Marvell: Fiscal 1Q19 Financial Results

53% of revenue in HDD, SSD controllers and data center storage solutions

This is a Press Release edited by StorageNewsletter.com on June 6, 2018 at 2:17 pm| (in $ million) | 1Q18 | 1Q19 | Growth |

| Revenue |

572.7 | 604.6 | 6% |

| Net income (loss) | 106.6 | 128.6 |

Marvell Technology Group Ltd. reported financial results for the first fiscal quarter of fiscal year 2019.

Revenue for the first quarter of fiscal 2019 was $605 million, which exceeded the midpoint of the company’s guidance provided on March 8, 2018.

GAAP net income from continuing operations for the first quarter of fiscal 2019 was $129 million, or $0.25 per diluted share. Non-GAAP net income from continuing operations for the first quarter of fiscal 2019 was $165 million, or $0.32 per diluted share. Cash flow from operations for the first quarter was $129 million.

“Fiscal 2019 is off to a strong start, driven by the performance of our storage, networking and connectivity businesses which grew 7% year over year in Q1. Marvell’s R&D engine is executing well, and our newly announced products are fueling a growing design win pipeline,” said president and CEO Matt Murphy. “Overall, I’m pleased with the results and thank the entire Marvell team for their effort and contribution.”

Second Quarter of Fiscal 2019 Financial Outlook

- Revenue is expected to be $600 million to $630 million. The guidance range excludes approximately $7 million in revenue from a Chinese OEM due to the trade restrictions imposed by the U.S. government.

- GAAP and non-GAAP gross margins are expected to be approximately 63% to 64%.

- GAAP operating expenses are expected to be $260 million to $270 million.

Non-GAAP operating expenses are expected to be approximately $210 million. - GAAP diluted EPS from continuing operations is expected to be in the range of $0.22 to $0.26 per share.

- Non-GAAP diluted EPS from continuing operations is expected to be in the range of $0.32 to $0.36 per share.

Comments

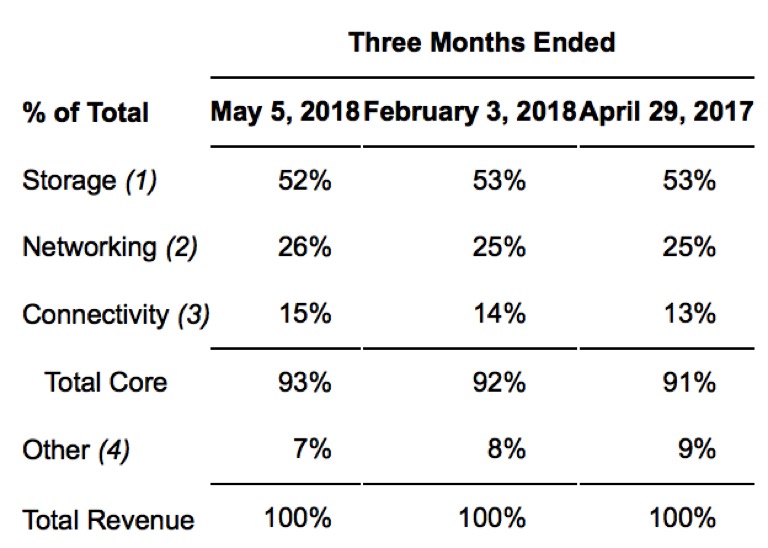

(1) Storage products are comprised primarily of HDD, SSD controllers and data center storage solutions.

(2) Networking products are comprised primarily of Ethernet switches, Ethernet transceivers, embedded ARM processors and automotive Ethernet, as well as a few legacy product lines in which we no longer invest, but will generate revenue for several years.

(3) Connectivity products are comprised primarily of WiFi solutions including WiFi only, WiFi/Bluetooth combos and WiFi microcontroller combos.

(4) Other products are comprised primarily of printer solutions, application processors and others.

Abstract of the earnings call transcript:

Matthew Murphy, president and CEO:

"Our storage business exceeded expectations growing 4% year-over-year. This growth was driven by two factors. First was record SSD revenue, which contributed more than 30% of total storage revenue. Second was the shifting mix of our HDD and SSD storage solutions as we expand in the enterprise and data center markets. The segment of our storage business grew 50% year-over-year, and overall demand continues to grow.

"The storage market shift to the enterprise and data center has been a key contributor to the recent strength in our HDD business. We continue to expand our presence in this market segment and anticipate a multiyear tailwind for our HDD business as we facilitate new storage technology transition such as HAMR, MAMR, and multi-actuator drives to increase aerial density and performance coupled with the ramp of our preamp business.

"We believe this strength will continue to largely offset secular declines in client HDDs."

Jean Hu, CFO:

"Our core business of storage, networking and connectivity accounted for 93% of revenue and grew 7% year-over-year, slightly ahead of expectations.

"Storage accounted for 52% of revenue and grew 4% year-over-year, well above our guidance due to record SSD revenue and continued growth in enterprise and the data center revenue for both our HDD and SSD solutions.

"We expect our storage revenue to be up low to mid single-digit year-over-year [for 2Q19.]"

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter