Seven Significant Trends in All-Flash Array Marketplace

By Ken Clippertonn, DCIG

This is a Press Release edited by StorageNewsletter.com on April 25, 2018 at 2:29 pm Ken Clipperton, lead analyst, storage, at DCIG, Inc. published this article on April 19. 2018.

Ken Clipperton, lead analyst, storage, at DCIG, Inc. published this article on April 19. 2018.

Seven Significant Trends in the All-Flash Array Marketplace

Much has changed since DCIG published its All-Flash Array Buyer’s Guide just one year ago. The DCIG analyst team is in the final stages of preparing a fresh snapshot of the all-flash array (AFA) marketplace. As we reflected on the fresh AFA data and compared it to the data we collected just a year ago, we observed seven significant trends in the AFA array marketplace that will influence buying decisions through 2019.

Trend #1: New Entrants, but Marketplace Consolidation Continues

Although new storage providers continue to enter the AFA marketplace-primarily focused on NVMe over Fabrics – the larger trend is continued consolidation. HPE acquired Nimble Storage. Western Digital acquired Tegile.

Every well-known provider has made at least one all-flash acquisition. Consequently, some providers are in the process of ‘rationalizing’ their all-flash portfolios. For example, HPE has decided to position Nimble Storage AFAs as ‘secondary flash’. HPE also announced it will implement Nimble’s InfoSight predictive analytics platform across HPE’s entire portfolio of data center products, beginning with 3PAR StoreServ storage. Dell EMC seems to be positioning VMAX as its lead product for mission critical workloads, Unity for organizations that value simplified operations, XtremIO for VDI/test/dev, and SC for low cost capacity.

Nearly all the AFA providers also offer at least one hyperconverged infrastructure product. These hyperconverged products compete with AFAs for marketing and data center infrastructure budgets. This will create additional pressure on AFA providers and may drive further consolidation in the marketplace.

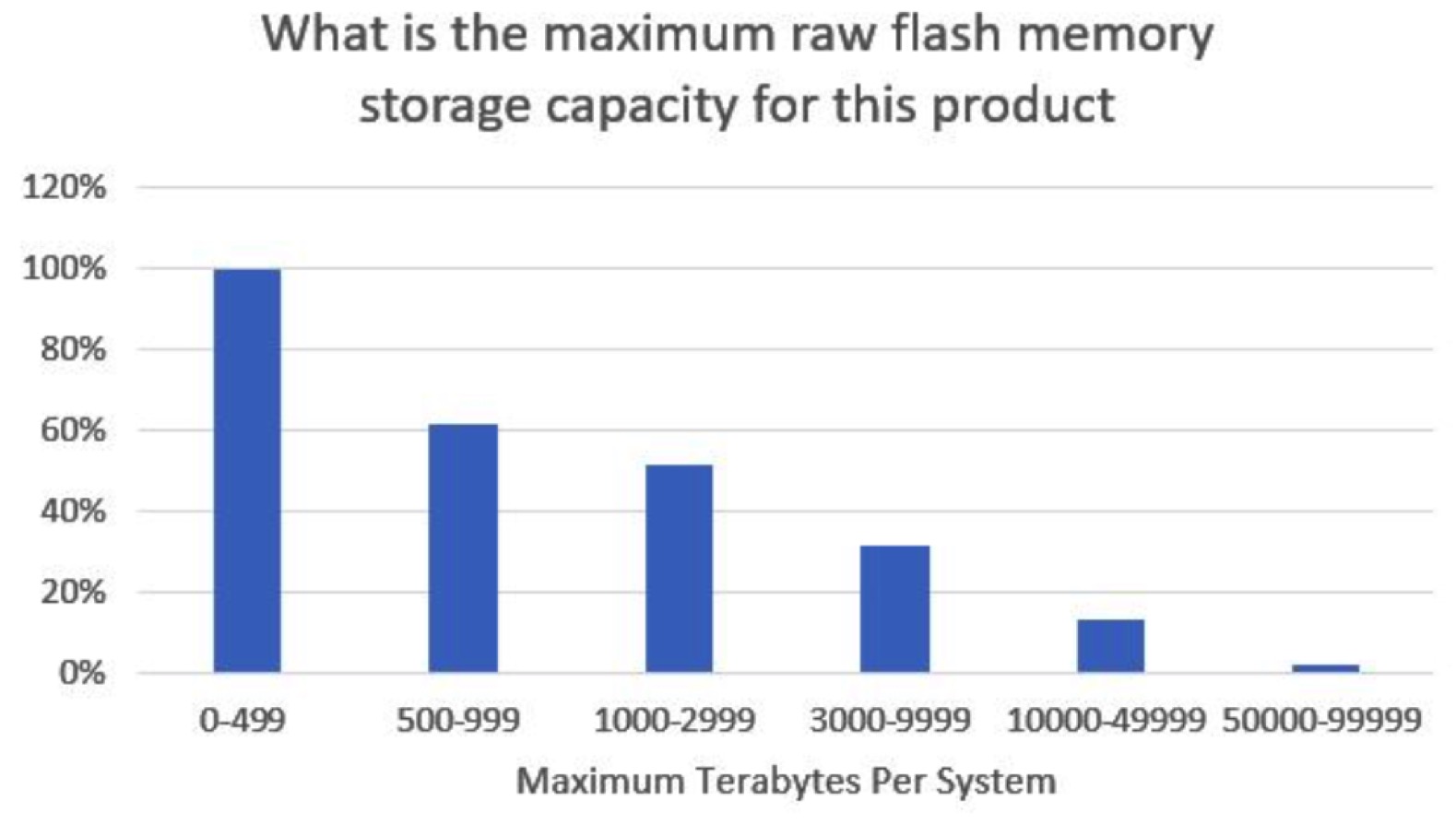

Trend #2: Flash Capacity Increasing Dramatically

The raw capacity of the more than 100 AFAs DCIG researched averaged 4.4PB. This is a 5-fold increase compared to the products in the 2017-18 edition. The highest capacity product can provide 70PB of all-flash capacity. This is a 7-fold increase. Thus, AFAs now offer the capacity required to be the storage resource for all active workloads in any organization.

(Source: DCIG, n=102)

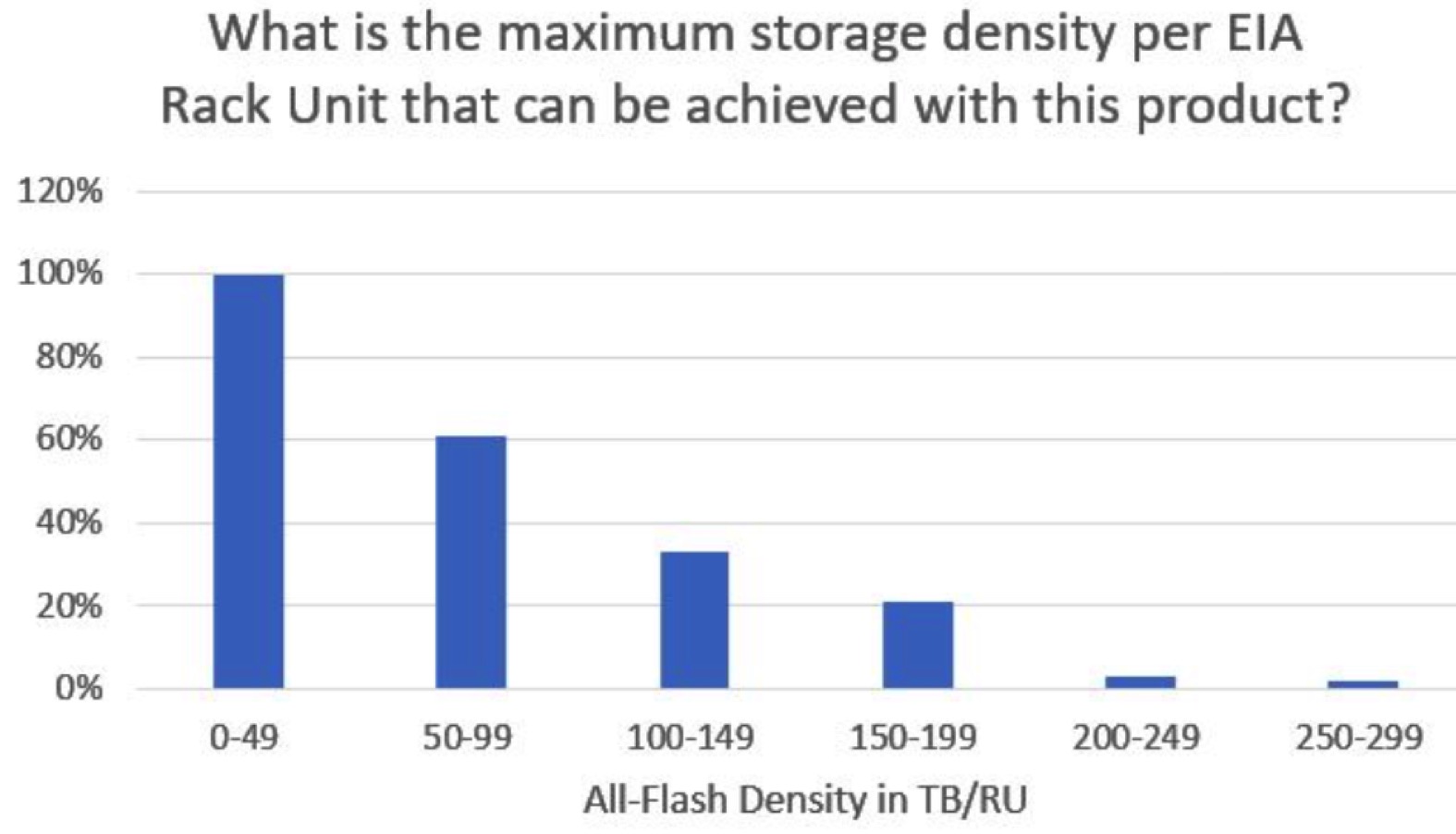

Trend #3: Storage Density Increasing Dramatically

The average AFA flash density of the products continues to climb. Fully half of the AFAs that DCIG researched achieve greater than 50TB/RU. Some AFAs can provide over 200TB/RU. The combination of all-flash performance and high storage density means that an AFA may be able to meet an organization’s performance and capacity requirements in 1/10th the space of legacy HDD storage systems and the first generation of AFAs. This creates an opportunity for many organizations to realize significant data center cost reductions. Some have eliminated data centers. Others have been able to delay building new data centers.

(Source: DCIG, n=102)

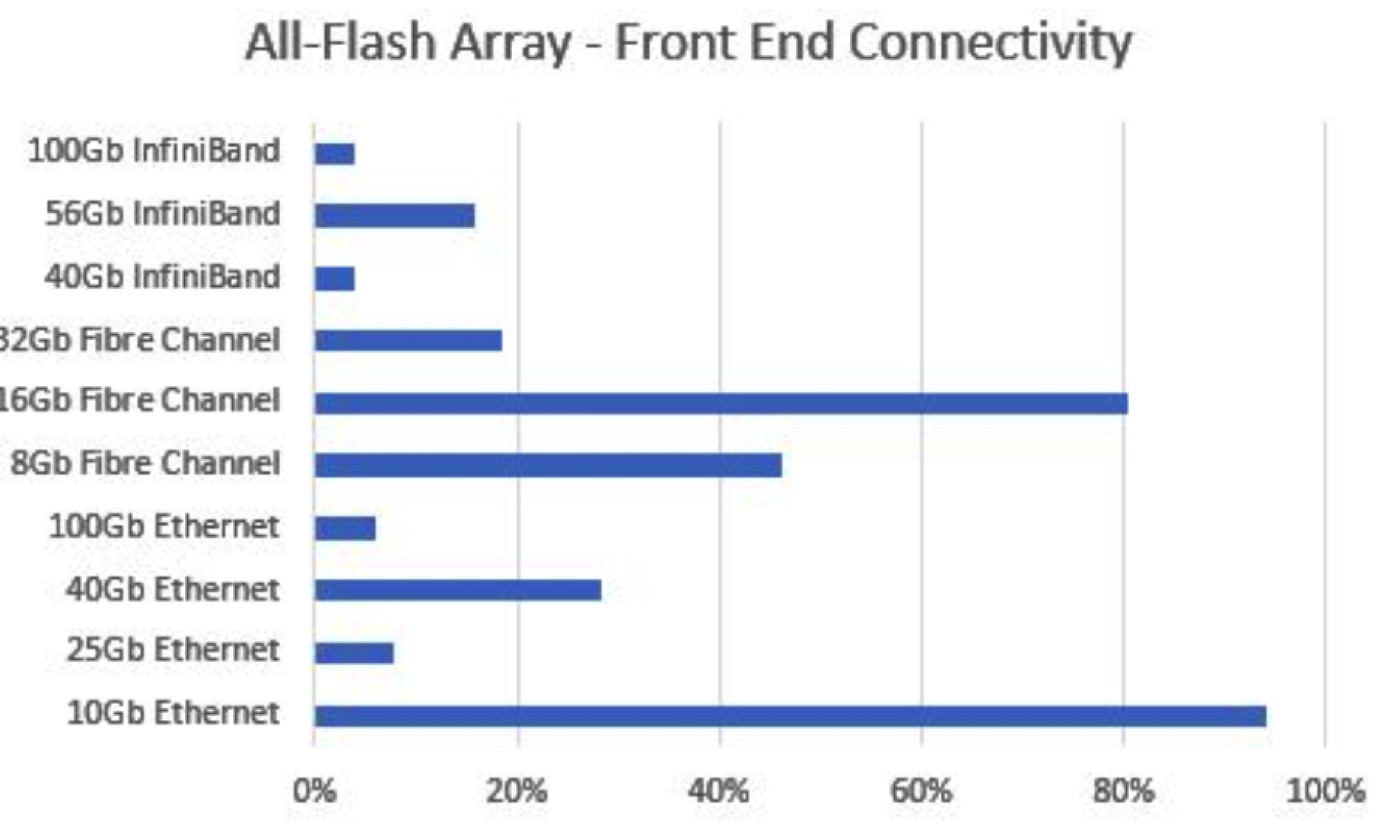

Trend #4: Rapid Uptake in Components that Increase Performance

Increases in flash memory capacity and density are being matched with new components that increase array performance.

These components include:

• a new generation of multi-core CPUs from Intel

• 32GB FC and 25/40/100GbE

• GPUs

• ASICS to offload storage tasks

• NVMe connectivity to SSDs.

Each of these components can unlock more of the performance available from flash memory. Organizations should assess how well these components are integrated to systemically unlock the performance of flash memory and of their own applications.

(Source: DCIG, n=102)

Trend #5: Unified Storage Is the New Normal

The first generations of AFAs were nearly all block-only SAN arrays. Tegile was perhaps the only truly unified AFA provider. Today, more than half of all AFAs DCIG researched support unified storage. This support for multiple concurrent protocols creates an opportunity to consolidate and accelerate more types of workloads.

Trend #6: Most AFAs Can Use Public Cloud Storage as a Target

Most AFAs can now use public cloud storage as a target for cold data or for snapshots as part of a data protection mechanism. In many cases this target is actually one of the provider’s own arrays running in a cloud data center or a software-defined storage instance of its storage system running in one of the true public clouds.

Trend #7: Predictive Analytics Get Real

Some storage providers can document how predictive storage analytics is enabling increased availability, reliability, and application performance. The promise is huge. Progress varies. Every prospective AFA purchaser should incorporate predictive analytics capabilities into their evaluation of these products, particularly if the organization intends to consolidate multiple workloads onto a single AFA.

Conclusion: All Active Workloads Belong on All-Flash Storage

Any organization that has yet to adopt an all-flash storage infrastructure for all active workloads is operating at a competitive disadvantage.

The current generation of all-flash arrays create business value by:

• making existing applications run faster even as data sets grow

• accelerating application development

• enabling IT departments to say, “Yes” to new workloads and then get those new workloads producing results in record time

• driving down data center capital and operating costs

DCIG expects to finalize its analysis of AFAs and present the resulting snapshot of this dynamic marketplace in a series of buyer’s guides during the second quarter of 2018.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter