Box: Fiscal 1Q19 Financial Results

Record sales of $141 million with net loss representing 26% of revenue

This is a Press Release edited by StorageNewsletter.com on June 1, 2018 at 2:48 pm| (in $ million) | 1Q18 | 1Q19 | Growth |

| Revenue |

117.2 | 140.5 | 20% |

| Net income (loss) | (40.1) | (36.6) |

Box, Inc. announced financial results for the first quarter of fiscal 2019, which ended April 30, 2018.

“In the first quarter, we drove strong attach rates for new products, expanded our international customer base and delivered product innovation and security for some of the largest and most regulated enterprises in the world,” said Aaron Levie, co-founder and CEO. “With customers like Mitsubishi Motors Corporation, Dignity Health and the Defense Advanced Research Projects Agency (DARPA) choosing Box to power their digital workplace, our focus on security and collaboration, as well as our vision for artificial intelligence, continues to resonate.”

“We delivered solid top line growth and improved cash flow from operations by $10 million year-over-year in the first quarter,” said Dylan Smith, co-founder and CFO. “Our continued focus on driving higher product attach rates and expanding our penetration in the large enterprise market position us for long-term growth on our path to $1 billion and beyond.“

Fiscal First Quarter Financial Highlights

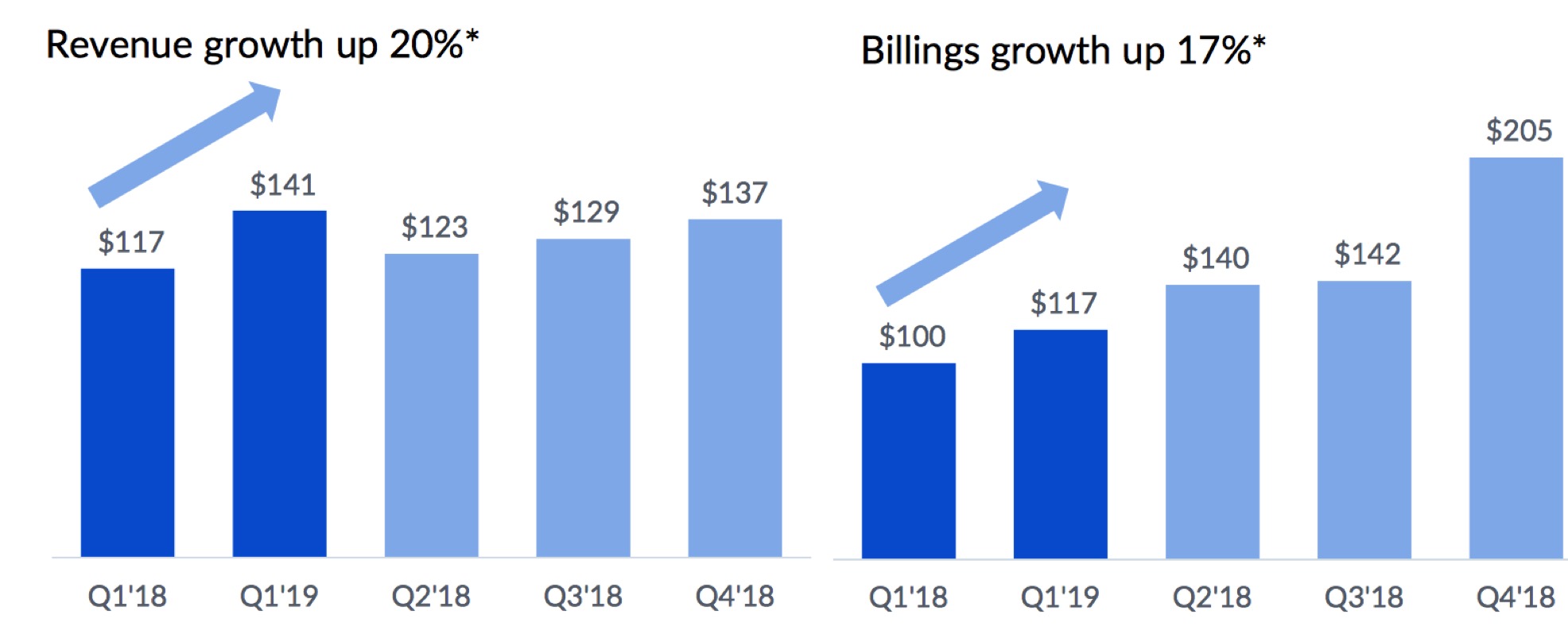

• Revenue was a record $140.5 million, an increase of 20% (ASC 606 in fiscal 2019 compared to ASC 605 in fiscal 2018) and 22% (ASC 605 in fiscal 2019 compared to ASC 605 fiscal 2018) from the first quarter of fiscal 2018.

• Deferred revenue as of April 30, 2018 was $286.9 million, an increase of 28% (ASC 606 to ASC 605) and 31% (ASC 605 to ASC 605) from April 30, 2017.

• Billings were $116.7 million, an increase of 17% (ASC 606 to ASC 605 and ASC 605 to ASC 605) from the first quarter of fiscal 2018.

• GAAP operating loss 2019 was $35.9 million, or 26% of revenue (ASC 606 to ASC 605), and $37.4 million, or 26% of revenue (ASC 605 to ASC 605). This compares to GAAP operating loss of $40.0 million, or 34% of revenue, in the first quarter of fiscal 2018.

• Non-GAAP operating loss was $9.2 million, or 7% of revenue (ASC 606), and $10.7 million, or 7% of revenue (ASC 605). This compares to a non-GAAP operating loss of $16.6 million, or 14% of revenue, in the first quarter of fiscal 2018.

• GAAP net loss per share, basic and diluted, was $0.26 (ASC 606) and $0.28 (ASC 605) on 138.5 million shares outstanding. This compares to a GAAP net loss per share of $0.30 in the first quarter of fiscal 2018 on 131.5 million shares outstanding.

• Non-GAAP net loss per share, basic and diluted, was $0.07 (ASC 606) and $0.08 (ASC 605). This compares to non-GAAP net loss per share of $0.13 in the first quarter of fiscal 2018.

• Net cash provided by operating activities totaled $18.4 million. This compares to net cash provided by operating activities of $8.5 million in the first quarter of fiscal 2018.

• Free cash flow was $7.3 million. This compares to $4.0 million in the first quarter of fiscal 2018.

Business Highlights Since Last Earnings Release

• Grew paying customer base to more than 85,000 businesses, including new or expanded deployments with organizations such as Blackboard, City of Philadelphia, DARPA, Dignity Health, Hitachi High Technologies, Mitsubishi Motors Corporation and Pokémon.

• Hosted Box World Tour Europe 2018 in London with hundreds of IT industry leaders from across Europe. As the European Union’s General Data Protection Regulation took effect May 25, Box, with Binding Corporate Rules, C5 and the TCDP, has been independently reviewed by European Data Protection Authorities for its privacy and cloud protection practices and is well-suited to support customers as they address GDPR.

• Launched multizone support for Box Zones, giving customers the choice to store data in and collaborate seamlessly across any of Box’s existing seven Zones, all from a single Box instance.

• Announced the availability of Box Drive to power seamless collaboration streamed directly from the desktop to further simplify businesses’ shift to the cloud.

• Released new capability to create metadata-driven retention policies for Box Governance, offering customers powerful, flexible and customizable controls over their data.

• Launched new Box Admin Insights Dashboard, providing IT admins with enhanced visibility, governance and understanding of how their employees leverage Box globally.

• Released Box’s integration with Apple’s office suite, iWork, enabling users to create, preview and collaborate on Pages, Numbers and Keynote files within Box.

• Established Future of Work Council with Workplace by Facebook and Okta, bringing together leaders from enterprises like American Express, NIKE and Farmers Insurance to rethink the culture, skills, organization and technology required to enable the future of work in the digital age.

Q2 FY19 Guidance: Revenue is expected to be in the range of $146 million to $147 million. GAAP and non-GAAP basic and diluted earnings per share are expected to be in the range of ($0.28) to ($0.27) and ($0.06) to ($0.05), respectively. Weighted average basic and diluted shares outstanding are expected to be approximately 141 million.

Full Year FY19 Guidance: Revenue is expected to be in the range of $603 million to $608 million. GAAP and non-GAAP basic and diluted earnings per share are expected to be in the range of ($1.07) to ($1.04) and ($0.19) to ($0.16), respectively. Weighted average basic and diluted shares outstanding are expected to be approximately 140 million.

Comments

Now with more than 1,800 employees, Redwood City, CA-based Box continues to grow rapidly, at 20% CAGR since FY015, but heavy losses are continuing.

For this most recent quarter, revenue, at $140.5 million, was up 20% Y/Y and ahead of guidance but only 3% Q/Q.

Most important firm's partners are IBM, Microsoft, Fujitsu, Amazon and Google.

During the quarter, Box closed 35 deals over $100,000 versus 26 a year ago, 4 deals over $500,000 versus 2 a year ago and 1 deal over $1 million in line with a year ago. Of these six-figure deals, two-thirds included at least one new product and partners played a role in more than 50% of six-figure deals.

With IBM in particular, the company closed six $100,000 plus deals. Mitsubishi Motors Corporation was sold through IBM and is deploying Box as a part of its digital transformation strategy.

24% of 1FQ19 revenue came from regions outside of the United States compared to 22% a year ago. Six-figure deals came from international markets with particular strength.

For current fiscal year, revenue are expected do increase between 19% and 20% from FY18 for another record. Company focus on path to $1 billion but didn't reveal when.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter