Tintri: Fiscal 1Q19 Financial Results

Out of cash and consequently unable to continue operations beyond June 30, 2018

This is a Press Release edited by StorageNewsletter.com on June 18, 2018 at 2:26 pmTintri, Inc. reported its preliminary results for its first quarter fiscal 2019 which ended on April 30, 2018, and provided a liquidity and business update.

Preliminary 1FQ19 Financial Results; Liquidity and Business Update

• The company is currently in breach of certain covenants under its credit facilities and likely does not have sufficient liquidity to continue its operations beyond June 30, 2018.

• The company continues to evaluate its strategic options, including a sale of the company.

• Q1 revenue is expected to be approximately $22 million and GAAP net loss per share is expected to be approximately ($1.14). These financial results are preliminary and the company’s independent registered public accounting firm has not completed its review of these preliminary financial results.

As of April 30, 2018, and May 31, 2018, Tintri held aggregate cash and cash equivalents of $30.9 million and $11.5 million, respectively. Based on the company’s current cash projections, and regardless of whether its lenders were to choose to accelerate the repayment of the company’s indebtedness under its credit facilities, the company likely does not have sufficient liquidity to continue its operations beyond June 30, 2018. The company continues to evaluate its strategic options, including a sale of the company. Even if the company is able to secure a strategic transaction, there is a significant possibility that the company may file for bankruptcy protection, which could result in a complete loss of shareholders’ investment.

As of April 30, 2018, the company had $15.4 million of principal indebtedness outstanding under its line of credit with Silicon Valley Bank, or SVB, and $50.0 million under its credit facility with TriplePoint Capital, or TriplePoint. The company does not currently have any borrowing capacity available under either credit facility.

Since May 31, 2018, the company has not been in compliance with certain financial and other covenants under these credit facilities, and SVB or TriplePoint may declare an event of default at any time. If either lender were to declare an event of default, the debt outstanding under the relevant facility would become immediately due and payable. The company does not at present, and may not in the future, have sufficient liquidity to repay amounts outstanding under its debt facilities should they become immediately due and payable. The company also has $25.0 million in principal amount of subordinated indebtedness outstanding in addition to other liabilities.

The company’s financial condition exposes its business to a number of risks. Existing and potential customers and suppliers have expressed concerns regarding the company’s financial condition, which may negatively impact the company’s ability to sell and ship products and services. In addition, the company’s financial condition may adversely affect its ability to continue to attract and retain key personnel and other employees. Tintri expects its bookings and revenues to be impacted in the second quarter by its liquidity constraints and overall financial condition.

The closing bid price of the company’s common stock on the Nasdaq Stock Market has been less than $1.00 per share since May 22, 2018. In accordance with Nasdaq rules, if the company’s closing bid price is less than $1.00 per share for 30 consecutive business days, then the company’s shares may eventually be delisted from and cease to trade on the Nasdaq Stock Market. Following such a delisting, Tintri’s common stock may trade only on the over-the-counter market, or not at all.

Quarterly Report on Form 10-Q for 1Q19

On June 15, 2018, Tintri filed a Notice of Late Filing with regards to its quarterly report on Form 10-Q for its 1FQ19 with the SEC. The company’s evaluation of its strategic options has required a considerable amount of time from the company’s management and other personnel that would otherwise be dedicated to the preparation of this quarterly report. The company has also experienced recent losses of employees whose job functions related to the preparation of the quarterly report. As a result of these and related factors, the company requires additional time to complete the preparation and review of the quarterly report and the financial statements contained therein. The company anticipates filing this quarterly report with the SEC in June 2018, although after the due date prescribed by SEC rules.

Tintri is not providing guidance for its 2FQ19.

Comments

Quarterly revenue and profitability

(in $ million)

| Quarter | Revenue | Q/Q growth | Loss |

| 1FQ16 | 15.6 | NA | 23.6 |

| 2FQ16 | 19.8 | 27% | 24.1 |

| 3FQ16 | 24.4 | 23% | 25.8 |

| 4FQ16 | 26.2 | 7% | 27.4 |

| 1FQ17 | 22.9 | -13% | 30.8 |

| 2FQ17 | 27.6 | 21% | 25.7 |

| 3FQ17 | 33.9 | 23% | 23.8 |

| 4FQ17 | 40.8 | 20% | 25.5 |

| 1FQ18 | NA | NA | NA |

| 2FQ18 | 34.9 | NA | 51.7 |

| 3FQ18 | 31.8 | -9% | 37.9 |

| 4FQ18 | 28.9 | -9% | 37.4 |

| 1FQ19* |

22 | -24% |

NA |

* preliminary results

There are too many actors in AFA sytems - around 125 in the world - , even if this market is rapidly expanding, and Tintri is one of the first to be a victim of this intense competition and probably not the last one.

It's a shame for Tintri:

- • $22 million in revenue for the quarter, down 24% from the previous three-month period, but above guidance of $20 million to $21 million

- • never profitable since inception in 2008

- • as of April 30, 2018, and May 31, 2018, held aggregate cash and cash equivalents of $30.9 million and $11.5 million, respectively to be compared to $32.3 million in January 31, 2018

- • does not have sufficient liquidity to continue its operations beyond June 30, 2018

- • may file for bankruptcy protection, which could result in a complete loss for investors and shareholders putting $260 million in financial funding investment and after $60 million poor IPO in June 2017

- • shares may be delisted from and cease to trade on the Nasdaq

- • no guidance revealed for next quarter

- • customers reluctant to acquire any more Tintri's AFAs or to update their systems because of all these considerations.

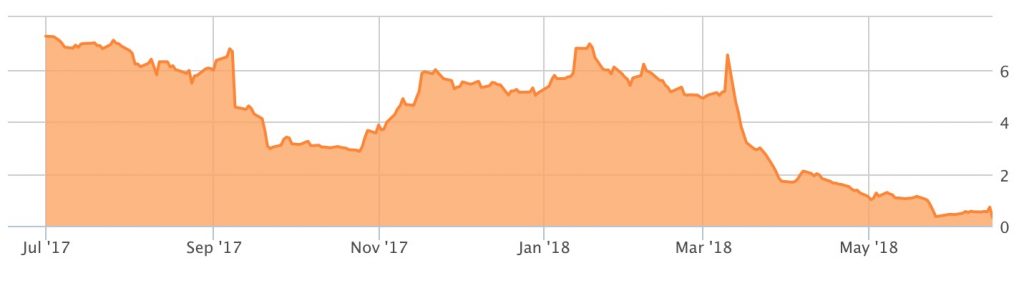

Shares of Tintri from July 2017

The only possibility for new CEO Tom Barton will be to find a buyer. The search began at the end of 2017 but as we comment formerly: "About all the relatively big storage firms have already offerings in this field." The price could be modest as company's market cap is less than $11 million.

Other AFA maker Violin Memory was in the same situation last year. Founded in 2005, it got $186 million in financial funding and $162 million in IPO in 2013 but then was in deep financial trouble and finally acquired at a low price by Quantum Partners in April 2017 rather than perish, but not by a storage company. After being suspended by NYSE and under Chapter XI, common stock began trading on OTCQX and the company became Violin Systems and will try to survive with new CEO Mark Lewis.

Read also:

Tintri: Fiscal 4Q18 Financial Results

Loss surpassing revenue, searching for new CEO

2018.03.06 | Press Release | [with our comments]

Tintri: Fiscal 3Q18 Financial Results

Not flashy at all, sale of company explored

2017.12.15 | Press Release | [with our comments]

Tintri: Fiscal 2Q18 Financial Results

Much more losses than revenue, up 101% and 27% Y/Y respectively

2017.09.12 | Press Release | [with our comments]

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter