EQT VIII Fund to Acquire Suse, in Open Source Linux OS, for $2.5 Billion

From global infrastructure software business Micro Focus International

This is a Press Release edited by StorageNewsletter.com on July 4, 2018 at 2:26 pmThe EQT VIII fund has agreed to acquire SUSE LLC, provider of open source infrastructure software for large enterprises, from the global infrastructure software business Micro Focus International plc for an enterprise value of $2.535 billion.

The transaction is subject to Micro Focus shareholder and customary regulatory approvals.

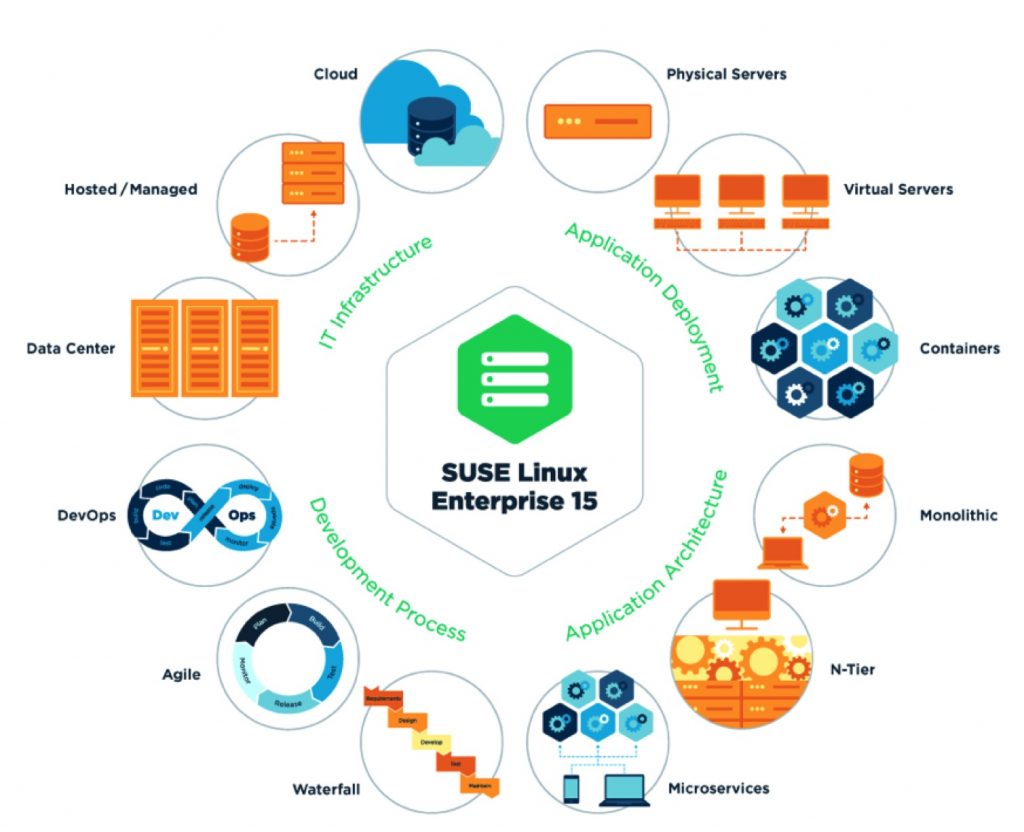

Founded in 1992, SUSE is the world’s first provider of an enterprise-grade open source Linux operating system. With sales of $320 million in the 12 months ended October 31, 2017 and approximately 1,400 employees worldwide, it is a leader in enterprise-grade, open source software-defined infrastructure and application delivery solutions for on premise and cloud-based workloads.

During the ownership of Micro Focus, SUSE has operated as a semi-independent business under the leadership of Nils Brauckmann, executing on a defined growth charter. The company has also expanded its product portfolio, including solutions for cloud and storage as well as container and application delivery technology.

Click to enlarge

EQT VIII will support SUSE’s next period of growth and innovation as an independent company.

The strategy includes strengthening its position as a leading open source player, both organically and through add-on acquisitions, leveraging EQT’s long-term experience in the software space. Priorities will be to further build SUSE’s public cloud business and to expand its next-generation product offerings in order to strengthen SUSE as a provider commercializing open source for enterprise customers.

“Today is an exciting day in SUSE’s history. By partnering with EQT, we will become a fully independent business,” said Nils Brauckmann, CEO, SUSE. “The next chapter in SUSE’s development will continue, and even accelerate, the momentum generated over the last years. Together with EQT, we will benefit both from further investment opportunities and having the continuity of a leadership team focused on securing long-term profitable growth combined with a sharp focus on customer and partner success. The current leadership team has managed SUSE through a period of significant growth and now, with continued investment in technology innovation and go to market capability, will further develop SUSE’s momentum going forward.”

Johannes Reichel, partner, EQT Partners, and investment advisor to EQT VIII, adds: “We are excited to partner with SUSE’s management in this attractive growth investment opportunity. We were impressed by the business’ strong performance over the last years as well as by its strong culture and heritage as a pioneer in the open source space. These characteristics correspond well to EQT’s DNA of supporting and building strong and resilient companies, and driving growth. We look forward to entering the next period of growth and innovation together with SUSE.”

The transaction is subject to approval from Micro Focus shareholders and other relevant authorities.

Jefferies Group LLC acted as lead financial advisor and Arma Partners acted as financial advisor to EQT VIII. Milbank, Tweed, Hadley & McCloy LLP and Latham & Watkins LLP acted as legal advisors to EQT VIII.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter