Commvault: Fiscal 1Q19 Financial Results

Sales up 6% and down 5% Q/Q, but not profitable since 5 quarters

This is a Press Release edited by StorageNewsletter.com on July 25, 2018 at 2:23 pm| (in $ million) | 1Q18 | 1Q19 | Growth |

| Revenue |

166.0 | 176.2 | 6% |

| Net income (loss) | (0.3) | (8.6) |

Commvault Systems, Inc. announced its financial results for the first quarter ended June 30, 2018.

N. Robert Hammer, chairman, president and CEO, stated: “Our first quarter highlights included total revenues of $176.2 million, which is an increase of 6% year-over-year, a 44% increase in year-over-year non-GAAP operating income, non-GAAP EPS of $0.36, 10% annual deferred revenue growth, and 24% year-over-year growth in operating cash flow. We continue to make excellent progress with our subscription-based pricing models, which increased 44% over the prior year. Our improved earnings were driven by cost efficiencies implemented as part of our Commvault Advance initiatives which include simplification of our business processes with an emphasis on products and packaging, pricing, go to market messaging, partnerships and alliances, and organizational changes within sales and distribution. We believe these strategic transformation initiatives will position us for long-term, sustainable growth, while improving operating performance in the near term.”

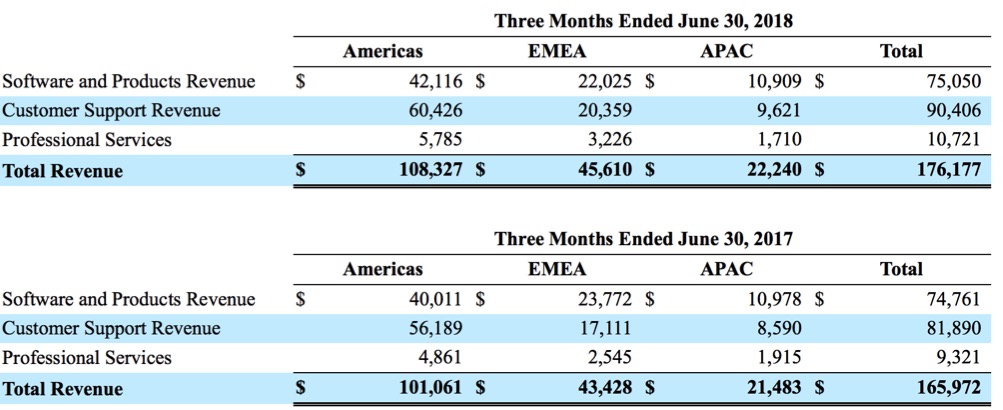

Total revenues for the first quarter of fiscal 2019 were $176.2 million, an increase of 6% year-over-year, and a decrease of 5% sequentially. Software and products revenue was $75.1 million, flat year-over-year, and down 10% sequentially. Services revenue in the quarter was $101.1 million, an increase of 11% year-over-year and flat sequentially.

On a GAAP basis, loss from operations (EBIT) was $6.8 million for the first quarter compared to a loss of $4.4 million in the prior year. Non-GAAP EBIT was $22.8 million in the quarter compared to $15.9 million in the prior year, an increase of 44%.

For the first quarter of fiscal 2019, Commvault reported a GAAP net loss of $8.6 million, or a $0.19 loss per diluted share. The first quarter GAAP results in fiscal 2019 included $11.4 million of expenses related to restructuring and a non-routine shareholder matter. These expenses have been excluded from our non-GAAP results and are further discussed in Table IV. Non-GAAP net income for the quarter was $17.3 million, or $0.36 per diluted share.

Operating cash flow totaled $24.8 million for the first quarter of fiscal 2019 compared to $19.9 million in the prior year quarter. Total cash and short-term investments were $461.7 million as of June 30, 2018 compared to $462.4 million as of March 31, 2018.

During the first quarter of fiscal 2019, Commvault repurchased approximately 366,000 shares of its common stock totaling $25.0 million.

Recent Business Highlights:

• On July 17, 2018, announced new, simplified product, pricing, and packaging that makes it easier than ever before to buy, implement and sell Commvault solutions. With these changes, the company converged data management solutions redefining how progressive enterprises of all sizes protect, manage and use their data – now even more simple, scalable, and complete. In addition, it also announced that it expanded its dedication to partners. Through significant commitments to personnel, programs and resources, all of which put partners firmly at the center of go-to-market strategy, it creates a foundation for the success of Commvault and its worldwide partner network.

• On July 2, 2018, announced Two Degrees Mobile Limited (2degrees), New Zealand’s newest full-service telecommunications provider, extended its engagement with the vendor to include the deployment of Commvault HyperScale Software to support the modernization of its data protection and management infrastructure.

• On June 27, 2018, announced a new technology partnership with Lucidworks, in AI-powered search and discovery. Through this agreement, the two companies will begin working together to bring new innovations in AI to the evolving data backup and protection market.

• On June 26, 2018, announced a new partnership with IBM, in which IBM Business Resiliency Services will be able to provide a managed service based on company’s portfolio of data management and protection software, including the Commvault Data Platform.

• On June 6, 2018, Commvault and Alibaba Cloud, the cloud computing arm of Alibaba Group, jointly announced a partnership to leverage each other’s technology and market advantages to deliver scalable hybrid cloud data management solutions to help customers and partners across the globe accelerate digital transformations.

• On May 23, 2018, announced continued business expansion by its ecosystem of channel partners worldwide as a result of the implementation of the Commvault Data Platform as the foundation of wider GDPR solutions.

• On May 22, 2018, announced expansion of its portfolio with further integrations into Microsoft Office 365 to improve data protection, migration, security, eDiscovery and compliance for its customers. Enterprise IT organizations can now extend their Commvault investments to protect their Office 365 assets.

Comments

Revenue mix for the quarter was split 43% software and products and 57% services.

Commvault make progress with its subscription based pricing models, which represented approximately 34% of 1FQ19 software and products revenues, up 44% of 1FQ18. For the quarter it had an all time number of subscription deals.

Maintenance revenue, the vast majority of services revenue, was impacted by some existing customers transitioning to subscription licensing models.

Good services revenues grew 11% Y/Y. The company had continuing good momentum and managing data in the cloud with customers putting over 280TB into the cloud which is approximately 2.5x over the prior year.

The firm overachieved its 1Q19 operating margin objectives due to a reduction in costs across all functional areas including a major restructuring of sales and distribution functions.

Repeatable revenue was up 17% Y/Y and Commvault is on track to achieve its goal of 70%+ repeatable revenue within the next one to two years.

Revenue from enterprise deals, defined as deals over $100,000 in software and product revenue in a given quarter, represented 59% of revenue. Sales from these transactions was down 6% Y/Y.

The number of enterprise revenue transactions increased 46% Y/Y. Average enterprise deal size was $243,000 during the quarter. Deals with less than $100,000 in software and product revenue were up 11% over the prior year.

Americas, EMEA and APAC represented 56%, 29% and 15% of software revenue respectively for the quarter. On a Y/Y growth basis, the Americas was up 5% and EMEA and APAC were down 7% and 1% respectively.

Click to enlarge

For the quarter, our day sales outstanding or DSO was 83 days, which is up from 75 days from the prior year and 77 days sequentially. 1Q19 DSO of 83 days includes a 10-day unfavorable impact related to unbilled accounts receivable.

The storage software company expects 2Q19 revenue to be $179 million or up 6% Y/Y and 2% Q/Q. Total FY19 sales are expected to between $745 million to $750 million or up 7% Y/Y. Services revenue will be flat sequentially next quarter. 2Q19 software and products revenue will be $78 million, up 8% over the prior year.

Commvault also expects its subscription pricing models as a percentage of total full year software and products revenue to increase from 25% in FY18 to approximately 35% in FY19.

The CEO search committee of the board has retained a search firm in May who have been identifying and interviewing candidates.

To read the earnings call transcript

Revenue and net income (loss) for Commvault

| Fiscal period | Revenue | Y/Y growth | Net income (loss) |

| 1Q15 | 152.6 | 14% | 12.7 |

| 2Q15 | 151.1 | 7% | 6.5 |

| 3Q15 | 153.0 | -0% | 3.1 |

| 4Q15 | 150.7 | -4% | 3.4 |

| FY15 | 607.5 | 4% | 25.7 |

| 1Q16 | 139.1 | -9% | (1.3) |

| 2Q16 | 140.7 | -7% | (9.2) |

| 3Q16 | 155.7 | 2% | 4.9 |

| 4Q16 | 159.6 | 6% | 5.8 |

| FY16 | 595.1 | -2% | 0.1 |

| 1Q17 | 152.4 | 10% | (2.0) |

| 2Q17 | 159.3 | 13% | (0.6) |

| 3Q17 | 165.8 | 7% | (0.0) |

| 4Q17 | 172.9 | 8% | 3.2 |

| FY17 | 650.5 | 9% | 0.5 |

| 1Q18 | 166.0 | 9% | (0.3) |

| 2Q18 | 168.1 | 5% | (1.0) |

| 3Q18 | 180.4 | 8% | (59.0) |

| 4Q18 | 184.9 | 11% | (1.7) |

| FY18 | 699.4 | 8% | (61.9) |

| 1Q19 |

176.2 |

6% |

(8.6) |

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter