$60 Million in New Funding for Scality

Probably last round before IPO expected in 2021, total to date at $152 million

This is a Press Release edited by StorageNewsletter.com on April 17, 2018 at 2:29 pmScality, Inc. closed an additional $60 million round of funding to continue executing on its technology innovation strategy as it makes multi-cloud real for its customers.

Since its last round of funding in 2015, Scality has made advances in technology and won numerous awards and accolades from analysts, industry groups and channel organizations for its Scality RING software-defined storage, including leadership position in the Gartner Magic Quadrant.

As a large independent vendor in its space, the company continues to add new logos as quickly as it expands its footprint with existing ones; now counting more than 200 customers, all with storage footprints measured in petabytes.

This latest funding round includes participation from all existing investors, Scality staff, and a new investor, Harbert European Growth Capital.

This round brings the company’s total funding to date to $152 million. Scality will use the new infusion to accelerate its bold investment in engineering to innovate in ways that transform IT and simplify the path to creating value with data.

“Scality has a history of industry firsts: first to offer an S3 interface in 2010; first with native scale-out file system interfaces in 2013; first to adopt Docker in 2015; and first to introduce multi-cloud data control with Zenko in 2017,” said Jerome Lecat, CEO, Scality. “We are very proud that our customers are delighted by the reliability, performance and cost-effectiveness of our solutions, and at the same time, they praise us for our forward thinking. The Fourth Industrial Revolution is a real force, challenging every company in its business model, and challenging every IT department. We help our customers be ready. Technology is not the goal; innovation is what allows us to deliver what seemed impossible: freedom and control at the same time. Thanks to Scality, enterprises and service providers can avoid hardware lock-in and cloud lock-in; while accommodating massive amounts of data growth and extract value from data.”

Simplifying multi-cloud is critical to successful enterprise IT. Scality is a core component of cloud services across industries and use cases for businesses that are leveraging – or are planning to leverage – cloud, including financial services, manufacturing and other Global 2000, media and entertainment and medical institutions.

The company counts among its customers around the world Rackspace, Orange, KDDI, DMM.com, Telstra, Bloomberg Media, Dailymotion, Lancaster General Health (Penn Medicine), Poole Hospital NHS Foundation Trust, Banque Natixis, SNCF and more. Making enterprise IT easier with flexible file and object interfaces, including industry-standard S3, and integration with top applications across use cases, Scality has customers using Veeam, Commvault, Oracle RMAN and IBM Spectrum Protect for backup; Broadpeak, Aspera, and Vizrt for M&E content distribution; and Philips, McKesson and Carestream for medical imaging.

“Scality’s leadership is apparent, not only through what we hear from Jerome Lecat and his team, but also through what the analysts are writing, and, most importantly, through what the company’s customers and partners are saying,” said Doug Carlisle, partner emeritus, Menlo Ventures. “It’s exciting to see them grow and innovate, anticipating the truly important trends that incorporate real needs, like multi-cloud control and open source code. Scality has built a solid reputation as a leader, and they continue to prove their vision.”

Comments

Born in February 2010, bi-cephalous company Scality (formerly BizangaStore) originated from Paris, France, but with another main office San Francisco, CA, got its highest round of financial funding, $60 million, total to date reaching $152 million including and investment of HPE in 2016, probably around $10 million.

Historically $60 million is the highest round for a start-up this year wotldwide, second historically for a French start-up behind Oodrive that got $69 million in 2017, as well as historically the highest total received by a French start-up in front of Crocus Technology getting $116 million.

Financial rounds of Scality:

(in $ million)

| Year | Amount |

| 2010 |

1 (seed funding) |

| 2010 | 5 |

| 2011 | 7 |

| 2013 | 22 |

| 2015 | 45 |

| 2016 | 12 |

| 2018 | 60 |

It will be probably his last financial round before an upcoming IPO.

The company's revenue is growing very fast, 85% in 2016 and 80% in 2017. CEO Jerome Lecat didn't reveal figures for sales. According the estimation of Owler, it's only $30.6 million, after ten years of business.

He admits that his company never was profitable, cumulative deficit being not far from total funding. In 2010 he expected to be profitable in 2012, now he projects 2020.

He also expected en IPO in 2017, now it's for 2021 on Nasdaq rather than to find a buyer even if Lecat said to "have received regularly offerings." The high price of Scality can only be paid by a storage giant. The first one coming in mind is HPE, the biggest of its OEMs, all of them representing as high 80% of Scality's global revenue, and the other ones being Cisco and Dell (but less efficient since the acquisition of EMC with competing products.) Other big one have their own products competing with Scality Ring, especially Dell EMC (Elastic Cloud Storage), IBM (Spectrum Scale coming fromm acquired Cleversafe), NetApp (StorageGRID), Red Hat (Ceph Storage), Hitachi Ventura (Hitachi Content Platform), Swiftstack (Multi-Cloud Data Management software). Qumulo (File Fabric) is also a main actor with smaller ones including Cloudian (HyperStore), DDN (Web Object Scaler) and Caringo (Swarm).

The success of the IPO is possible as the Nasdaq investors love companies growing very fast and then getting rapidly market shares, even they are not profitable. The best example in storage is fast-growing Pure Storage getting $425 million in an IPO in 2015 after getting $470 million in financial funding and also never profitable - even now. Of course, AFAs and scale-out object storage are different businesses but both of them are among the fastest ones in the storage industry.

Scality claims 200 customers - not a lot in a decade - and 51 new ones in 2017, the largest with over 100PB managed by its object and scale-out file storage software. It shipped over 100TB of usable storage that brought 20 new petabyte-scale customers in 4CQ17 alone. Lecat reveals a $500,000 contract for the first time in Russia for a public company. Scality stores a total of 800 billion objects for 500 million end-users.

Scality customers by category in %

| Telco, service and cloud provider | 40% (half for emails) |

| Media and entertainment | 20% |

| Global 2000 | 20% |

| Hospitals | 10% |

| Others | 10% |

Today, the company employs 200 people including 90 in France.

There was recently a lot of turnovers. "I decided to restructure the company at the beginning of the year," justifies Lecat, who added: "Also we have no more CMO having separate technical and corporate marketing."

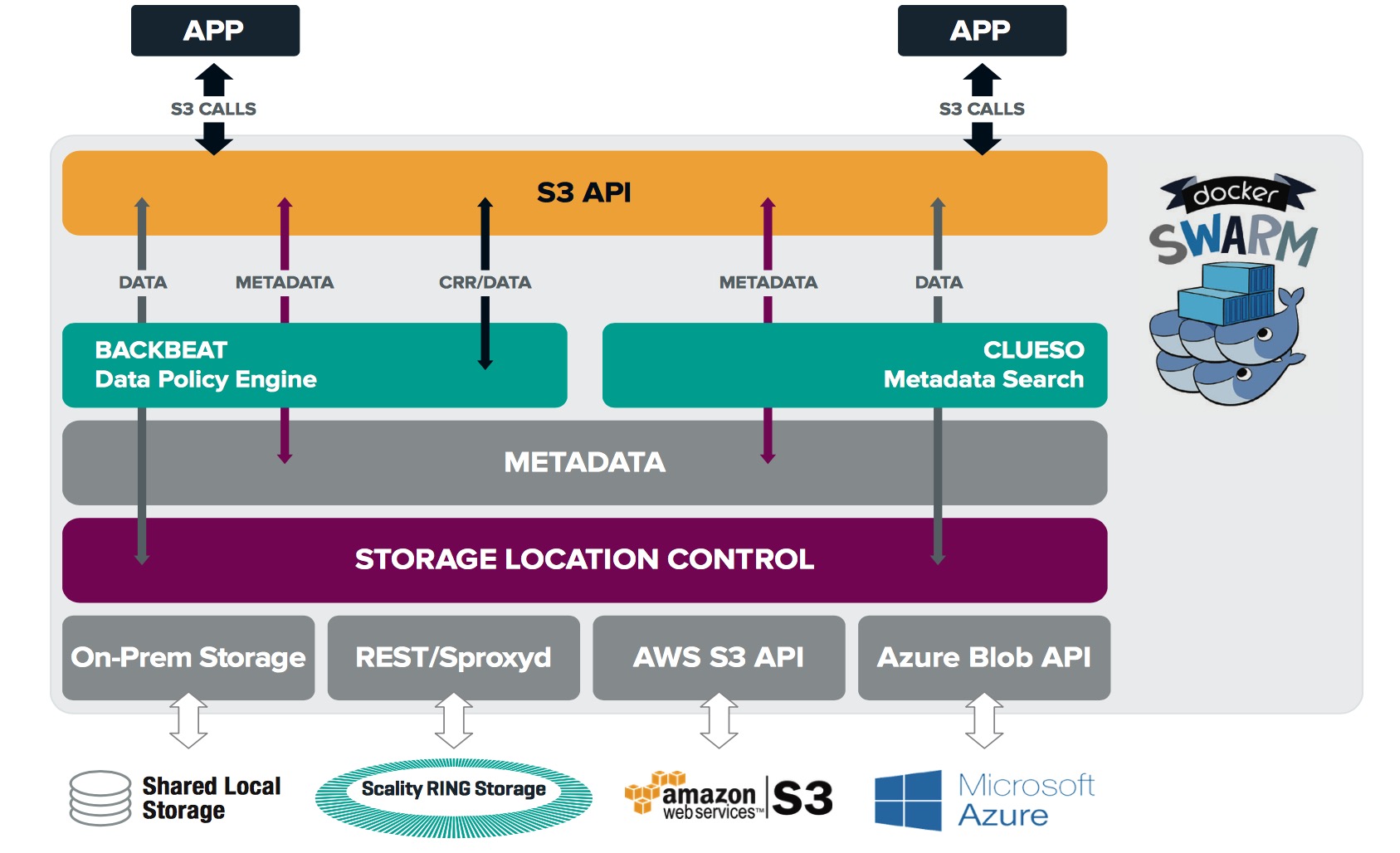

Roadmap includes an easier use of flagship software Ring and the push of Zenko, an open source software to assure data control in a multi-cloud environment and released last July. The multi-cloud controller provides insight into and control of unstructured data while leveraging the efficiency and scale of both private and public cloud storage. It provides an unified interface based on a proven implementation of the Amazon S3 API across clouds.

Click to enlarge

Here is the opinion of Gartner on Scality published in its Magic Quadrant for Distributed File Systems and Object Storage.

Strengths

• Scality is a well-funded software company with an established customer base of multi-petabyte deployments in North America and EMEA.

• Customers praise technical support and responsiveness to end-user needs, which result in a high level of repeat business.

• Scality's S3 Server and Zenko releases are resonating with reference end users looking to expand Ring to enable cloud-native and hybrid cloud capabilities with unified data management.

Cautions

• When replacing a traditional NAS filer, end users must validate performance and features of Scality, as Ring's file system is not designed for general-purpose enterprise file share workloads.

• Ring does not have native compression or deduplication features.

• Gartner clients are becoming concerned with Scality product pricing as large OEM storage vendors now offer high-density solutions with deep discounts.

Read also:

Start-Up's Profile: Scality

With petabyte storage software platform for email messaging

by Jean Jacques Maleval | 2010.08.16 | News | [with our comments]

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter