Micron: Fiscal 3Q18 Financial Results

Revenue to reach $30 billion for fiscal year, beating all storage companies

This is a Press Release edited by StorageNewsletter.com on June 21, 2018 at 2:17 pm| (in $ million) | 3Q17 | 3Q18 | 9 mo. 17 | 9 mo. 18 |

| Revenue | 5,566 | 7,797 | 14,184 | 21,951 |

| Growth | 40% | 55% | ||

| Net income (loss) |

1,467 | 3,823 |

2,721 | 9,810 |

Micron Technology, Inc. announced results of operations for its third quarter of fiscal 2018, which ended May 31, 2018.

“Micron delivered record results in financial performance for the third fiscal quarter, supported by strong execution and ongoing secular demand trends,” said president and CEO Sanjay Mehrotra. “We strengthened our competitive position and grew our revenue across virtually all of our high-value product segments. We set new records for revenue in SSDs, mobile managed NAND and automotive solutions along with cloud/enterprise and graphics DRAM memory. We see ongoing momentum and healthy industry fundamentals in the fourth quarter to close out an exceptionally strong fiscal 2018.”

Revenues for the third quarter of 2018 were 6% higher compared to the second quarter of 2018, reflecting increased demand broadly across our products and end markets. Our overall consolidated gross margin of 60.6% for the third quarter of 2018 was higher compared to 58.1% for the second quarter of 2018 primarily due to execution across our product portfolio.

Investments in capital expenditures, net of amounts funded by partners, were $2.10 billion, which resulted in adjusted free cash flows of $2.16 billion for the third quarter of 2018. During the quarter, we repurchased or converted $2.31 billion principal amount of our debt, lowering our total carrying value of debt to $7.34 billion exiting the quarter. We ended the third quarter in a net cash positive position with cash, marketable investments, and restricted cash of $7.68 billion.

Comments

Micron continues to be by far the leader in the worldwide storage industry.

Revenue for most recent published quarter in $ million

| Ranking | Company | Revenue |

| 1 | Micron | 7,797 |

| 2 | Western Digital | 5,013 |

| 3 | Dell EMC* | 4,082 |

| 4 | Seagate | 2,803 |

| 5 | NetApp | 1,641 |

| 6 | Broadcom* | 1,162 |

| 7 | HPE* | 912 |

| 8 | IBM* | 406 |

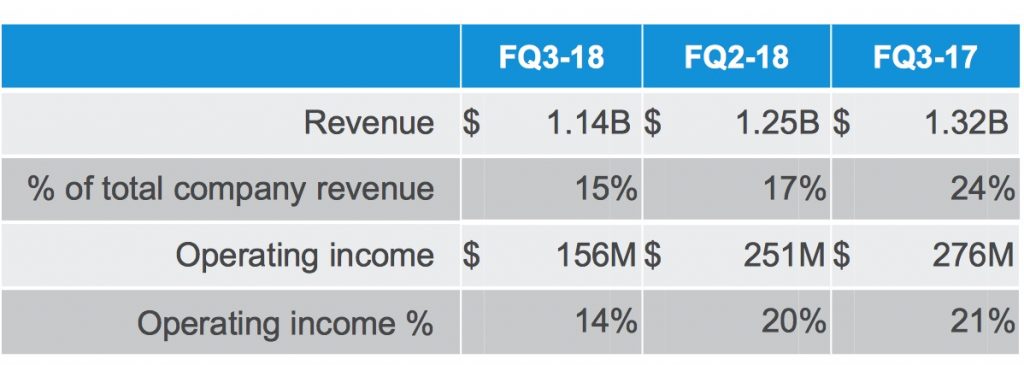

Some analysts do not consider DRAM and NOR flash as storage products because they are non volatile memory. Without these components, Micron's revenue reached $1.14 billion. Here are not included storage sales of Toshiba (NAND chips, SSDs and HDDs) and Samsung (NAND chips and SSDs) that could be included in the table above, as they don't reveal their figures in this segment.

Micron is announcing historical record revenue (up 6% Q/Q and 40% Y/Y) and profitability in this quarter, generating $4.3 billion in cash from operations, representing 55% of revenue.

But sales of the storage business unit (SBU) comprising SSD, NAND components, and 3D XPoint sales, decreased 9% Q/Q and 13% Y/Y:

In this sector, it reflects the shift of NAND supply to high-value mobile managed NAND. High-value mobile NAND revenue nearly doubled Q/Q, driven by eMMC/eMCP. 85% of managed NANDGB shipped were TLC vs. <1% in 3FQ17. Company is continuing to build momentum with SSD portfolio with new record for SSD revenue, now >50% of total SBU revenue. It is now ramping lower-cost 64L 3D NAND SATA SSDs, shipping QLC-based SSD, built on 1Tb die. It completed qualification of 64L 3D NAND surveillance-grade microSD card strong design-ins on LP automotive DRAM and qualification of 1Xnm and GDDR696L is expected to have production shipments in the second half of this year.

Trade NAND represents 25% of overall company revenue in 3FQ18 up 8% Q/Q and 14% Y/Y but shipment quantities were flat Q/Q.

For next quarter Micron expects revenue between $8 to $8.4 billion an increase of 3% to 8% Q/Q to reach record of more than $30 billion for fiscal year, a figure never reached by a storage firm, with an exceptional annual increase of around 48%.

Abstract of the earnings call transcript:

Sanjay Mehrotra, president and CEO:

"We were particularly pleased with our mobile business, where we increased revenue by 12% sequentially, setting a new company record. Revenue from high-value mobile NAND nearly doubled quarter-over-quarter, enabled by the ramp of eMMC and eMCP products to multiple smartphone OEMs. 85% of Managed NAND gigabytes that we shipped in FQ3 were lower-cost TLC NAND, as compared to virtually no TLC NAND just one year ago.

"Memory and storage content per phone continues to rise, creating ongoing demand for our mobile solutions. We are strategically shaping our mobile portfolio to put us in the best competitive position, including the production launch of our 1Y nm low-power DDR4 memory and several new 64-layer TLC UFS and eMCP Managed NAND solutions, all later this year.

"Data center trends are also driving momentum for Micron's DRAM and NAND solutions, with combined revenue up 87% year-over-year. In the third quarter, ongoing demand for our memory and storage solutions in cloud computing was a key highlight. Our DRAM and NAND revenue from cloud customers increased sequentially by 33% and 24%, respectively. This performance was enabled by our improving execution, ability to expand share, and strengthening relationships with key customers in this rapidly growing segment.

"We also set another company record in overall SSD sales, increasing our revenue by 37% versus a year ago. We began volume production shipments of our 64-layer 3D NAND enterprise SATA SSD and shipped the world's first QLC-based SSD, a high-capacity drive ideal for read-centric applications like streaming media servers. This QLC SSD is built on our industry-leading 64-layer 3D NAND, utilizing the first-ever terabit NAND die in the industry. As we continue to introduce new SSD solutions on lower-cost, next-generation technologies, we believe that we can unlock new pools of demand that are currently being served by HDDs.

"We still expect to have production shipments on our 96-layer 3D NAND in the second half of calendar year 2018. We are also making good progress on the development of our fourth-generation 3D NAND, which will utilize our novel replacement gate technology.

"We remain focused on our 3D XPoint product development and are on track to introduce our first products in late calendar 2019, with meaningful revenue in 2020."

Dave Zinsner, CFO:

"We continue to build momentum with our SSD portfolio and set a new record for SSD revenue, which now represents over 50% of total SBU revenue. Consistent with our strategy and as we shared at our investor event, we are shifting more of our NAND supply away from components to high-value products such as managed NAND, which are targeted for our mobile and embedded markets, as well as SSDs. This shift to NAND supply and lower 3D XPoint sales to our partner resulted in a 9% sequential decline in our SBU revenue.

"Today, a majority of our SSD sales are based on 32-layer 3D NAND."

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter