External Storage Market in India Declined by 4.7% Y/Y

Stood at $74.1 million in 4Q17, led by Dell, HPE, IBM, NetApp, Hitachi

This is a Press Release edited by StorageNewsletter.com on April 4, 2018 at 2:14 pmAs per IDC Corp.‘s AsiaPac Quarterly Enterprise Storage Systems Tracker 4Q17 release, India’s external storage market witnessed a decline of 4.7% Y/Y (by vendor revenue) and stood at $74.1 million in 4Q17.

Market witnessed a Y/Y decline due to lesser spend in banking and manufacturing verticals in 4Q17. However, these segments still are amongst the highest contributors to the external storage market along with professional services and telecommunications industries. Increased adoption of 3rd platform technologies is pushing organizations to improve performance and optimize storage infrastructure to achieve its business objectives and respond to changing business needs faster with lower TCO.

“Adoption of all flash arrays (AFAs) is growing exponentially and becoming mainstream in storage deployments across enterprises to address the demand for workload/application acceleration with high IO/s and minimal latency,” says Dileep Nadimpalli, associate research manager, enterprise Infrastructure.

Market witnessed a continued shift towards AFAs. This segment saw a significant growth at 54.9% Y/Y in 4Q17 contributing to 23.4% of the overall external storage market. AFAs are getting deployed across most verticals with banking, telecommunications and professional services contributing to most of these deployments in 4Q17. Flash footprint also continues to increase in hybrid flash arrays (HFAs), as end users are procuring a higher proportion of SSD’s vs HDD’s to achieve a better price to performance ratio.

High end storage segment witnessed a high double-digit growth of 39.2% in 4Q17 due to large deployments in telecommunications and banking industries. Consumption models for storage are impacting both mid-range and entry level segments leading to a Y/Y decline in 4Q17.

“Digital transformation will drive customers to look for storage requirements and innovative storage technologies. Adoption for HCI, object oriented storage, software-defined storage grew in the India market addressing the new-age storage requirements of customers,” says Ranganath Sadasiva, director, enterprise solutions, IDC India.

Major Vendors Analysis

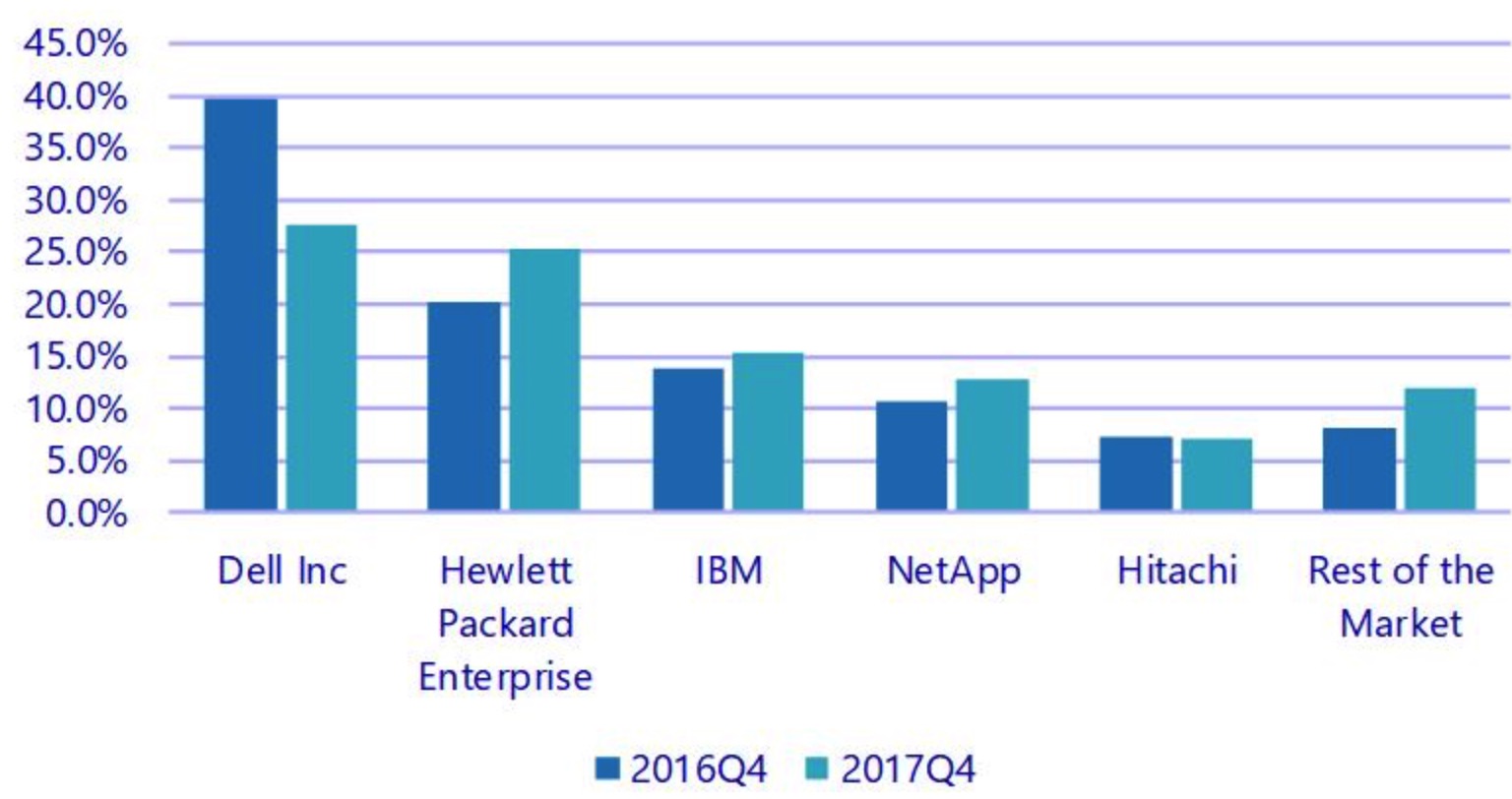

India External Storage Systems by Market Share

(vendor revenue, 4Q17)

Dell Inc. continued to be the market leader with a 27.6% market share by vendor revenue, however witnessed a Y/Y decline in 4Q17. Hewlett Packard Enterprise and NetApp saw a significant growth predominantly driven by deals from banking and telecommunications industry.

India Forecast

The external enterprise storage systems market is expected to grow at a single digit CAGR for 2017-2022 period. This growth is expected to come from an increased spending into digital transformation initiatives across industries. Banking and government verticals are expected to drive a majority of the growth next year.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter