FalconStor: Fiscal 1Q18 Financial Results

Tumble continues.

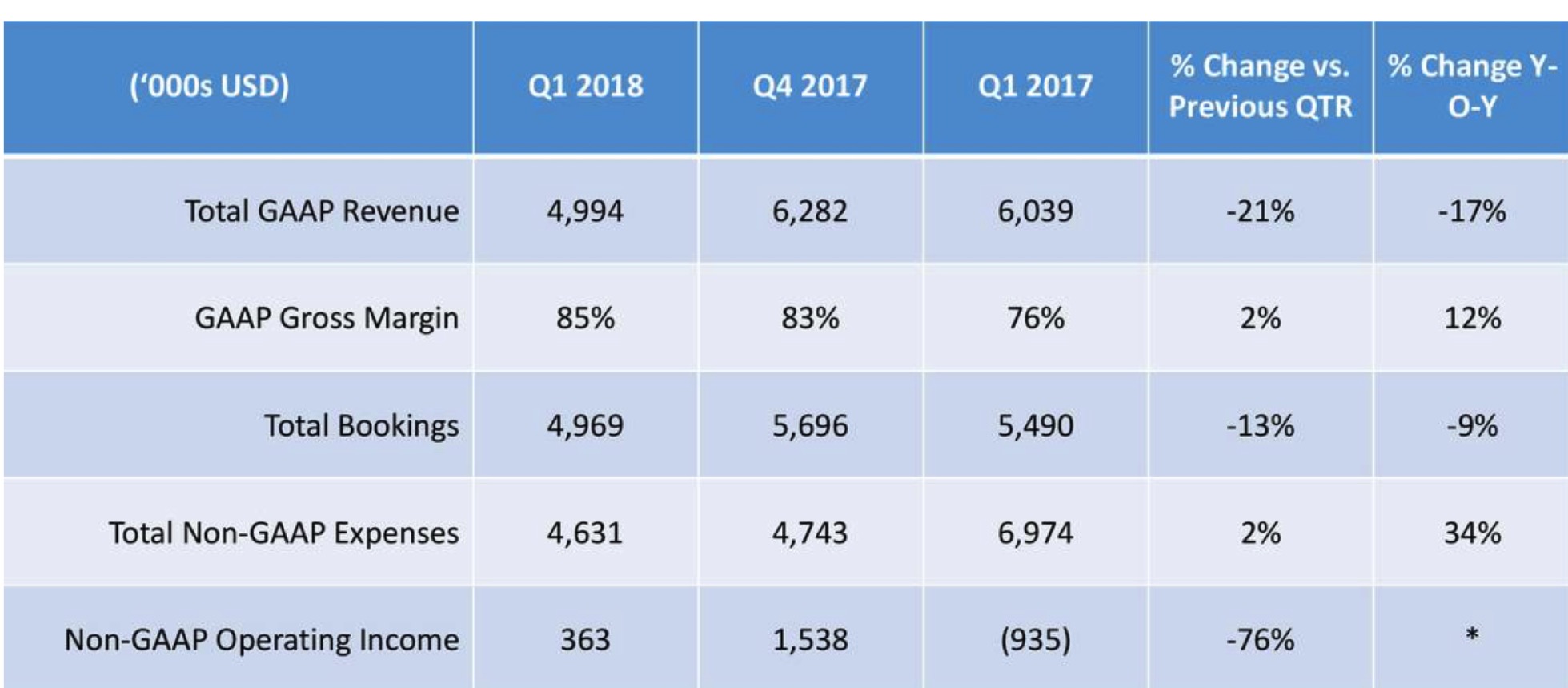

This is a Press Release edited by StorageNewsletter.com on May 14, 2018 at 2:25 pm| (in $ million) | 1Q17 | 1Q18 | Growth |

| Revenue |

6.0 | 5.0 | -17% |

| Net income (loss) | (1.1) | 0.5 |

FalconStor Software, Inc. announced financial results for its first quarter ended March 31, 2018.

“We are pleased with our Q1 performance and resultant financial results, which continued the return to profitability delivered in Q3 and Q4 of 2017,” stated Todd Brooks, CEO. “Our products play a key role in efficiently managing and protecting critical data within enterprises around the world. Given our improved financial stability and continually improving operational efforts, our focus for the balance of 2018 will shift to further product innovation and strategic growth.”

For the three months ended March 31, 2018 we delivered net GAAP operating income of $0.6 million on revenues of $5.0 million.

Included in operating results above for the three months ended March 31, 2018 and 2017 were $0.0 million and $0.4 million of share-based compensation expense, respectively.

Deferred revenue at March 31, 2018 was $13.1 million, compared with $18.4 million at December 31, 2017.

The decrease is primarily related to our adoption of new revenue recognition accounting guidance on January 1, 2018 using the modified retrospective transition method applied to contracts which were not completed as of January 1, 2018.

Our cash balance at March 31, 2018 was $4.6 million, compared with $1.0 million at December 31, 2017.

Comments

Eighteen years old, the public company is becoming a tiny one with only $5 million in revenue for the quarter in a market reported in 2017 by IDC to be sized $7 billion and predicted to grow at a CAGR of over 13% through 2021.

And, in bad shape, FalconStor continues to shrink with revenues declining 21% vs. 4Q17 and 17% vs. 1Q17, and bookings down 13% and 9% respectively, even if it records its third consecutive quarter of profitable double-digit operating margin.

According to Seeking Alpha, enterprise value is now only 16.27 million and market cap $6.85 million. For 52-week range shares are between $0.06 and $1.02. Remember that trading of common stock left Nasdaq for OTC last year.

The storage sofwtare firm was betting to rebound on its FreeStor software, available since June 2015 but it didn't happen.

CEO Brooks tries to be positive: "So as an example, let me highlight three stats from the quarter: first, FalconStor billings generated by six of our top 12 partners, more than doubled in Q1 as compared to Q1 2017. Second, billings for FreeStor are newest and most powerful product increased by 58% across all partners in Q1 as compared to Q1 2017; and finally, number three, our global book-to-bill ratio, in Q1 was 103.3%. That's the first time that the company has exceeded 100% book-to-bill ratio since Q4 2016. (...) So obviously, we're encouraged by the progress we delivered toward returning the company to the organic growth in Q1."

Now the long-term strategy of the company is to acquire other storage technologies to be back to growth but its financial resources are too low to get a dominant storage software actor.

CEO Brooks said: "Our M&A will absolutely become a key component to our long-term growth strategy as we move forward. While our plan is in early stages right now, we are developing a strategy that will include acquiring, and fully integrating companies that offer complementary storage related technologies or storage-centric vertical applications and solutions."

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter