WW Cloud IT Infrastructure Revenue Continues to Grow by Double Digits in 1Q18 – IDC

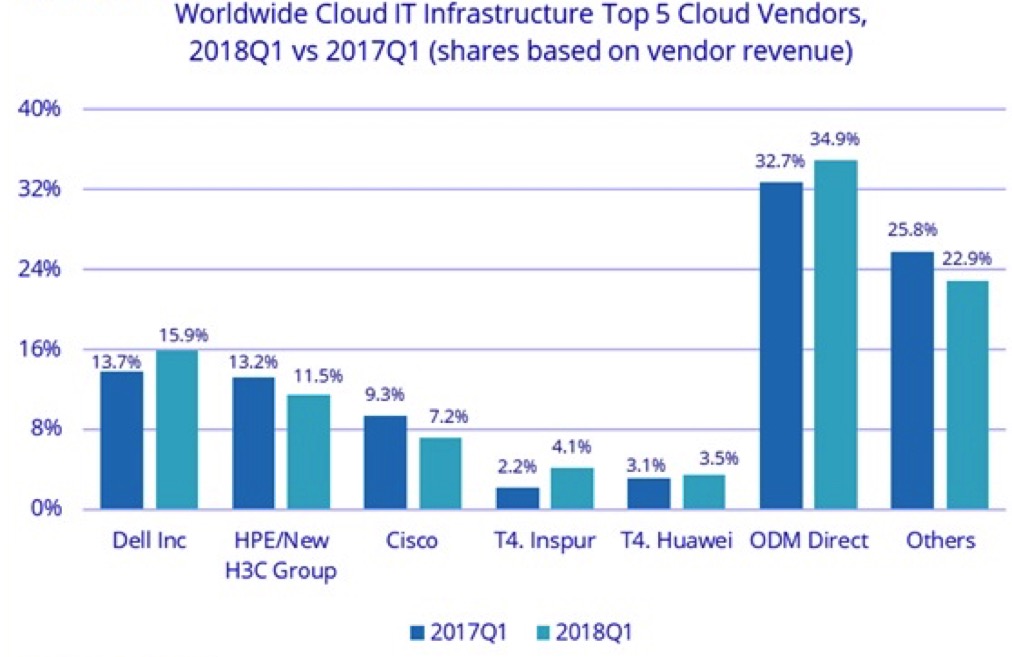

Market dominated by Dell, HPE, Cisco, Inspur, Huawei

This is a Press Release edited by StorageNewsletter.com on June 22, 2018 at 2:28 pmAccording to the International Data Corporation‘s Worldwide Quarterly Cloud IT Infrastructure Tracker, vendor revenue from sales of infrastructure products (server, storage, and Ethernet switch) for cloud IT, including public and private cloud, grew 45.5% Y/Y in 1Q18, reaching $12.9 billion.

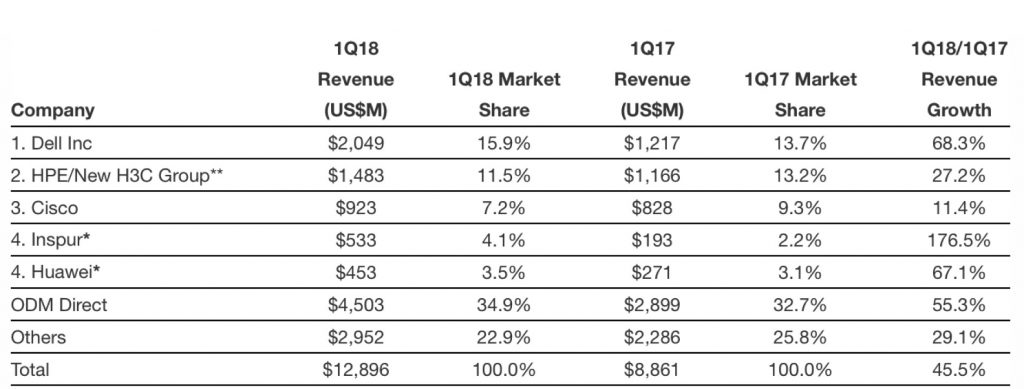

Top Companies, WW Cloud IT Infrastructure Vendor Revenue,

Market Share, and Y/Y Growth, 1Q18

(revenue in $ million)

Click to enlarge

(Source: IDC’s Quarterly Cloud IT Infrastructure Tracker, 1Q18)

Notes:

* IDC declares a statistical tie in the worldwide cloud IT infrastructure market when there is a difference of one percent or less in the vendor revenue shares among two or more vendors.

** Due to the existing joint venture between HPE and the New H3C Group, IDC will be reporting external market share on a global level for HPE as HPE/New H3C Group starting from 2Q16 and going forward.

Of the $57.2 billion in cloud IT infrastructure spend forecast for 2018, public cloud will account for 67.0% of the total, growing at an annual rate of 23.6%. Private cloud will grow at 16.7% year over year.

IDC also raised its forecast for total spending on cloud IT infrastructure in 2018 to $57.2 billion with year-over-year growth of 21.3%.

Public cloud infrastructure quarterly revenue has more than doubled in the past three years to $9.0 billion in 1Q18, growing 55.8% year over year. Private cloud revenue reached $3.9 billion for an annual increase of 26.5%. The combined public and private cloud revenues now represent 46.1% of the total worldwide IT infrastructure spending, up from 41.8% a year ago. Traditional (non-cloud) IT infrastructure revenue grew 22.0% from a year ago, although it has been generally declining over the past several years; at $15.1 billion in 1Q18 it still represents 53.9% of total worldwide IT infrastructure spending.

“Hyperscaler datacenter expansion and refresh continued to drive overall cloud IT infrastructure growth in the first quarter,” said Kuba Stolarski, research director for infrastructure platforms and technologies, IDC. “While all infrastructure segments continued their strong growth, public cloud has been growing the most. IDC expects this trend to continue through the end of 2018. Digital transformation initiatives such as edge computing and machine learning have been bringing new enterprise workloads into the cloud, driving up the demand for higher density configurations of cores, memory, and storage. As systems technology continues to evolve towards pooled resources and composable infrastructure, the emergence of these next-generation workloads will drive net new growth beyond traditional enterprise workloads.”

All regions grew their cloud IT Infrastructure revenue by double digits in 1Q18. AsiaPac (excluding Japan) grew revenue the fastest, by 74.7% Y/Y. Next were USA (43.6%), Middle East and Africa (42.3%), Central and Eastern Europe (39.2%), Latin America (37.7%), Canada (29.4%), Western Europe (26.1%), and Japan (15.0%).

Worldwide spending on traditional non-cloud IT infrastructure is expected to grow by 4.2% in 2018 as enterprises continue to refresh their infrastructure. Traditional IT infrastructure will account for 54.0% of total end user spending on IT infrastructure products, down from 57.8% in 2017. This represents a decelerating share loss as compared to the previous four years. The growing share of cloud environments in overall spending on IT infrastructure is common across all regions.

Long-term, IDC expects spending on cloud IT infrastructure to grow at a five-year CAGR of 10.5%, reaching $77.7 billion in 2022, and accounting for 55.4% of total IT infrastructure spend. Public cloud datacenters will account for 64.7% of this amount, growing at a 10.2% CAGR. Spending on private cloud infrastructure will grow at a CAGR of 11.1%.

Taxonomy Notes

IDC defines cloud services more formally through a checklist of key attributes that an offering must manifest to end users of the service. Public cloud services are shared among unrelated enterprises and consumers; open to a largely unrestricted universe of potential users; and designed for a market, not a single enterprise. The public cloud market includes variety of services designed to extend or, in some cases, replace IT infrastructure deployed in corporate datacenters. It also includes content services delivered by a group of suppliers IDC calls Value Added Content Providers (VACP). Private cloud services are shared within a single enterprise or an extended enterprise with restrictions on access and level of resource dedication and defined/controlled by the enterprise (and beyond the control available in public cloud offerings); can be onsite or offsite; and can be managed by a third-party or in-house staff. In private cloud that is managed by in-house staff, ‘vendors (cloud service providers)’ are equivalent to the IT departments/shared service departments within enterprises/groups. In this utilization model, where standardized services are jointly used within the enterprise/group, business departments, offices, and employees are the ‘service users.’

IDC defines compute platforms as compute intensive servers. Storage platforms includes storage intensive servers as well as external storage and storage expansion (JBOD) systems. Storage intensive servers are defined based on high storage media density. Servers with low storage density are defined as compute intensive systems. Storage platforms does not include internal storage media from compute intensive servers. There is no overlap in revenue between compute platforms and storage platforms, in contrast with IDC’s Server Tracker and Enterprise Storage Systems Tracker, which include overlaps in portions of revenue associated with server-based storage.

Read also:

WW Cloud IT Infrastructure Revenue Grows 26% in 2Q17, Reaching $12 Billion – IDC

Driven by expansion in public cloud

2017.10.09 | Press Release

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter