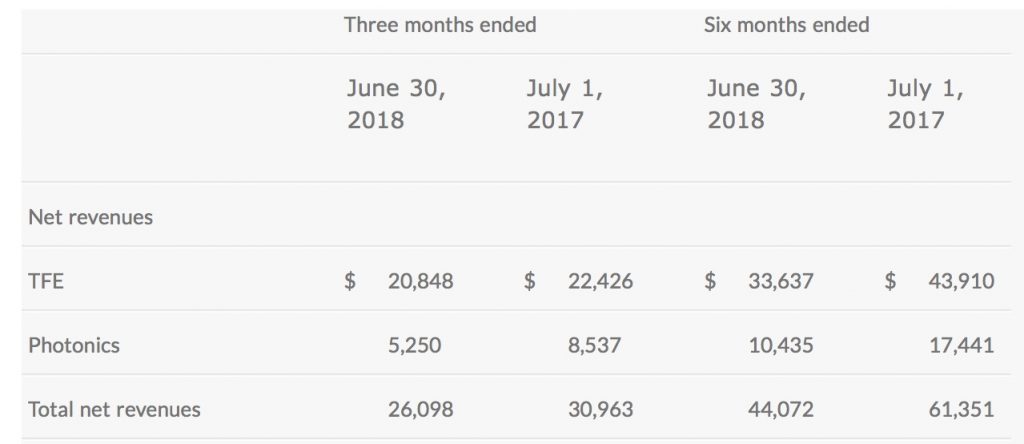

Revenues were $26.1 million, including $20.8 million of TFE revenues and Photonics revenues of $5.3 million. TFE revenues consisted of two 200 LeanHDD systems, upgrades, spares and service. Photonics revenues consisted of $2.8 million of R&D contracts and $2.5 million of product sales. In 2FQ17, revenues were $31.0 million, including $22.4 million of TFE revenues, which consisted of one 200 LeanHDD system, one pilot INTEVAC MATRIX solar ion implant system, two ENERGi solar ion implant systems, upgrades, spares and service, and Photonics revenues of $8.5 million, which included $7.4 million of product sales and $1.1 million of R&D contracts.

TFE gross margin was 41.7% compared to 38.4% in 2FQ17 and 35.6% in 1FQ18. The improvement from 2FQ17 was primarily due to product mix, with an increase in HDD upgrades in the second quarter of 2018 compared to the second quarter of 2017, which also had included a lower-margin pilot INTEVAC MATRIX solar ion implant system. The improvement from the first quarter of 2018 was primarily due to a higher mix of higher-margin upgrades, higher revenues and improved factory absorption.

Photonics gross margin was 20.4% compared to 33.4% in 2FQ17 and 6.2% in 2FQ18. The decline from the 2FQ17 was primarily due to lower revenue levels, a higher mix of lower-margin R&D contracts and incremental loss provisions recorded on several contracts. The improvement from 1FQ18 was primarily due to improved margins on R&D contracts and smaller loss provisions recorded on contracts. Consolidated gross margin was 37.4%, compared to 37.0% in 2FQ17 and 27.1% in 1FQ18.

R&D and SG&A expenses were $9.7 million, compared to $10.1 million in 2FQ17 and $10.0 million in 1FQ18. The lower level of expenses primarily reflects cost control initiatives implemented in the first quarter.

Order backlog totaled $64.6 million on June 30, 2018, compared to $66.9 million on March 31, 2018 and $68.9 million on July 1, 2017. Backlog at June 30, 2018 included three 200 Lean HDD systems and twelve ENERGi solar ion implant systems. Backlog at March 31, 2018 included two 200 Lean HDD systems and twelve ENERGi solar ion implant systems. Backlog at July 1, 2017 included five 200 Lean HDD systems and twelve ENERGi solar ion implant systems.

The company ended the quarter with $39.1 million of total cash, restricted cash and investments and $77.4 million in tangible book value.

First Six Months 2018 Summary

The net loss was $5.3 million, or $0.24 per diluted share, compared to net income of $2.9 million, or $0.13 per diluted share, for the first six months of 2017. The non-GAAP net loss was $5.2 million or $0.23 per diluted share. This compares to first-half 2017 non-GAAP net income of $3.0 million or $0.13 per diluted share.

Revenues were $44.1 million, including $33.6 million of TFE revenues and Photonics revenues of $10.4 million, compared to revenues of $61.4 million, including $43.9 million of TFE revenues and Photonics revenues of $17.4 million, for the first six months of 2017.

TFE gross margin was 39.4%, compared to 40.7% in the first six months of 2017. We recognized revenue on three 200 LeanHDD systems in the first half of 2018.

The company recognized revenue on two 200 Lean HDD systems, one pilot INTEVAC MATRIX solar ion implant system, two ENERGi solar ion implant systems and four VERTEX coating systems for display cover panels in the first half of 2017. Photonics gross margin was 13.4% compared to 38.1% in the first six months of 2017. The decline from the first half of 2017 was primarily due lower revenue levels, a higher mix of lower-margin R&D contracts and incremental loss provisions recorded on several contracts. Consolidated gross margin was 33.2%, compared to 40.0% in the first six months of 2017.

R&D and SG&A expenses were $19.7 million compared to $21.0 million in the first six months of 2017. The lower level of expenses reflects cost control initiatives implemented in the first quarter, lower legal expenses for patent activity and contracts and decreased accruals for variable compensation programs.

To read the earnings call transcript

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter