Commvault: Fiscal 4Q18 Financial Results

Revenue up 8% for FY18 with heavy loss, CEO to quit

This is a Press Release edited by StorageNewsletter.com on May 2, 2018 at 2:43 pm| (in $ million) | 4Q17 | 4Q18 | FY17 | FY18 |

| Revenue | 166.7 | 184.9 | 645.0 | 699.4 |

| Growth | 11% | 8% | ||

| Net income (loss) | 0.2 | (1.7) | (0.5) | (61.9) |

Commvault Systems, Inc. announced its financial results for the fourth quarter and fiscal year ended March 31, 2018 and unveiled Commvault Advance, a multi-pronged transformation initiative spanning a series of actions completed over the past year, currently underway, and still to come that together are designed to drive sustained business performance.

N. Robert Hammer, Commvault’schairman, president and CEO stated: “We concluded our fiscal year achieving quarterly software and products revenue of $83.5 million, representing 7% growth year over year, and total revenues of $184.9 million, which increased 11% year over year. Our software and products revenue growth was driven by a record number of enterprise transactions and significant acceleration of our subscription-based pricing model. For the fourth quarter, approximately 37% of our software and products revenue was attributable to subscription-based pricing which resulted in full year fiscal 2018 subscription-based pricing being 25% of our software and product revenues. We are also pleased with the early success of our Commvault HyperScale Appliance, Commvault HyperScale Software, and Platform enhancements that had a significant impact to product revenues in the quarter.”

“These results show the progress we are making in strengthening our competitive technology position, enhancing and expanding distribution, and realigning resources to drive our go-to-market as a partner-led organization. However, we know we can and must do more in order to return the company to sustainable, profitable growth. The transformation plan announced, Commvault Advance, is designed to accelerate our margin improvement and ensure we fully capitalize on Commvault’s market leadership, with value creation for our shareholders and customers alike. Finally, we remained opportunistic during the fourth fiscal quarter repurchasing $21 million of our common stock bringing our full fiscal year 2018 repurchases to $112 million,” he added.

Fiscal Fourth Quarter and Fiscal 2018 Financial Results

Total revenues for the fourth quarter of fiscal 2018 were $184.9 million, an increase of 11% year-over-year and 3% sequentially. Software and products revenue in the fourth quarter of fiscal 2018 was $83.5 million, an increase of 7% year-over-year and 3% sequentially. Services revenue in the fourth quarter of fiscal 2018 was $101.4 million, an increase of 15% year-over-year and 2% sequentially.

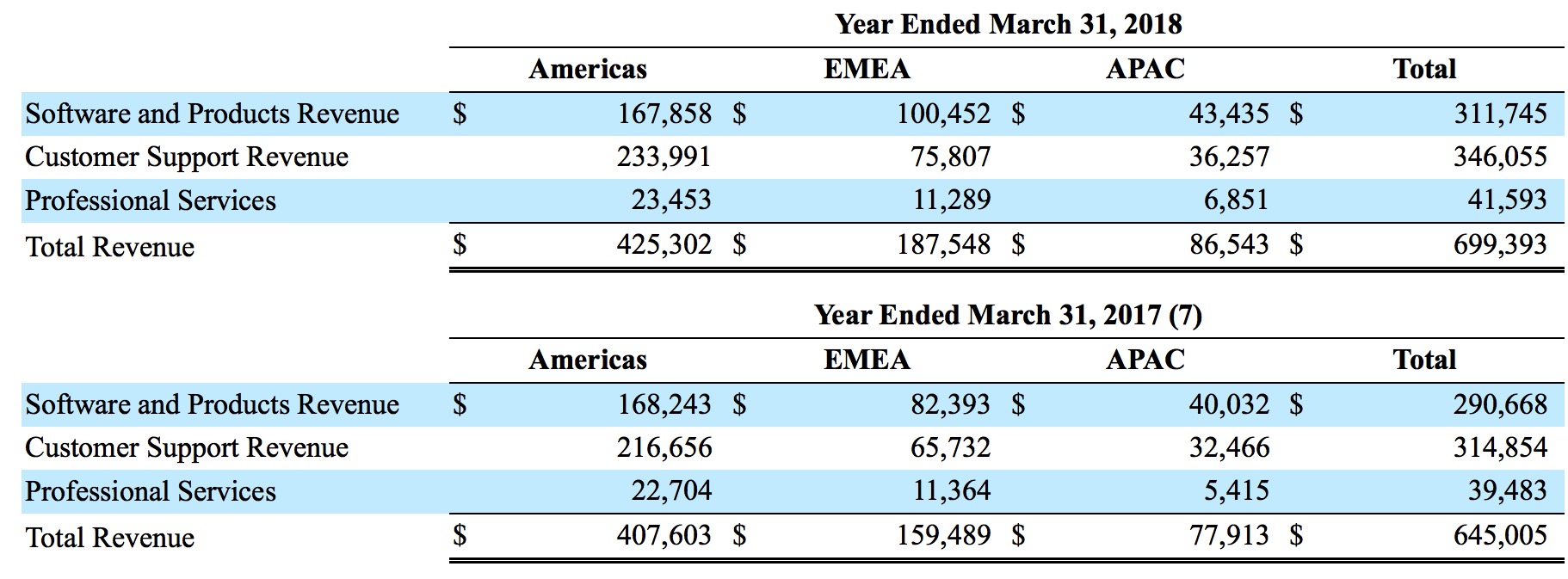

For the full fiscal year, total revenues were $699.4 million, an increase of 8% from fiscal 2017. Software and products revenue for the full fiscal year was $311.7 million, an increase of 7% from fiscal 2017. Services revenue for the full fiscal year was $387.6 million, an increase of 9% from fiscal 2017.

On a GAAP basis, income from operations (EBIT) increased to $4.6 million for the fourth quarter compared to a loss of $1.8 million in the same period of the prior year. Non-GAAP income from operations (EBIT) increased to $22.5 million in the fourth quarter of fiscal 2018 compared to $17.6 million in the fourth quarter of the prior year.

On a GAAP basis, loss from operations (EBIT) for the full fiscal year was $0.9 million. Non-GAAP income from operations (EBIT) increased 2% to $76.0 million in fiscal 2018 compared to $74.5 million in fiscal 2017.

For the fourth quarter of fiscal 2018, the company reported net loss of $1.7 million. Non-GAAP net income for the quarter increased to $14.5 million, or $0.31 per diluted share, from $11.1 million, or $0.24 per diluted share, in the same period of the prior year.

For the full fiscal year, it reported a net loss of $61.9 million. During the year, it recorded approximately $52.5 million of non-cash income tax charges related to the combined impact of the lower US corporate income tax rate on deferred tax assets and recording a valuation allowance against the remaining value of deferred tax assets. Non-GAAP net income for the full fiscal year increased to $48.7 million, or $1.03 per diluted share, from $47.1 million, or $1.01 per diluted share, in fiscal 2017.

Operating cash flow totaled $23.3 million for the fourth quarter of fiscal 2018 compared to $29.0 million in the fourth quarter of fiscal 2017. For the full fiscal year, operating cash flow was $84.2 million, compared to $100.0 million for fiscal 2017. Total cash and short-term investments were $462.4 million as of March 31, 2018 compared to $450.2 million as of March 31, 2017. During the fiscal fourth quarter, Commvault repurchased $21.0 million of common stock (0.4 million shares) bringing the fiscal 2018 total repurchases to $112.2 million (2.1 million shares). It made no borrowings against its line of credit in fiscal 2018. Commvault terminated the line of credit in February 2018.

Commvault Advance

Increasing the rate of top line growth and getting Commvault back to sustainable growth in operating margins are at the core of the Advance initiative. Advance began implementation internally with product improvements developed over the course of the past 18 months, followed by strategic partner actions late in 2018, and was designed to accelerate change and to be announced at the beginning of the company’s new fiscal year, staring April 1, 2018.

Commvault has already taken actions to achie these objectives, including:

• Established product solution groups that more tightly bridge between product development and product go-to-market, speeding the time from product conception to market availability.

• Made changes over the past year to deliver solutions that are simpler for customers to implement and use, including a powerful yet simple, web-based user interface, and appliance offerings.

• Made changes in pricing and packaging, making it easier for customers to buy products, including subscription-based pricing models that have accounted for approximately 37% of Q4 and 25% of FY’18 software and product revenue.

• Launched new products into market to extend leadership, including Commvault HyperScale Software and Appliances; data migration and cloud management solutions; and the portfolio of software-as-a-service and outcomes-based offerings. For example, in their first full quarter of being in market, HyperScale Technology and ScaleProtect with Cisco UCS had a significant contribution to quarterly software and product revenue.

• Over the past year, it has established a broader, stronger partner ecosystem with announcements with the following key strategic partners: Cisco, HPE, Microsoft and AWS; and new relationships with Infinidat, and Google and Oracle,and others.

• Added new senior leadership to drive a strategic re-focusing of go-to-market with partners, including new worldwide heads of partnerships, alliances and channels.

Commvault announced that it is implementing a series of new transformational moves under Advance.

These steps include:

• Immediate moves to create a more efficient go-to-market team by restructuring and reorganizing field-facing resources in sales and marketing to be directly tied to key routes to market with alliances, distribution, service provider, and global SI partners.

• A worldwide cost-reduction effort, with actions underway to reduce, consolidate and align resources across all functional areas. This effort will include an examination of the use of contracted employees, third party expenses, T&E and targeted headcount reductions of approximately 4% of the workforce.

• Supplemental pricing and packaging options in the company’s core data protection offering, and upcoming new product announcements that are aligned with key routes to market.

In addition, as separately announced in connection with an agreement with Elliott Management, Commvault and its board of directors have initiated new governance initiatives and a comprehensive review of its business and capital allocation to identify additional opportunities for improvement and value creation.

Comments

It's not good news for Commvault to be investigated by American investment management firm Elliott Management Corporation which is also the largest activist fund in the world.

It's not the first time it is looking at storage companies. Examples:

- Elliott Management Urging EMC to Spin Off VMware

- Riverbed Received Unsolicited Proposal from Elliott Management

- NetApp Said to Be Pushed by Investor Elliott Management to Change Board

The business of the activist consists to acquire a minimum of shares in a company, here from Commvault, and then to send a letter explaining that it has to restructure to for a better value for shareholders and offering advices and a change of executives and board's directors. Commvault could disagree with Elliott Management but this later will send other letters to convince shareholders, and it will be a long process. It was not done by Commvault surprisingly being growing since 1FQ18 - but not profitable each quarter of FY18.

Later, after restructuring Commvault, eventually for better results, Elliott Management will sell its higher-prices shares or search for a buyer for storage firm.

Abstracts of the earnings call transcript:

Bob Hammer, president and CEO:

"We saw a solid billings growth driven by a 16% year-over-year increase in deferred revenue. We had good services revenue growth of 15% year-over-year. We continue to make excellent progress with our subscription-based pricing models, which represented approximately 37% of our Q4 and 25% of our FY 2018 software revenue. Entering the year, our historical run rate of repeatable software revenue was less than 10%.

"This quarter, we will introduce updated data protection solutions including our appliances, incorporating advanced machine learning for automatic dynamic scheduling, improved operational efficiency and position for faster, automated, dynamic disaster recovery. This quarter, we will also introduce new solutions with advanced machine learning for new cyber solutions, for threat detection and mitigation and high-volume disaster recovery.

Next quarter, we will come to market with the most advanced solutions, again, using machine learning and AI for GDPR. We will also expand it to outcome-based services and SaaS."

Brian Carolan, CFO:

"Revenue from enterprise deals, which we define as deals over $100,000 in software revenue in a given quarter, represented 60% of software revenue. Revenue from these transactions was up 5% year-over-year and 9% sequentially. Our average enterprise deal size decreased 6% year-over-year to approximately $264,000 during the quarter. The number of enterprise revenue transactions was a quarterly record, increasing 12% year-over-year and 10% sequentially.

"During the quarter, 51% of software revenue was sold through our traditional per terabyte capacity models, down from 67% in Q4 2017 and 66% in Q3 2018. Sales of these traditional terabyte capacity models has declined in recent quarters, as we've been transitioning customers to stand-alone solution sets, Appliances and HyperScale solutions, that are also licensed based on the amount of data under management.

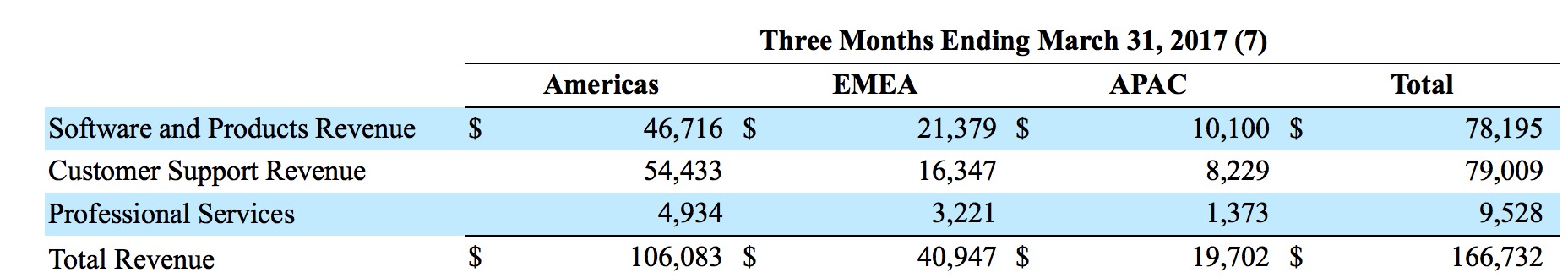

"From a geographic perspective, Americas, EMEA and APAC represented 56%, 31% and 13% of software revenue, respectively, for the quarter. On a year-over-year growth basis, EMEA and APAC were up 22% and 9%, respectively, while Americas was down 1%. The revenue mix for the quarter was split 45% software and 55% services.

"We expect total Q1 year-over-year revenue growth to be in the mid- to high-single digits. We expect the Q1 EBIT margin percentage to be approximately 9.6%. We expect lower revenue growth in the first half of FY 2019 due to the fact that our key initiatives will not offset the move to subscription-based pricing.

"We expect total FY 2019 revenue growth to approach 10% with EBIT margin expansion of approximately 200 basis points. We expect our subscription pricing models as a percentage of total software and products revenue to increase from 25% to approximately 30%, which reflects the continued shift to repeatable revenue streams."

Read also:

Commvault Needs Fundamental Change …

Estimates Elliott Management, owner of 10% common stock.

2018.04.03 | Press Release

… Commvault Response to Elliott Management

"We go into these discussions with open mind."

2018.04.03 | Press Release

Revenue and net income (loss) for Commvault

| Fiscal period | Revenue | Y/Y growth | Net income (loss) |

| 1Q15 | 152.6 | 14% | 12.7 |

| 2Q15 | 151.1 | 7% | 6.5 |

| 3Q15 | 153.0 | -0% | 3.1 |

| 4Q15 | 150.7 | -4% | 3.4 |

| FY15 | 607.5 | 4% | 25.7 |

| 1Q16 | 139.1 | -9% | (1.3) |

| 2Q16 | 140.7 | -7% | (9.2) |

| 3Q16 | 155.7 | 2% | 4.9 |

| 4Q16 | 159.6 | 6% | 5.8 |

| FY16 | 595.1 | -2% | 0.1 |

| 1Q17 | 152.4 | 10% | (2.0) |

| 2Q17 | 159.3 | 13% | (0.6) |

| 3Q17 | 165.8 | 7% | (0.0) |

| 4Q17 | 172.9 | 8% | 3.2 |

| FY17 | 650.5 | 9% | 0.5 |

| 1Q18 | 166.0 | 9% | (0.3) |

| 2Q18 | 168.1 | 5% | (1.0) |

| 3Q18 | 180.4 | 8% | (59.0) |

| 4Q18 | 184.9 | 11% | (1.7) |

| FY18 | 699.4 | 8% | (61.9) |

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter