WW Enterprise Storage Market Exploding, Up 34% Y/Y in 1Q18 to $13 Billion – IDC

Dell largest supplier in front of HPE, NetApp, Hitachi and IBM

This is a Press Release edited by StorageNewsletter.com on June 7, 2018 at 2:32 pmThe total worldwide enterprise storage systems factory revenue grew 34.4% year over year during 1Q18 to $13.0 billion, according to the International Data Corporation‘s Worldwide Quarterly Enterprise Storage Systems Tracker.

Total capacity shipments were up 79.1% year over year to 98.8EB during the quarter.

Revenue generated by the group of original design manufacturers (ODMs) selling directly to hyperscale datacenters increased 80.4% Y/Y in 1Q18 to $3.1 billion. This represented 23.9% of total enterprise storage investments during the quarter.

Sales of server-based storage increased 34.2% Y/Y, to $3.6 billion in revenue. This represented 28.0% of total enterprise storage investments. The external storage systems market was worth $6.3 billion during the quarter, up 19.3% from 1Q17.

“This was a quarter of exceptional growth that can be attributed to multiple factors,” said Eric Sheppard, research VP, server and storage infrastructure. “Demand for public cloud resources and a global enterprise infrastructure refresh were two important drivers of new enterprise storage investments around the world. Solutions most commonly sought after in today’s enterprise storage systems are those that help drive new levels of datacenter efficiency, operational simplicity, and comprehensive support for next generation workloads.”

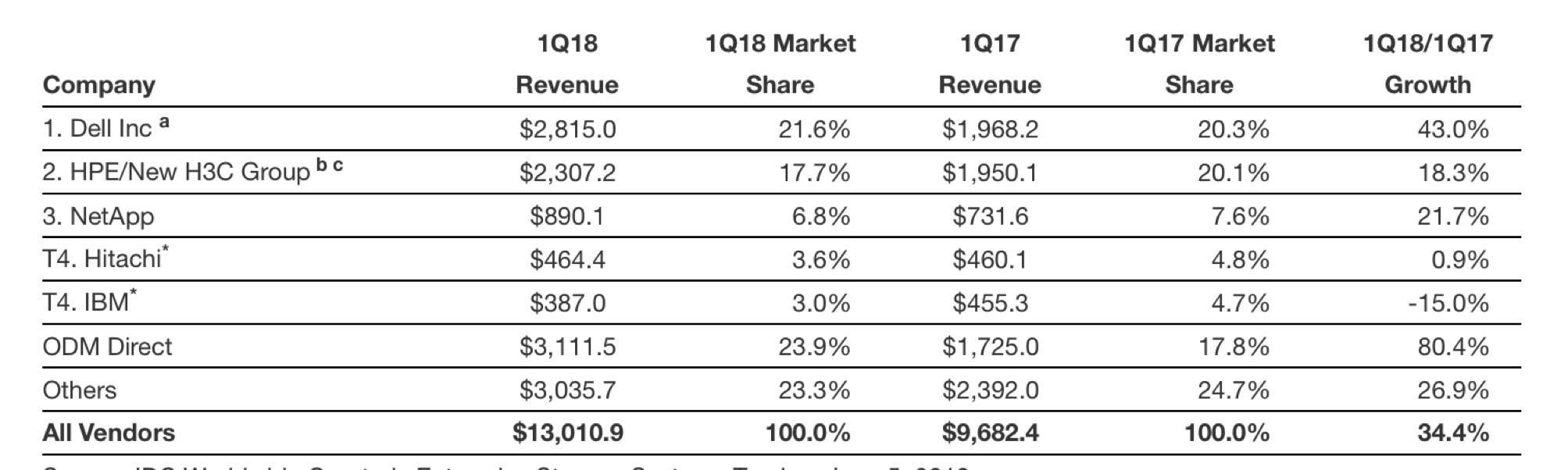

1Q18 Total Enterprise Storage Systems Market Results, by Company

Dell Inc. was the largest supplier for the quarter, accounting for 21.6% of total worldwide enterprise storage systems revenue and growing 43.0% over 1Q17. HPE/New H3C Group was the second largest supplier with 17.7% share of revenue. This represented 18.3% growth over 1Q17. NetApp generated 6.8% of total revenue, making it the third largest vendor during the quarter. This represented 21.7% growth over 1Q17. Hitachi and IBM were statistically tied* as the fourth largest suppliers with 3.6% and 3.0% respective share of revenue during the quarter. As a single group, storage systems sales by ODMs directly to hyperscale datacenter customers accounted for 23.9% of global spending during the quarter, up 80.4% over 1Q17.

Top 5 Vendor Groups, WW Total Enterprise Storage Systems Market, 1Q18

(in $ million)

(Source: IDC Worldwide Quarterly Enterprise Storage Systems Tracker, June 5, 2018)

* IDC declares a statistical tie in the worldwide enterprise storage systems market when there is 1% difference or less in the revenue share of two or more vendors.

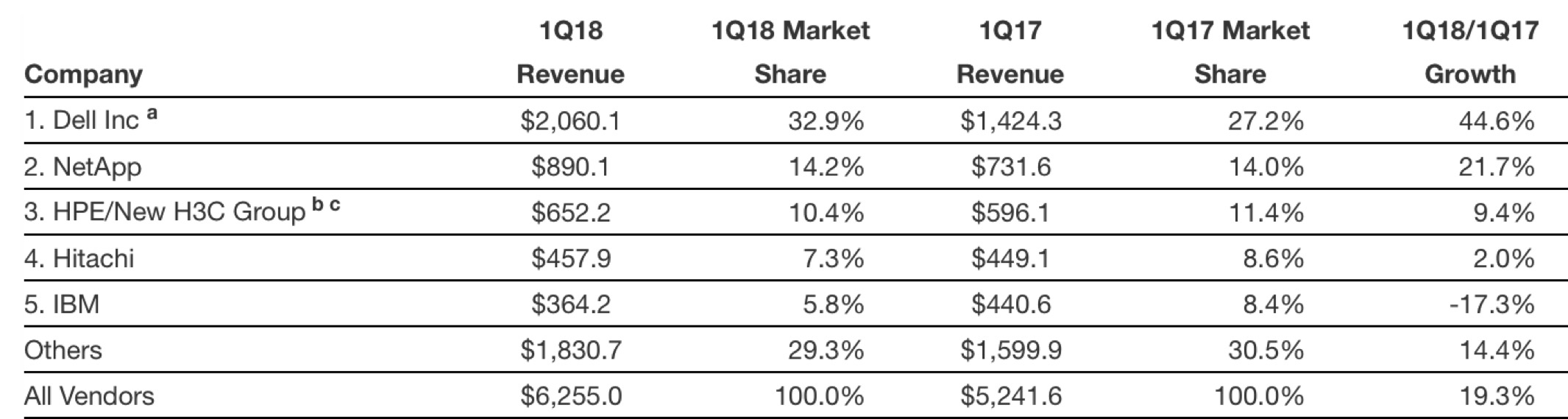

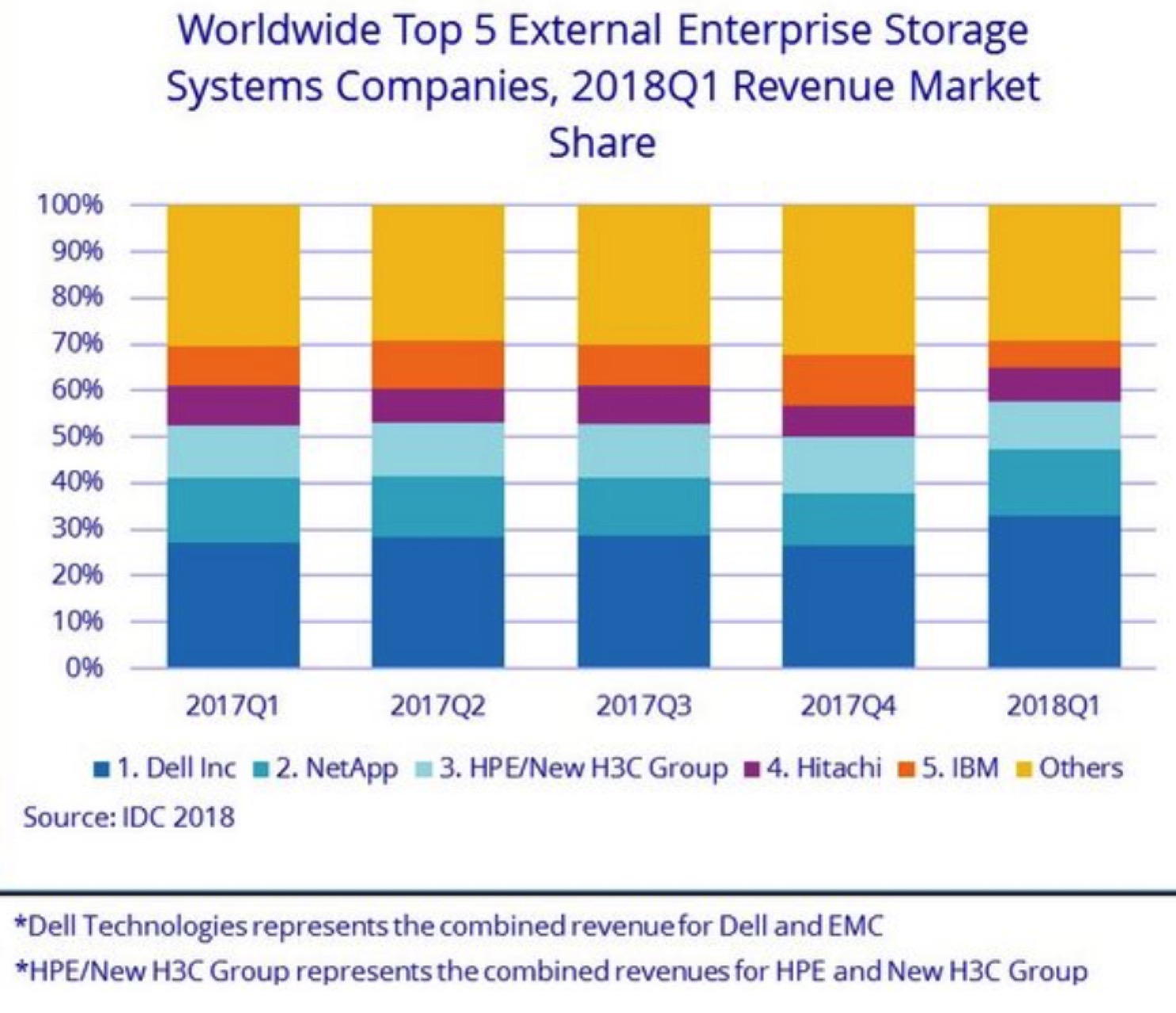

1Q18 External Enterprise Storage Systems Results, by Company

Dell Inc. was the largest external enterprise storage systems supplier during the quarter, accounting for 32.9% of worldwide revenues. NetApp finished in the number 2 position with 14.2% share of revenue during the quarter. HPE/New H3C Group was the third largest with 10.4% share of revenue. Hitachi and IBM rounded out the top 5 with 7.3% and 5.8% market share, respectively.

Top 5 Vendor Groups, WW External Enterprise Storage Systems Market, 1Q18

(in $ million)

(Source: IDC Worldwide Quarterly Enterprise Storage Systems Tracker, June 5, 2018)

Notes:

a – Dell Inc. represents the combined revenues for Dell and EMC.

b – Due to the existing joint venture between HPE and the New H3C Group, IDC will be reporting market share on a global level for HPE as HPE/New H3C Group starting from 2Q16 and going forward.

c – HPE/New H3C Group includes the acquisition of Nimble, completed in April 2017.

Flash-Based Storage Systems Highlights

The total all flash array market generated $2.1 billion in revenue during the quarter, up 54.7% year over year. The hybrid flash array (HFA) market was worth $2.5 billion in revenue, up 23.8% from 1Q17.

Taxonomy Notes

IDC defines an enterprise storage Ssystem as a set of storage elements, including controllers, cables, and (in some instances) HBAs, associated with three or more disks. A system may be located outside of or within a server cabinet and the average cost of the disk storage systems does not include infrastructure storage hardware (i.e. switches) and non-bundled storage software.

The information in this quantitative study is based on a branded view of the enterprise storage systems sale. Revenue associated with the products to the end user is attributed to the seller (brand) of the product, not the manufacturer. OEM sales are not included in this study.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter